In this CPG Insight, we delve into the fascinating world of consumer preferences in the health and wellness sector. Discover the choices people make when it comes to brain health, immune support, digestive wellness, and plant-based nutrition, and how different factors like age, income, and regional differences shape these choices!

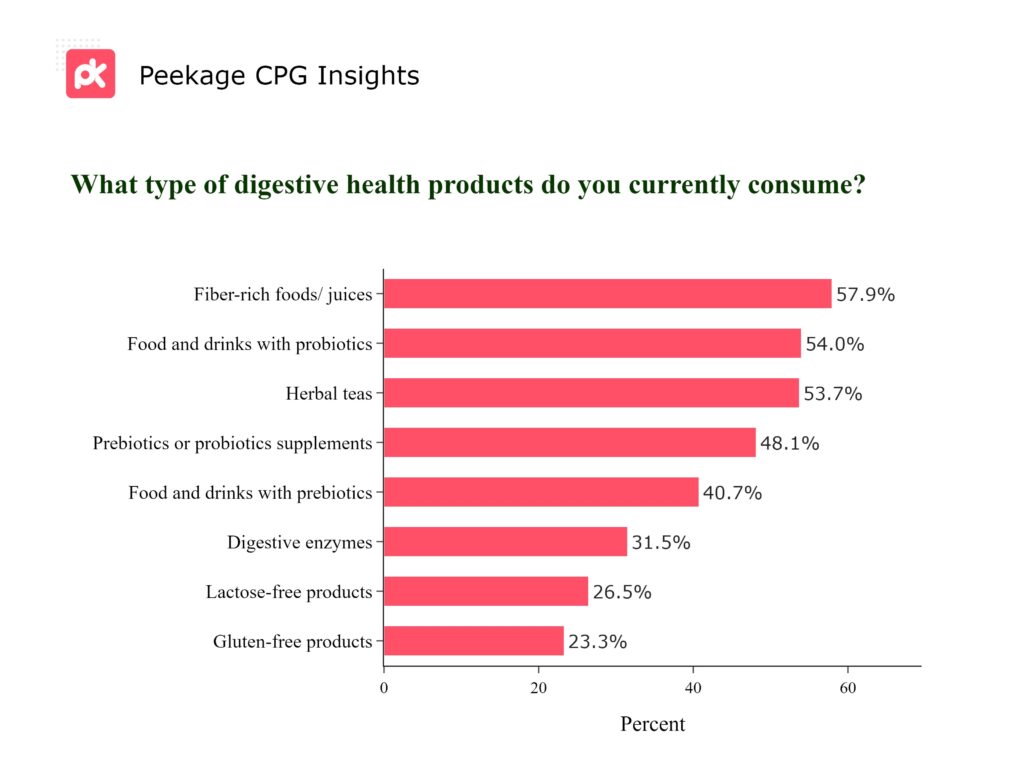

The Shift Towards Fiber-Rich and Probiotic Foods

Consumers are gravitating towards fiber-rich food-and-drinks, probiotics, over supplements. This suggests a preference for natural and convenient options. Herbal teas are also a hit, indicating a love for soothing, flavorful remedies. Digestive enzymes and prebiotics, although less popular, are on the rise!

Incorporating more fiber and friendly bacteria into offerings is a wonderful suggestion for brands looking to make a positive impact. Crafting products that promote gut health can not only keep digestive systems happy but also help elevate sales!

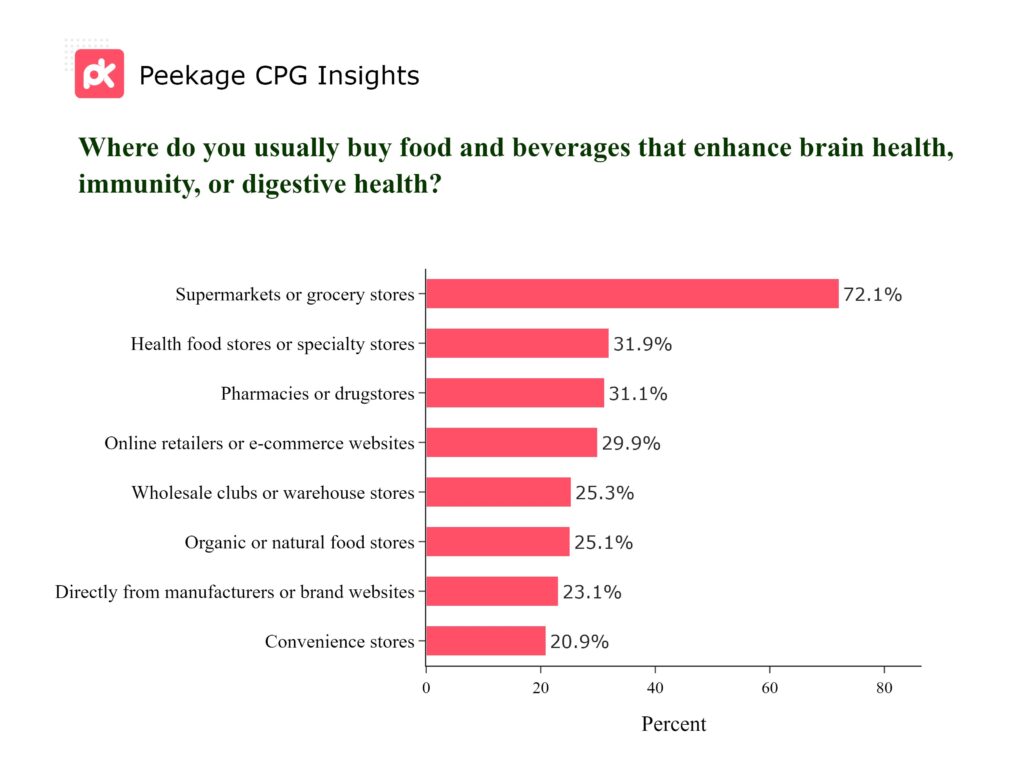

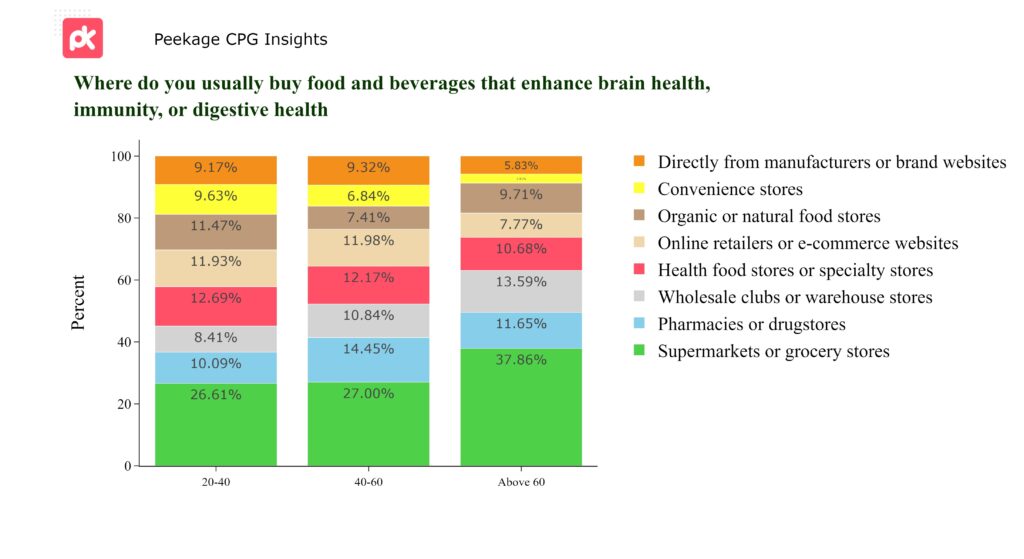

The Go-To Destinations for Health and Wellness Products

Supermarkets and grocery stores take the lead for top spots of purchasing brain health, immunity and digestive health products with 72.1%. This indicates that consumers prefer the convenience of one-stop shopping for all their health and wellness needs.

