In this post we dive into the evolving landscape of beverage consumption. Today's consumers are moving beyond drinking solely for pleasure or hydration. A significant 70% now prioritize drinks based on their functional benefits. Moreover, the demand for low and non-alcoholic options is on the rise. In this article, we focus on non-alcoholic beverages and their emerging trends. Join us as we explore how these shifts are shaping the beverage market and what they mean for both brands and consumers.

Trendy Tipples

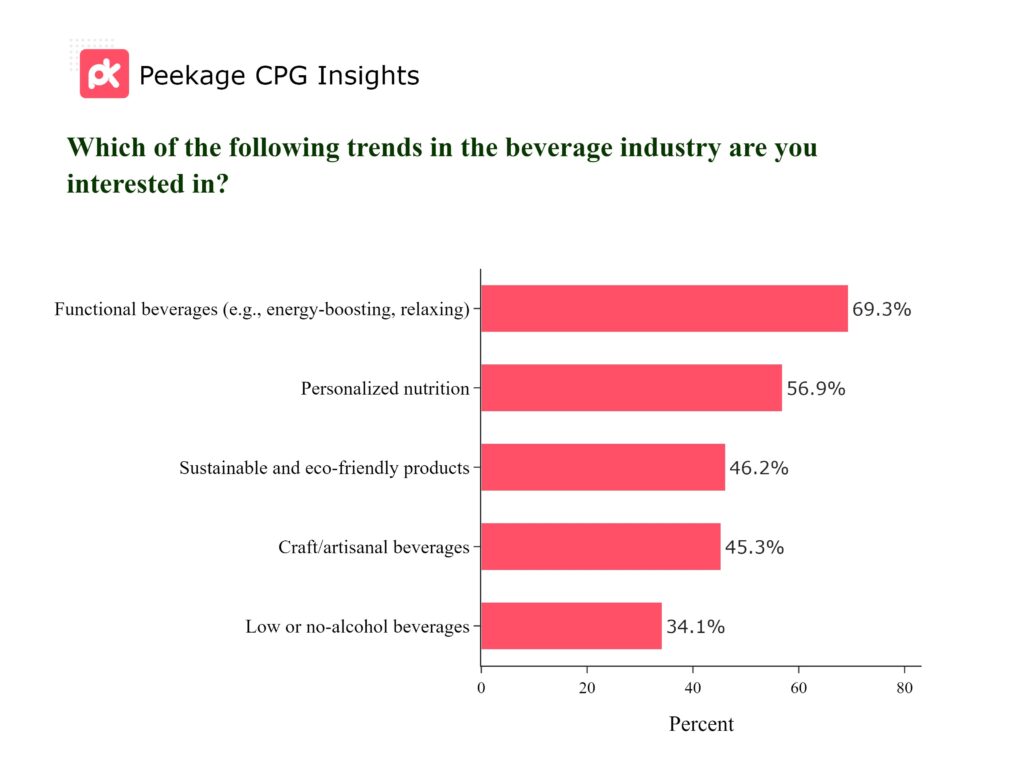

Drinking just for fun or thirst is a thing of the past. Now, a staggering 69% of people choose drinks for a function, like boosting energy or helping them relax. There's also a big trend toward personalized drinks, with 57% of customers wanting beverages that fit their unique needs and lifestyles. Let's not overlook the surging demand for low and non-alcoholic options either. A new trend is emerging.

Takeaway: Today's consumers are seeking drinks that do more than just quench their thirst. Functionality and personalization are key drivers in their beverage choices. Moreover, as we previously reported, sustainability and eco-friendliness remain significant factors influencing purchasing decisions. Don't overlook this evolving landscape. Seize this excellent opportunity to tap into this burgeoning market.

Shop Talk

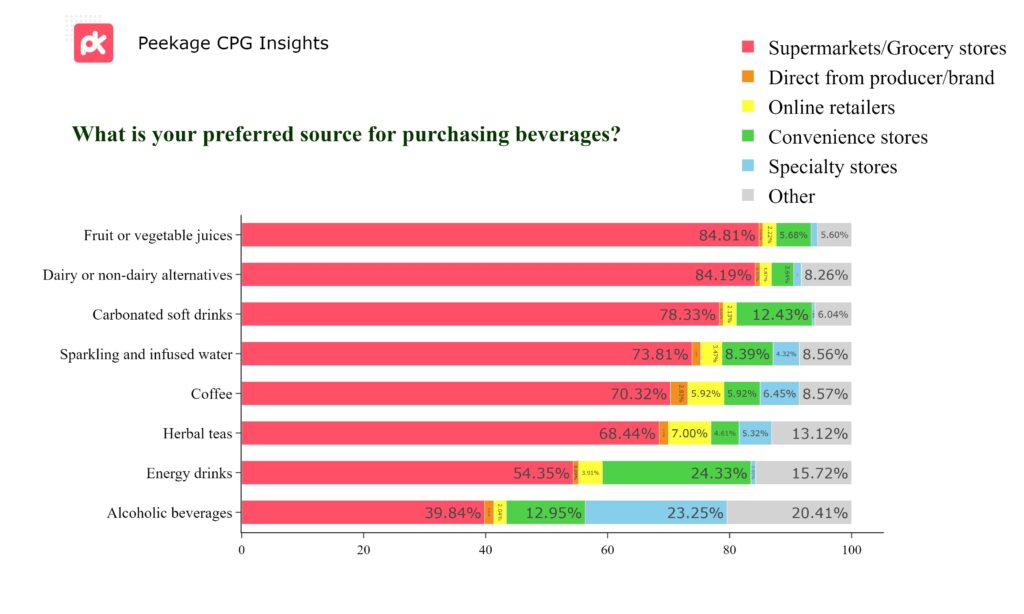

When it comes to where people buy their beverages, grocery stores remain the go-to option for most. Convenience stores come in second place. Notably, when it comes to specialty drinks like energy drinks or alcoholic beverages, the landscape shifts slightly. Customers seeking these specialized options tend to turn to specialty stores and the rising market of online retailers.

Takeaway: While convenience stores remain the primary choice of purchase for customers, the distribution share within convenience stores and online retailers often goes under the radar. By leveraging these powerful distribution networks, you can unlock new markets and maximize your reach to potential customers.