Ensuring products stand out on supermarket shelves is crucial for brands aiming to attract a wide and diverse customer base.

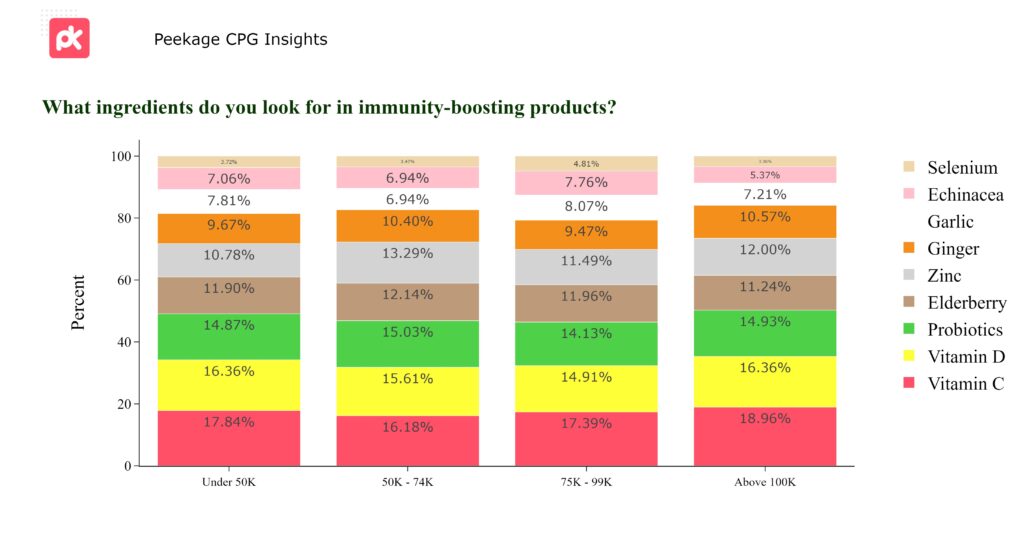

The Rising Popularity of Vitamin Supplements and the Untapped Potential of Natural Boosters

It's clear that across all income groups, people prefer supplements like Vitamin C and D for boosting their immunity, with probiotics also in the mix. Although natural immunity boosters like echinacea, selenium, garlic, and ginger are less popular, they are not far from mainstream vitamin supplements.

For brands, emphasizing the advantages of lesser-known ingredients alongside popular vitamins is key for a holistic approach to immune support.

Catering to the Health and Wellness Needs of Older Consumers

Older consumers (above 60) prefer supermarkets or grocery stores for their health-enhancing food and beverages. This suggests that older individuals prioritize traditional shopping experiences, whereas younger consumers seek convenience and direct-to-consumer options.

Brands should factor in shopping preferences across age groups when devising distribution and marketing plans for broader reach.

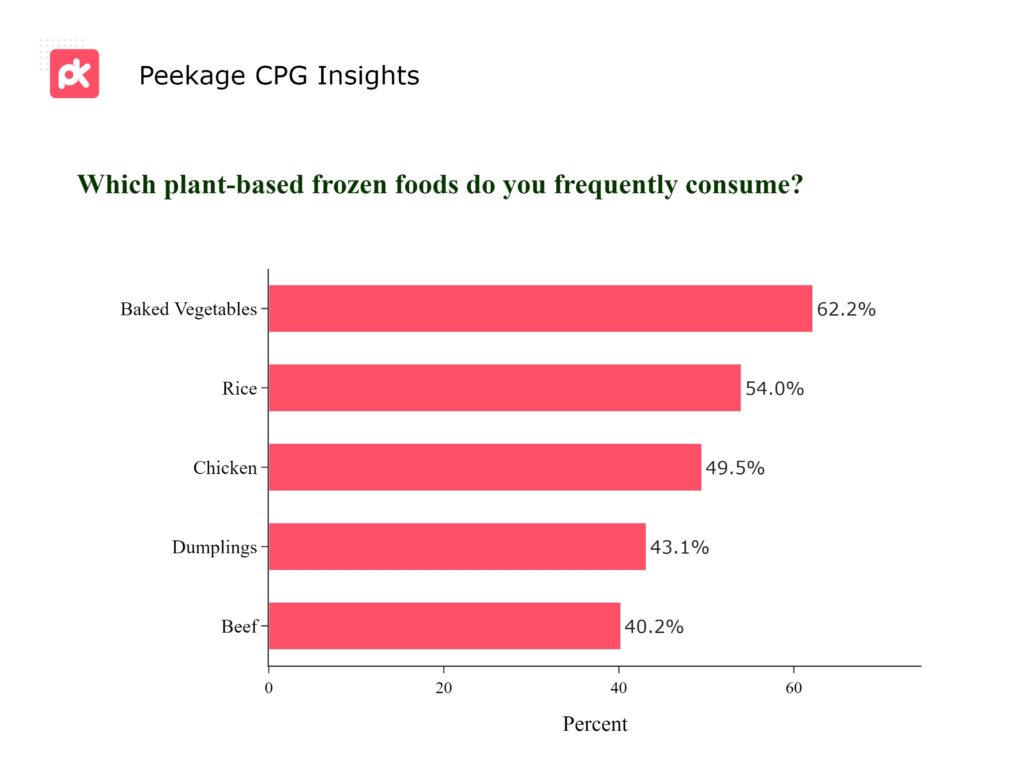

Veggie vibes!

Frozen favorites! Baked vegetables reign supreme in the plant-based frozen food world, with a 62.17% consumer preference. Rice and chicken alternatives follow closely behind.

Expanding their range of plant-based frozen options, particularly in leading categories, could be beneficial for brands. Focusing on the convenience, taste , and health benefits of these products in marketing strategies is a friendly suggestion.