Health in a bottle

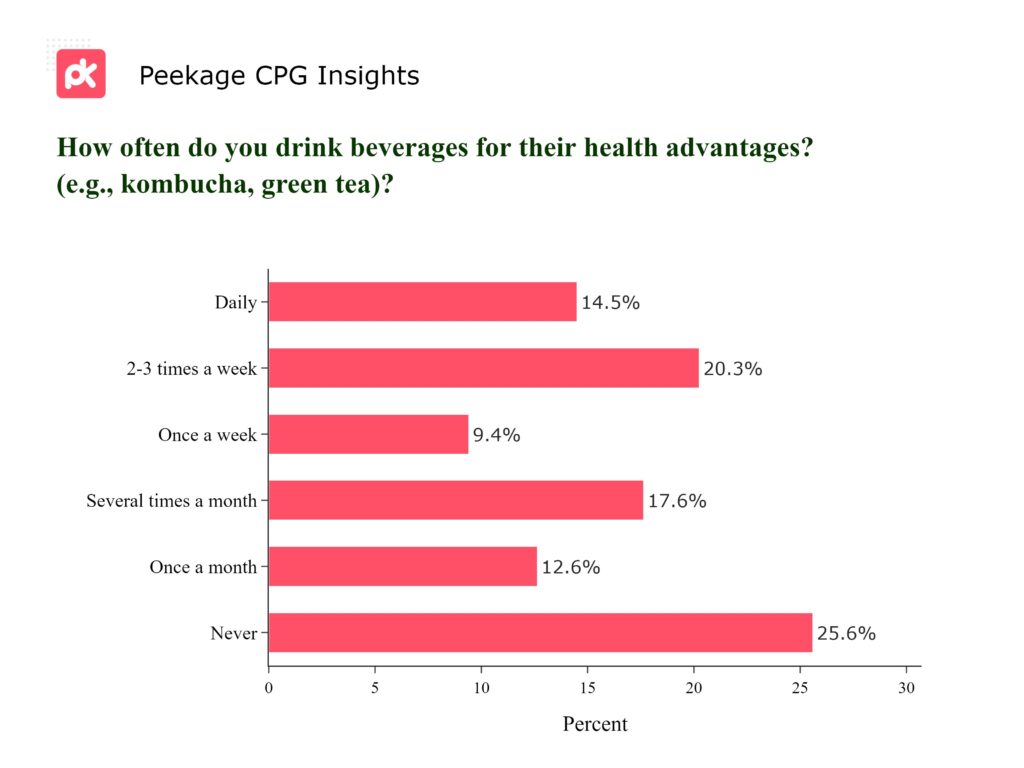

Healthy drinks, such as kombucha and green tea, are becoming more popular each day. According to our study, more than 44% of customers consume beverages to improve their health at least once a week. Among them, about 35% enjoy these healthy drinks more than once a week. However, some people are still lagging behind, with an eye-opening 25% of customers yet to try these drinks. It's a matter of when, not if, the majority of this untapped market will join the growing trend.

Takeaway: Many brands have traditionally overlooked healthy drinks in their product lineup. However, the growing demand for health-focused beverages is clear. If your brand is aiming to expand their customer base, reconsider your strategy neglecting healthy drinks. The market is more ready now than ever before.

Age and Elixirs

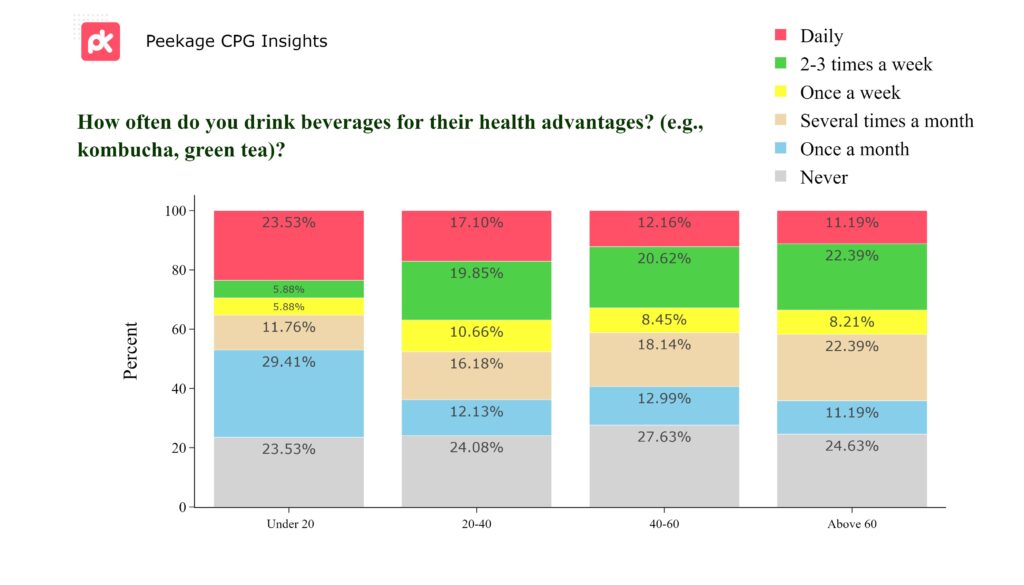

Age plays a fascinating role in how often people drink health-focused beverages. Among the under-20 crowd, 23.5% drink daily, while an equal 23.5% never indulge. In the 20-40 age group, 24.1% never drink these beverages. The 40-60 age group has 27.6% abstaining. Interestingly, the above-60 demographic sees 22.4% consuming health drinks 2-3 times a week, but 24.6% never do.

Takeaway: These insights reveal key opportunities for marketers. For younger audiences, focus on education and appealing flavors to convert non-drinkers. Older demographics already show interest and could be further enticed with subscription models or loyalty programs. Emphasize long-term health benefits and cater to mature taste preferences for the 40-60 and above-60 age groups to deepen engagement.

Green Glasses

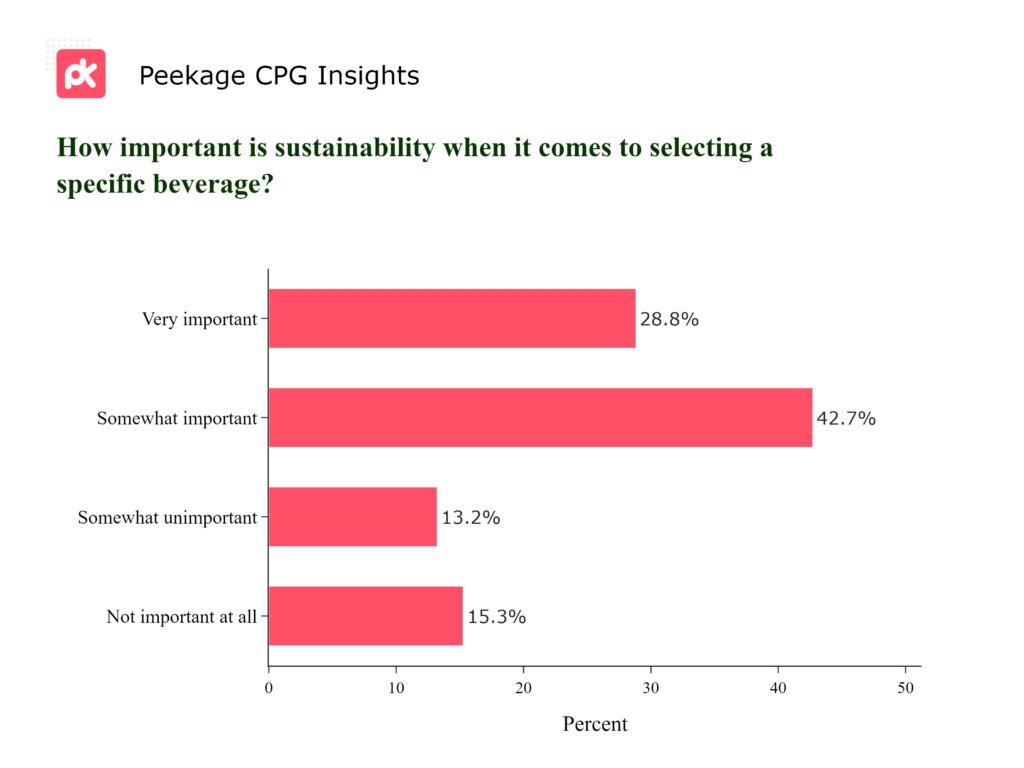

Sustainability is more than just a buzzword in the beverage industry. Our survey shows 42.7% of consumers find it 'somewhat important' when selecting a drink, and 28.8% deem it 'very important'. However, 15.3% consider it 'not important at all'. This split in consumer attitudes towards sustainability presents a diverse market perspective.

Takeaway: This is a clear signal to 'go green' but with nuance. Target the majority who value sustainability with clear, authentic eco-friendly practices and branding. Yet, remember the significant minority for whom this isn't a priority—maintain a balance in your product offerings. Sustainability sells, but it's not a one-size-fits-all.

Thirst for Change

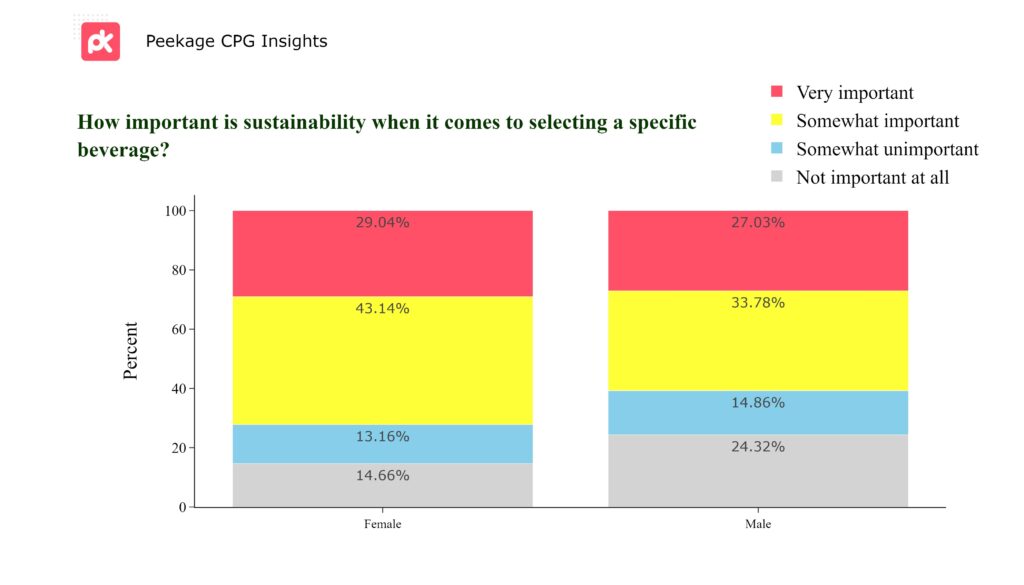

Sustainability in beverage choices shows intriguing gender differences. Among females, more than 72% view it as 'important.' Interestingly, only 14.7% of females find it 'not important at all.' In contrast, males show higher indifference, with 24.3% deeming sustainability 'not important at all.' However, more than 60% of males still find it important,' highlighting a significant interest in eco-friendly choices among both genders.