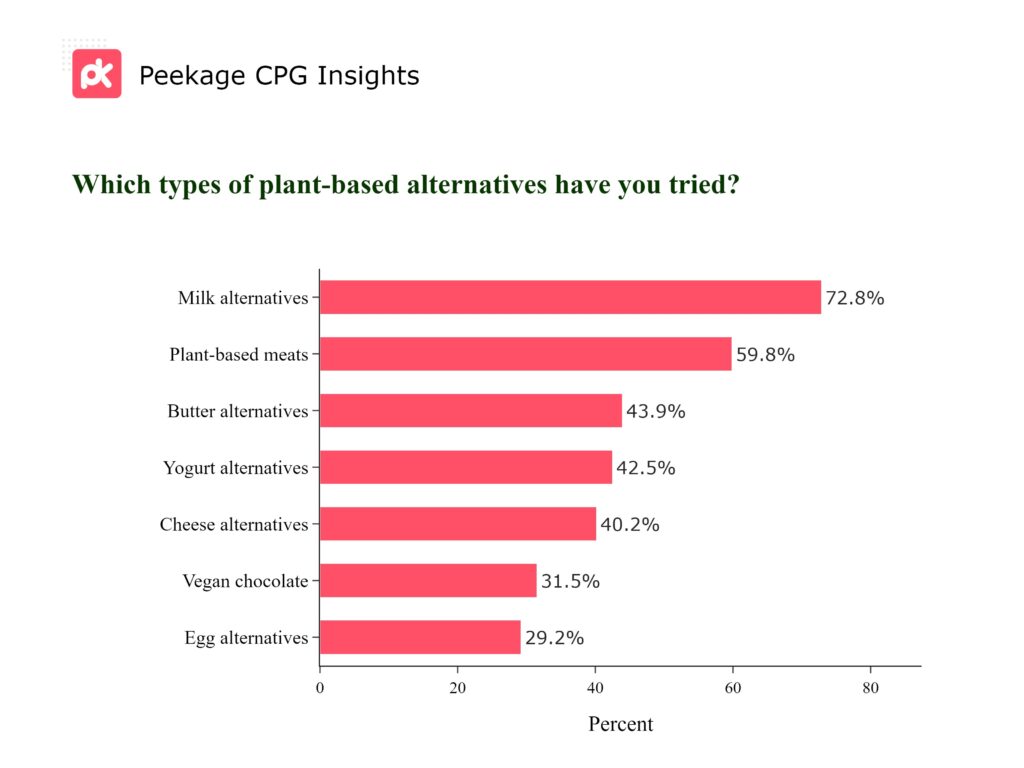

Alternative exploration!

Milk and meat alternatives are leading the plant-based charge, with over 60% of consumers having tried them. However, there's growing interest in other categories like butter, yogurt, and cheese alternatives.

Brands have a great opportunity to innovate and broaden their offerings in less-saturated markets. By emphasizing the taste and health benefits of their products, they can draw more consumers towards a plant-based lifestyle.

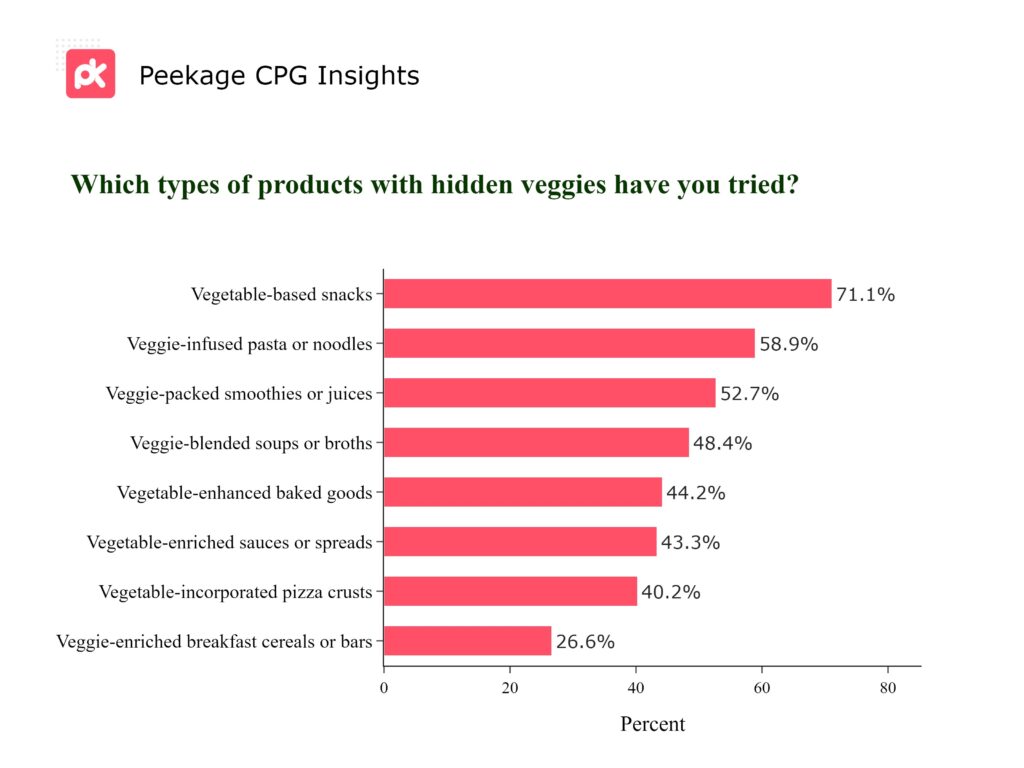

Hidden gems!

With 71.10% of consumers enjoying vegetable-based snacks and 58.92% indulging in veggie-infused pasta, it's clear that hidden veggies are a hit! However, vegetable-enriched breakfast cereals lag behind at 26.63%, possibly due to the popularity of traditional incumbents.

Brands can ride the veggie wave by venturing into veggie-infused pastas, smoothies, and pizza crusts. Embracing innovation and spotlighting the hidden nutrition in delicious offerings is key. Also, improving the flavor and convenience of vegetable-enriched breakfast cereals can make them a go-to option for quick, tasty, and veggie-packed mornings!

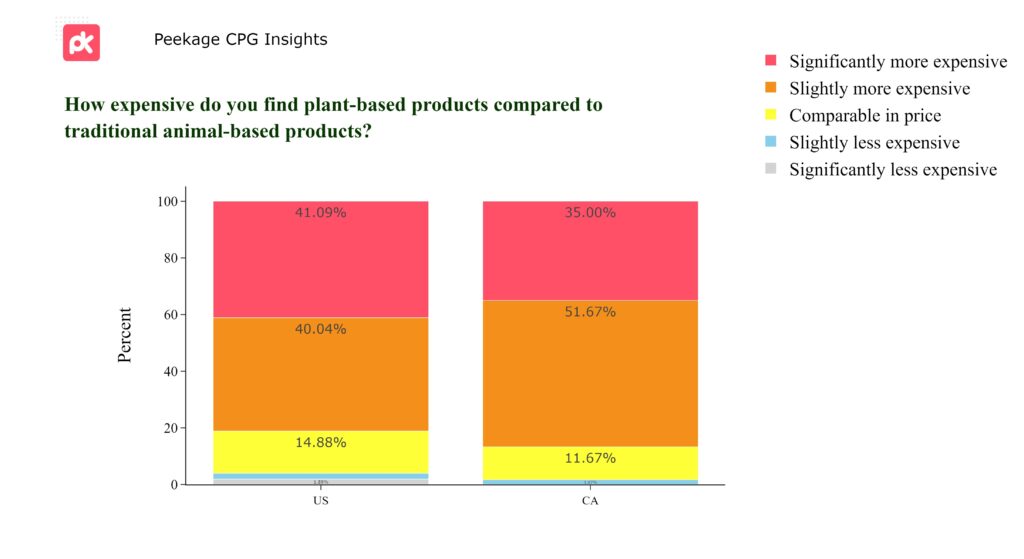

Plant-based premium!