Takeaway: Female consumers show a stronger preference for sustainability, so focus on eco-friendly messaging and practices. For the male market, there's notable interest in sustainability, but a segment remains less influenced by eco-considerations. Consider implementing a balanced approach that highlights both sustainability and other value propositions.

Enhancing Sips

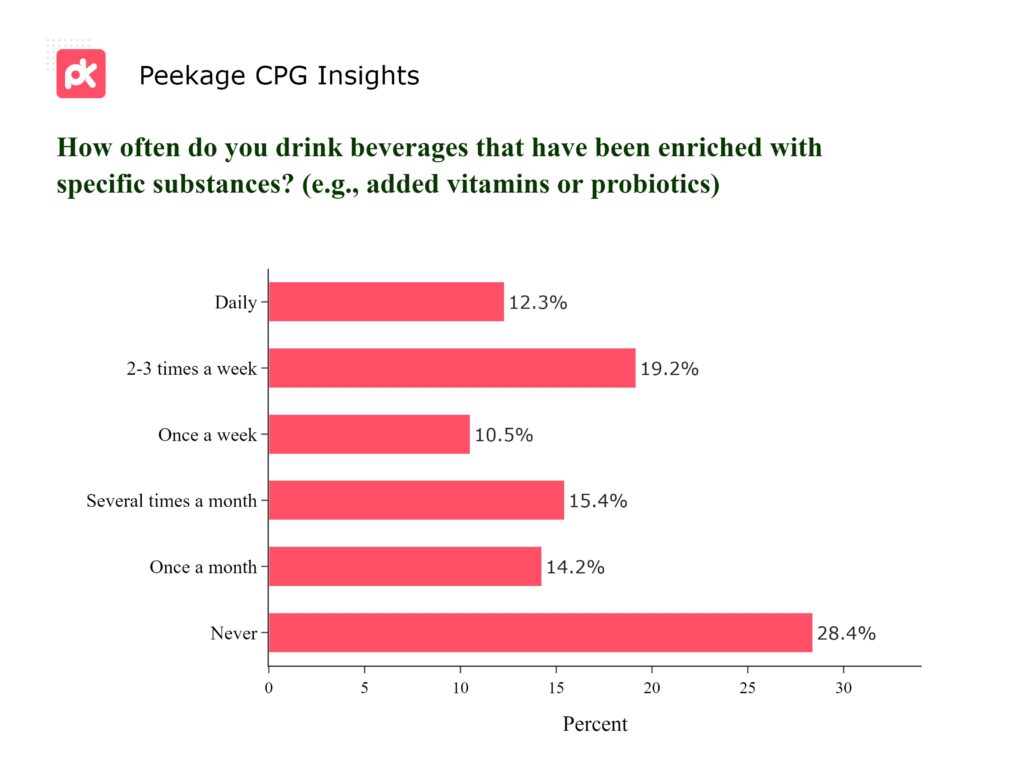

Alternative drinks are getting a huge boost in popularity. Right now, 65% of customers have made these enriched drinks a part of their routine, with 39% being regular consumers. This is a huge opportunity in the market. Yet, there's still an untapped market, with 28% of customers who have never tried these nutritious drinks.

Takeaway: There's a huge opportunity for drinks enriched with nutrients, which brands shouldn't miss. Offering new and exciting flavors or health benefits can help attract those who have already switched. Plus, educating the 28% who haven't tried these drinks yet will be key to winning them over. Focus on which part of this spectrum you want to target. Clearly, alternative drinks are growing fast and even outpacing traditional ones.