A majority of consumers find plant-based products more expensive, with about 42.49% saying they're slightly pricier and 38.57% finding them significantly more costly.

Brands are encouraged to focus on price accessibility, introduce value packs, or emphasize the long-term health and environmental benefits to justify premium pricing and appeal to cost-conscious consumers!

Canadians perceive plant-based products as more expensive compared to Americans, with a higher percentage finding them slightly more expensive.

Brands eyeing the Canadian market might explore strategies to tackle price sensitivity, like launching promotions, and value packs, or underscoring the long-term health and environmental perks to justify the expense. Moreover, cutting production costs could enhance accessibility and allure for Canadian shoppers.

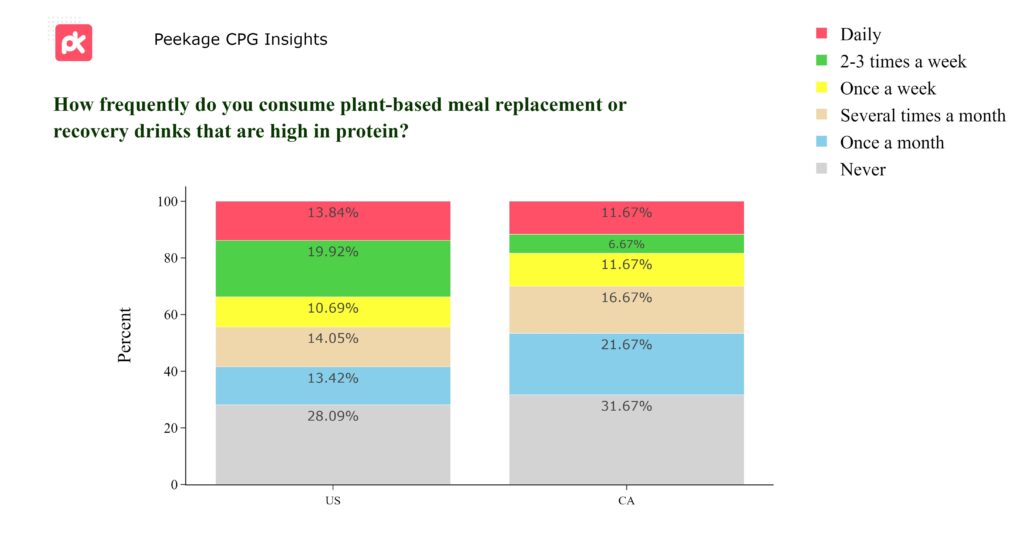

Plant-based boost!

While 27.3% of consumers haven't yet embraced plant-based protein drinks, 32% of consumers are regularly reaching for these meal replacements. It's clear that health and convenience are on the menu!

Also breaking the results down by country, reveals that Americans consume plant-based protein drinks more frequently than Canadians, with a higher percentage of Americans enjoying them 2-3 times a week and daily. In contrast, a larger portion of Canadians never opt for these drinks.

To increase plant-based drink consumption in Canada, brands could concentrate on awareness initiatives that spotlight the health advantages and convenience of these beverages. Collaborating with local influencers or health experts to foster trust, alongside hosting sampling events and promotions, might encourage consumer trials. Expanding the range of flavors and formulations could further boost appeal and consumption.

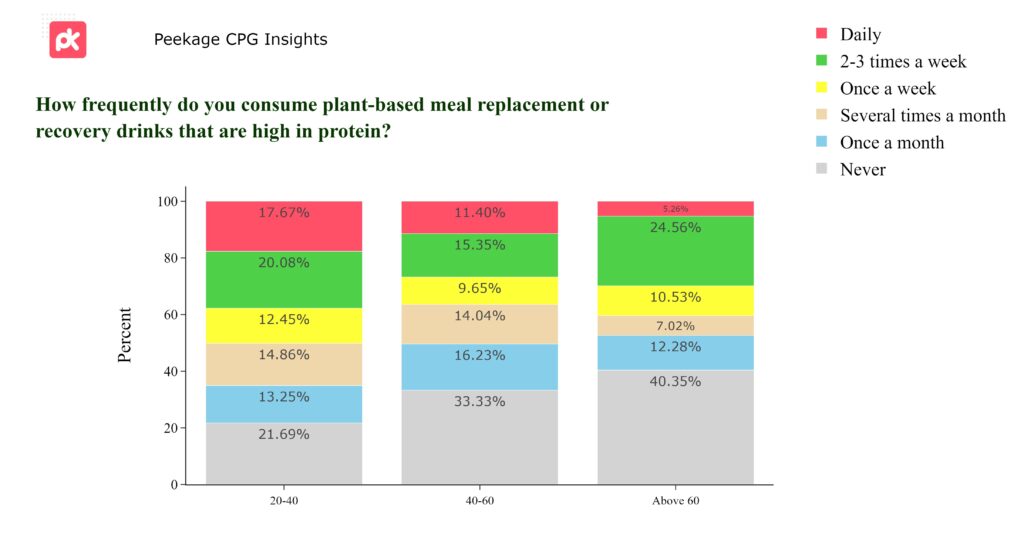

Youthful choices!

Younger consumers (20-40) are embracing plant-based protein drinks more frequently, with higher "daily" and lower "never" responses compared to older age groups. This suggests a growing trend towards plant-based nutrition and an active lifestyle among the younger demographic.

Brands can leverage this trend by introducing a diverse array of flavors, user-friendly packaging, and marketing efforts tailored to the health-aware, active lifestyle preferred by younger demographics.

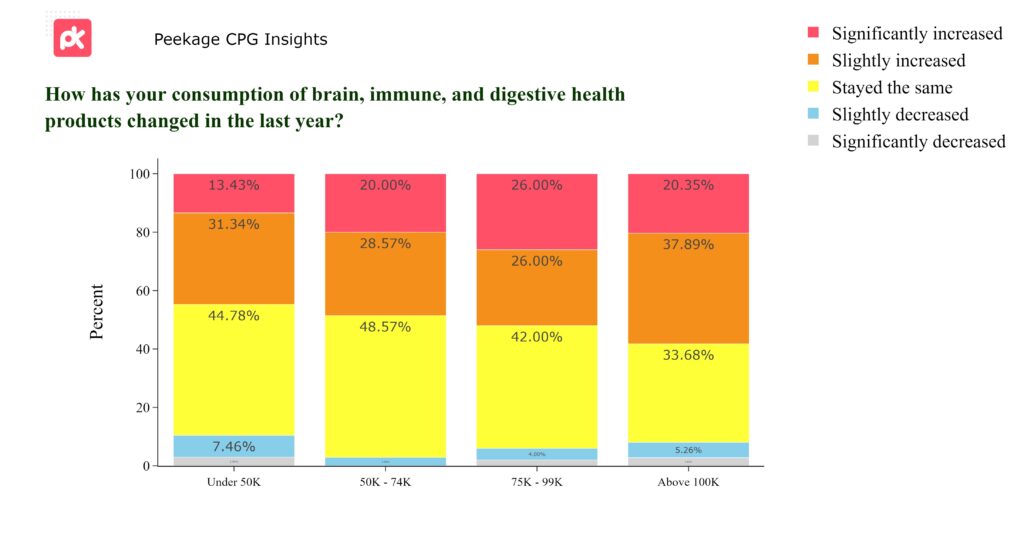

Wellness wave!

With about half of consumers boosting their consumption of brain, immune, and digestive health products, there's a clear demand for wellness-focused goods.

It seems that higher-income groups have increased their consumption of these products more than lower-income groups. This could be due to greater health awareness and financial ability to invest in these products among those with higher incomes.

Brands could target this segment with premium products, emphasizing the unique benefits and superior ingredients in their marketing efforts. Additionally, creating loyalty programs or subscription services might foster ongoing engagement with this demographic.

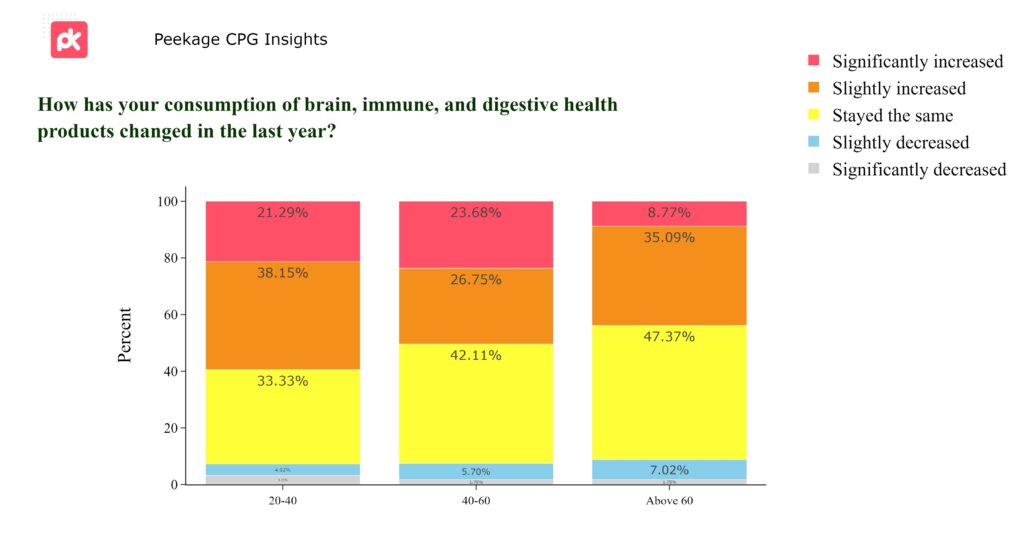

Age trends!

Older individuals (above 60) have mostly kept their consumption of brain, immune, and digestive health products the same, while younger age groups (20-40 and 40-60) show a tendency towards increased consumption, both slightly and significantly.

Brands might consider appealing to younger consumers by focusing marketing messages on the proactive benefits of their products for long-term health and vitality. For older consumers, emphasizing how these products support overall well-being could attract this health-conscious group, potentially driving growth in health product lines!

maintaining trust and familiarity with consistent product quality and benefits is key.

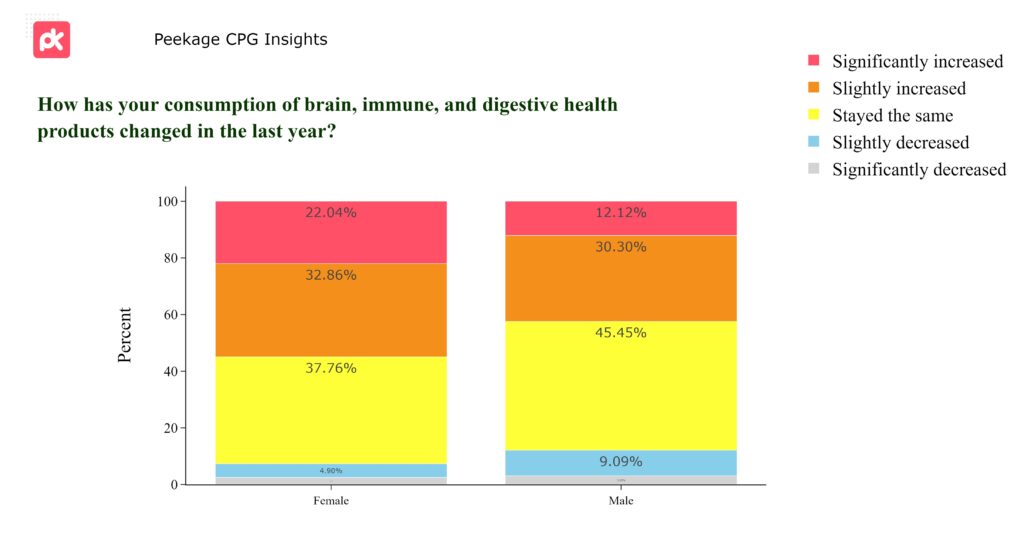

Women driving the health wave!

While both males and females have increased their consumption levels of brain, immune, and digestive health products, women, in general, have increased their intake more, both slightly and significantly.

With a lower percentage of males reporting increased consumption of health products, there's a significant opportunity for brands to more effectively target this demographic. Developing and marketing products specifically designed for men's health needs, like energy-boosting supplements or options that aid in muscle recovery and enhance mental clarity, could tap into this potential market.