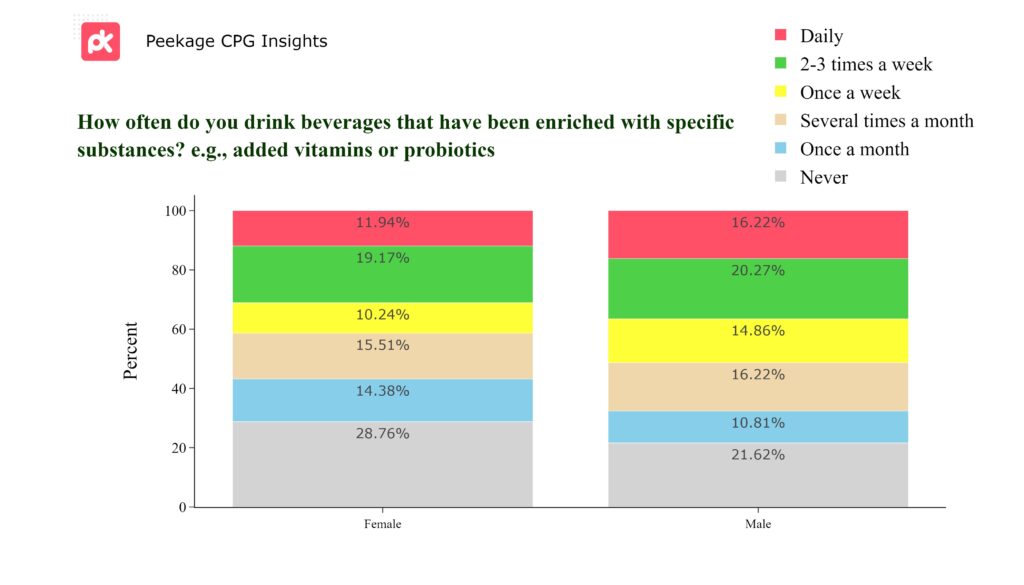

Boosted Beverages by Gender

When it comes to beverages enriched with specific substances, gender plays a role in consumption patterns. Among females, the largest group (28.8%) doesn't indulge in these kinds of beverages at all, while 19.2% do so 2-3 times a week. Also, daily consumption is relatively lower at 11.9%. In contrast, males show a slightly higher frequency, with 20.3% consuming enriched beverages 2-3 times a week and 16.2% doing so daily.

Takeaway: For female consumers, consider highlighting the health and wellness benefits of enriched beverages, aiming to convert the non-consumers. With males, emphasize the daily benefits and performance enhancement aspects, tapping into the higher daily consumption trend.