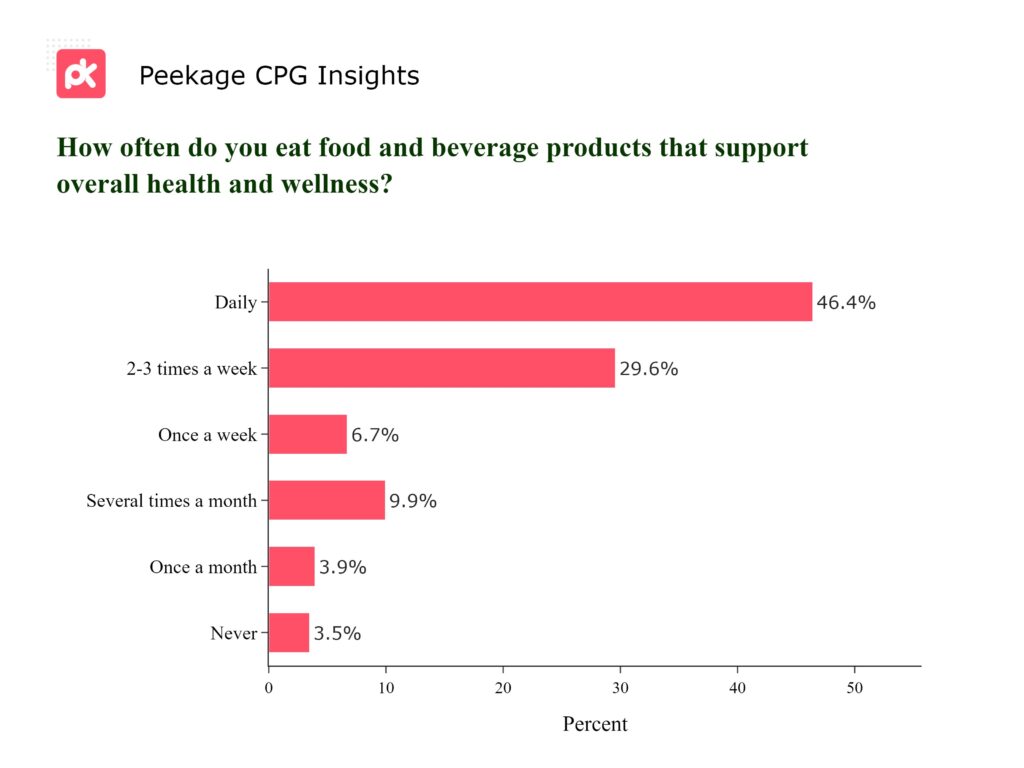

Daily dose of wellness!

A whopping 46.42% of consumers munch on health-supporting food and beverage products every day.

Brands have a chance to back this trend by highlighting the daily benefits of their products and offering delicious, convenient choices that make healthy living easier! Growth opportunities exist in segments less frequent in using health-supportive products. Attract these occasional users with trial-size offerings and engaging content on the benefits of regular use, encouraging them to weave wellness into their daily routines!

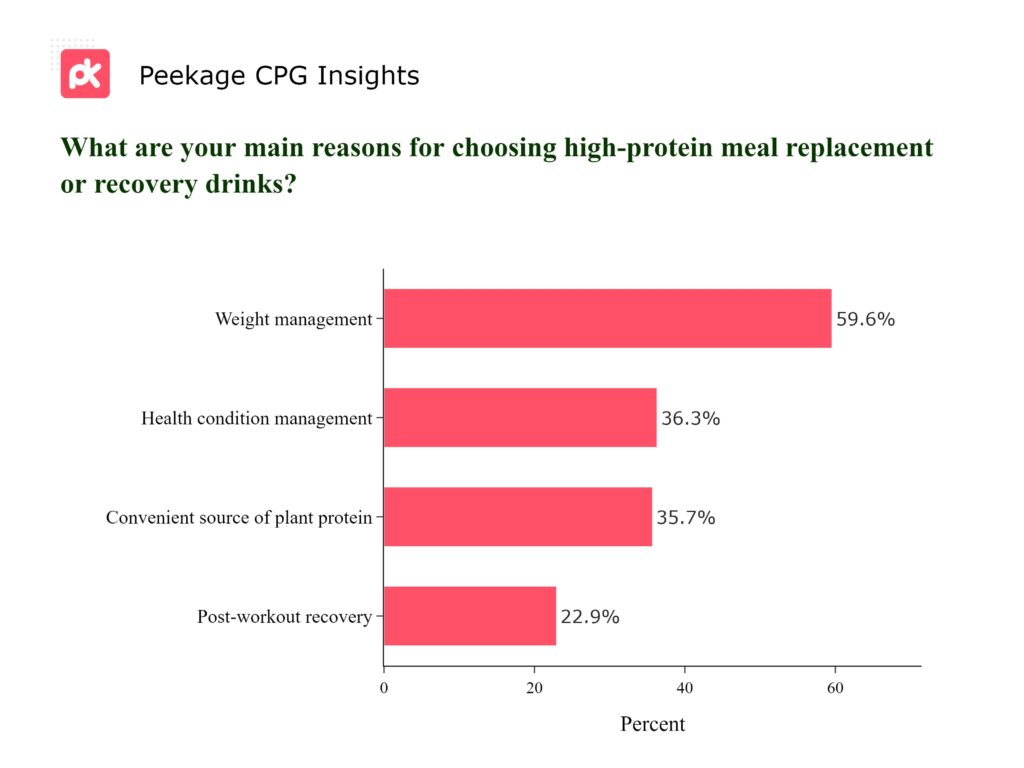

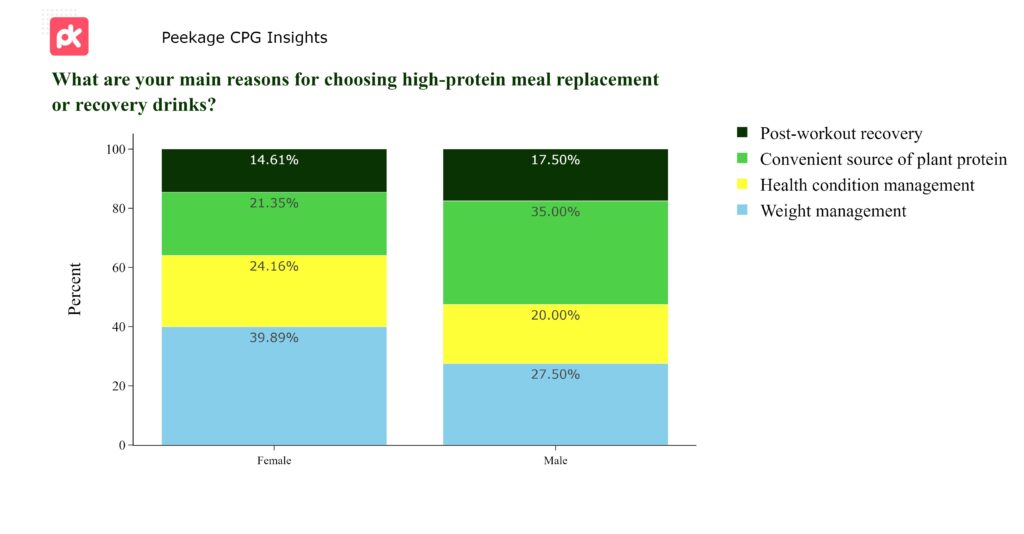

Protein power!

At 59.55%, the primary motivation for selecting high-protein beverages is weight control; convenience and health condition management are also important factors, accounting for over 35% of the vote.

Brands should be aware that women often prioritize weight management and health condition management when selecting high-protein drinks, whereas men tend to value convenience and post-workout recovery. It's beneficial to customize product formulations and marketing strategies to meet these specific preferences, with products aimed at women focusing on weight and health benefits, and those targeted at men emphasizing protein content and workout recovery benefits.

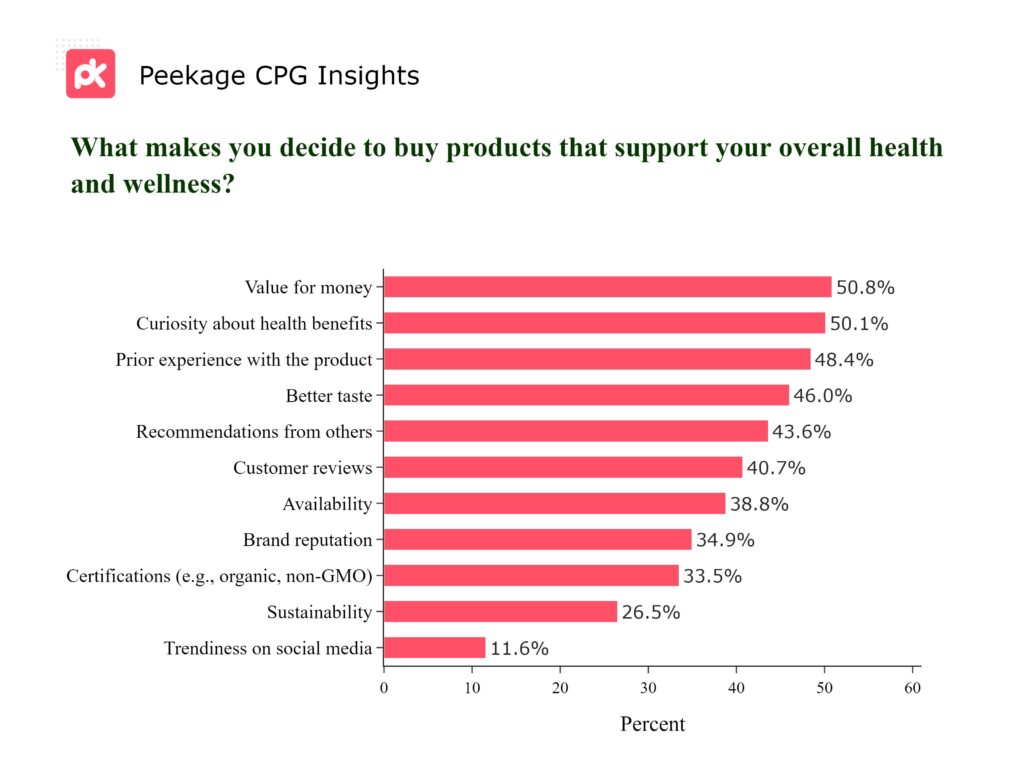

Wellness wise!

Consumers want reasonably priced goods with clear health benefits. Previous experiences, taste, and recommendations play important roles, indicating that word-of-mouth, flavor, and positive past interactions are important factors in decision-making.

On the other hand, brand reputation, certifications, sustainability, and trendiness hold less weight.

To appeal to discerning consumers, brands should offer competitive pricing and underscore the health benefits of their products in marketing initiatives. Additionally, implementing product sampling campaigns can give shoppers a firsthand experience of the advantages, fostering positive impressions that may result in word-of-mouth endorsements and favorable reviews.

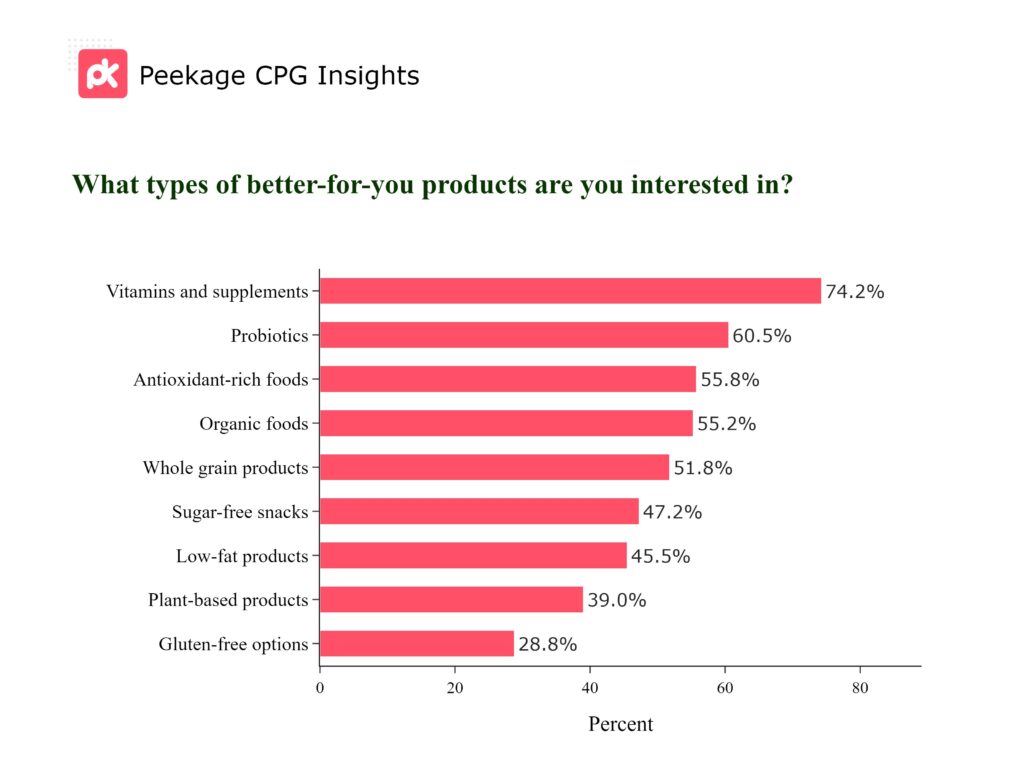

Health trend alert!

The most popular better-for-you products are vitamins and supplements, at 74.2%; probiotics are also very well-liked. Organic, whole grain, and antioxidant-rich options follow closely behind, demonstrating a comprehensive interest in wellness.

Better-for-you boom! With vitamins, supplements, probiotics, and antioxidant-rich foods leading consumer interest, brands should prioritize these areas in their product development and marketing strategies. Organic foods are also in high demand, signaling a shift towards natural and wholesome options. Additionally, the growing interest in plant-based products, with 40% of the market showing interest, indicates that this trend is becoming mainstream.

Brands have the opportunity to align with consumer preferences by introducing a variety of health-oriented products that meet the changing demands of wellness-aware shoppers. By embracing the plant-based trend and showcasing the advantages of their offerings, brands can effectively tap into this growing market segment!

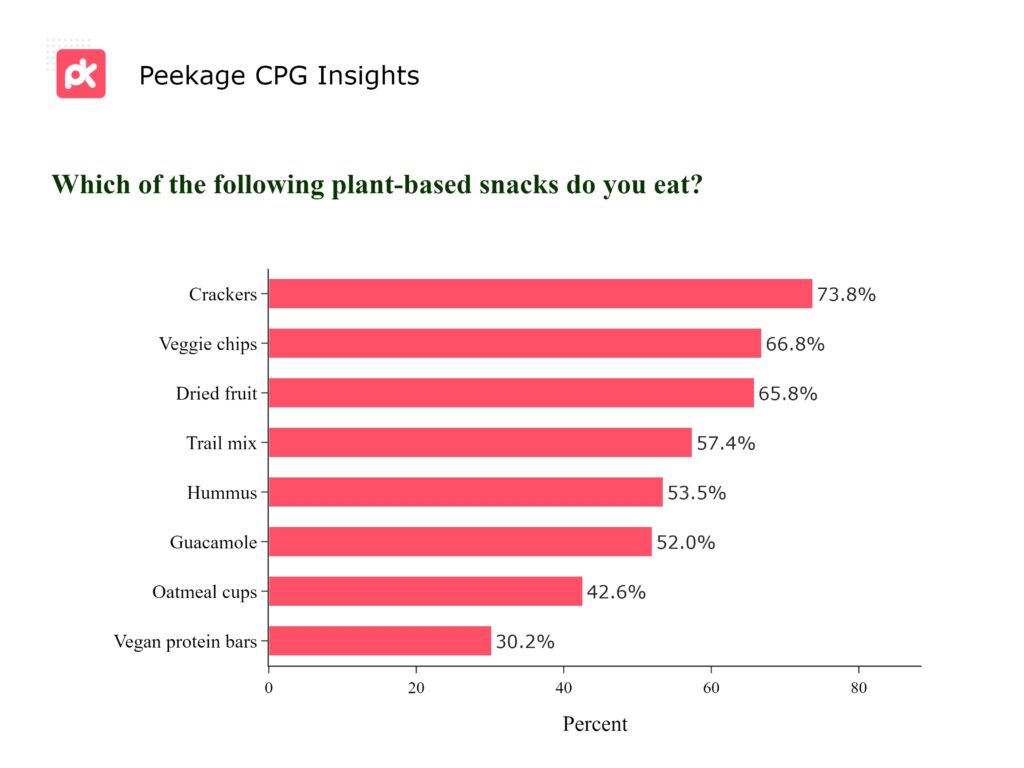

Snack on veggies!

Crackers take the lead in plant-based snacking at 70.05%, with veggie chips and dried fruit close behind.

Brands can consider this a prompt to innovate in the snack aisle by providing a diverse range of flavors and health benefits, ensuring consumers return for more of these plant-based delights!

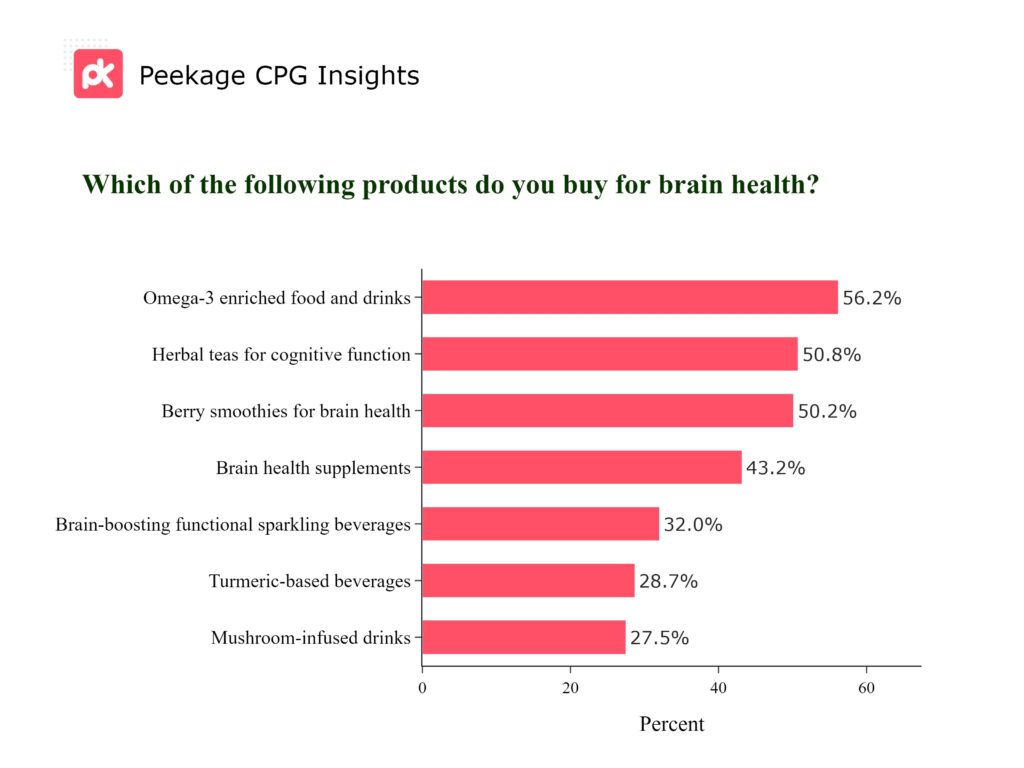

Brain boost!

Omega-3 enriched foods and drinks lead the way in brain health purchases at 56.19%, followed closely by herbal teas and berry smoothies at around 50%.

Exploring the cognitive benefits of Turmeric-based or mushroom-infused beverages could offer brands a unique opportunity to engage their audience. Enlightening campaigns and captivating content that highlight the science and positive testimonials behind these brain-enhancing drinks may attract a broader consumer base, expanding their reach in the brain health sector.

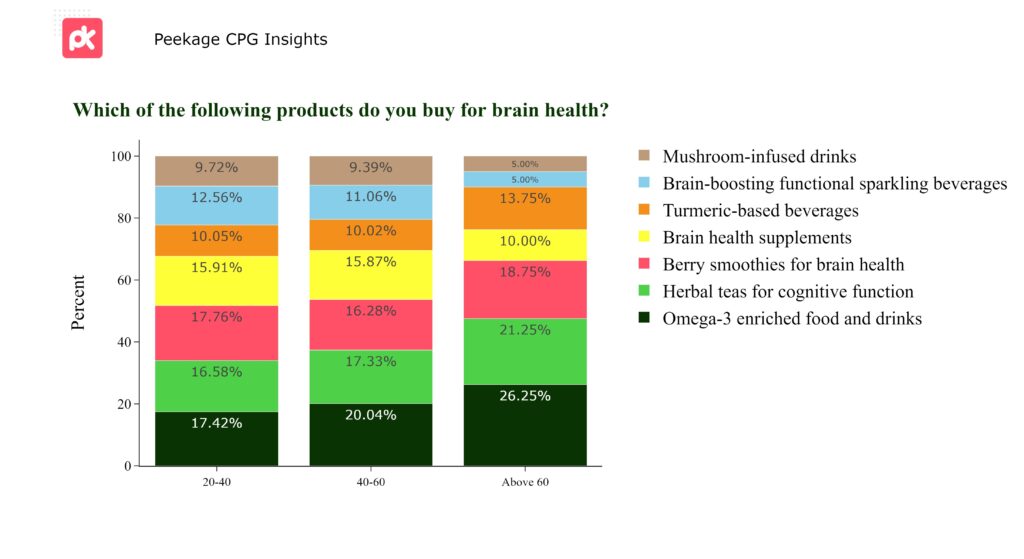

Brain health preferences!

Older consumers (above 60) favor omega-3 enriched foods and herbal teas for cognitive function, while younger consumers (20-40) show a preference for berry smoothies and omega-3 enriched foods. Interestingly, turmeric-based beverages and mushroom-infused drinks are more popular among younger consumers.

Brands could benefit from tailoring their messaging to cater to different age groups: highlighting the cognitive benefits of omega-3 enriched foods and herbal teas for older consumers, while for younger consumers, emphasizing the modern and health-conscious allure of berry smoothies, turmeric-based beverages, and mushroom-infused drinks.