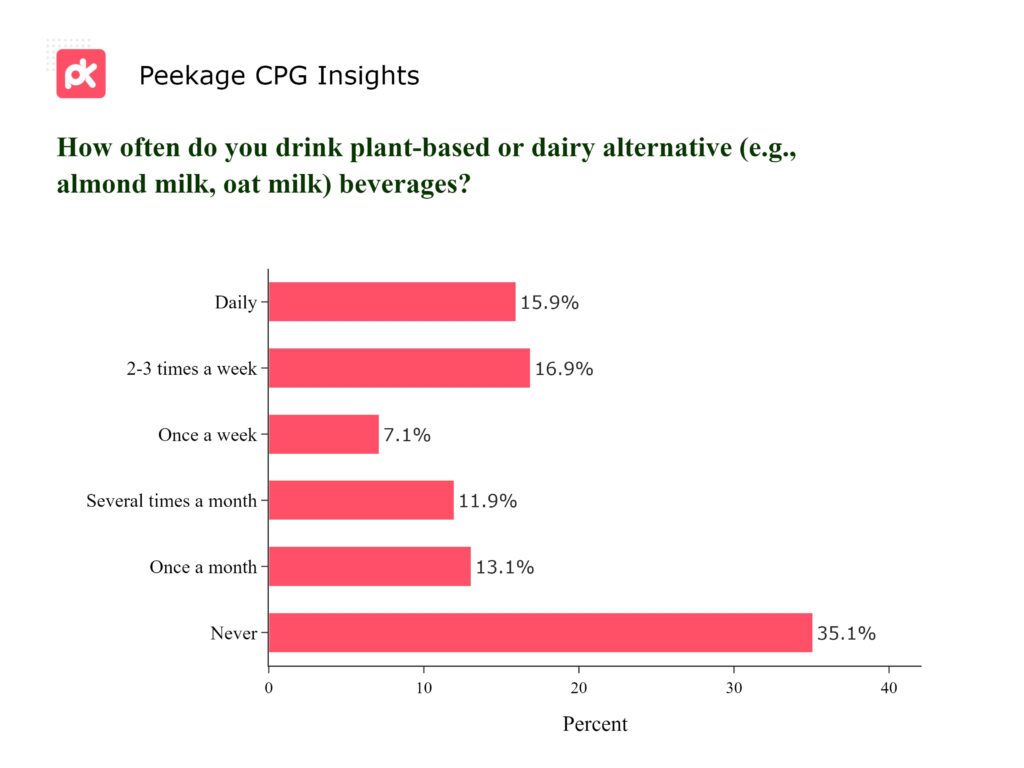

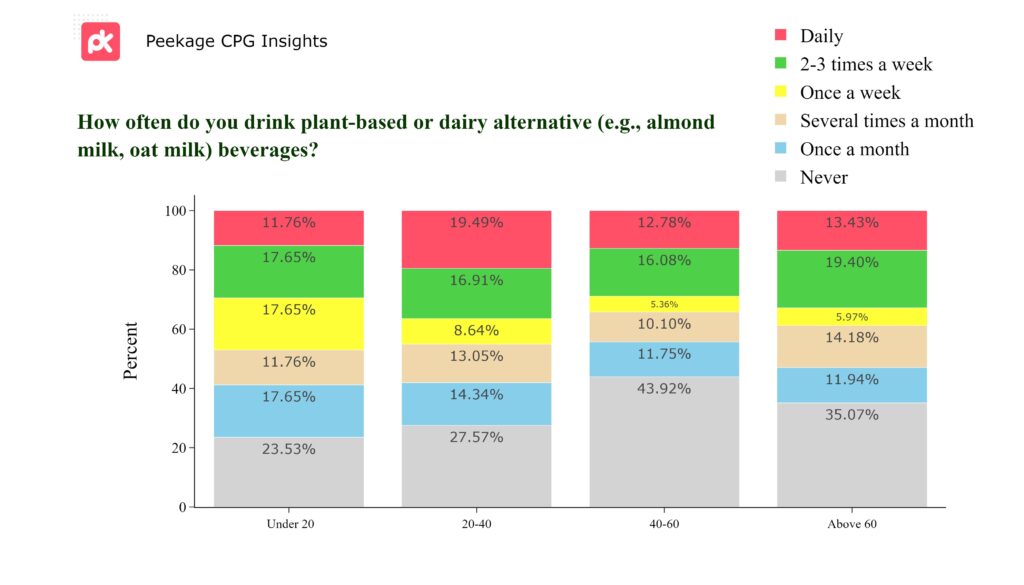

Plant-Powered Pours

The preference for plant-based or dairy alternative beverages shows distinct generational trends. Among the youngest group (under 20), a balanced pattern emerges with 17.6% enjoying these drinks 2-3 times a week and 17.6% never indulging. The 20-40 age group sees a higher daily consumption rate at 19.5%, yet 27.6% don't partake at all. The 40-60 demographic has the highest 'never' percentage at 43.9%, suggesting resistance among older consumers. Interestingly, the above-60 crowd shows a resurgence in interest, with 19.4% consuming 2-3 times a week, though 35.1% still steer clear.

Takeaway: For the younger crowd, emphasize the trendiness and variety of plant-based options. The 20-40 age group, already keen on daily consumption, might be enticed with subscription models or loyalty programs. For the 40-60 and above-60 segments, focus on health benefits and how these beverages fit into a holistic wellness routine. The key is to customize your approach to resonate with each age group's lifestyle and preferences.

Generational Greens

Preference for plant-based or dairy alternative beverages varies significantly by generation. Among the under-20 group, over 46% enjoy these drinks at least once a week. In the 20-40 age group, active users are at a similar percentage, with 19.5% consuming them daily, though 27.6% do not partake at all. The 40-60 demographic shows the highest resistance, with 43.9% never consuming these beverages. Interestingly, those above 60 demonstrate a renewed interest, with 19.4% drinking 2-3 times a week, though 35% still avoid them.

Takeaway: For the younger crowd, emphasize the trendiness and variety of plant-based options. The 20-40 age group, already inclined towards daily consumption, can be further engaged with subscription models and loyalty programs. For the 40-60 and above-60 segments, focus on the health benefits and how these beverages contribute to a holistic wellness routine. Tailor your approach to match each age group's lifestyle and preferences.

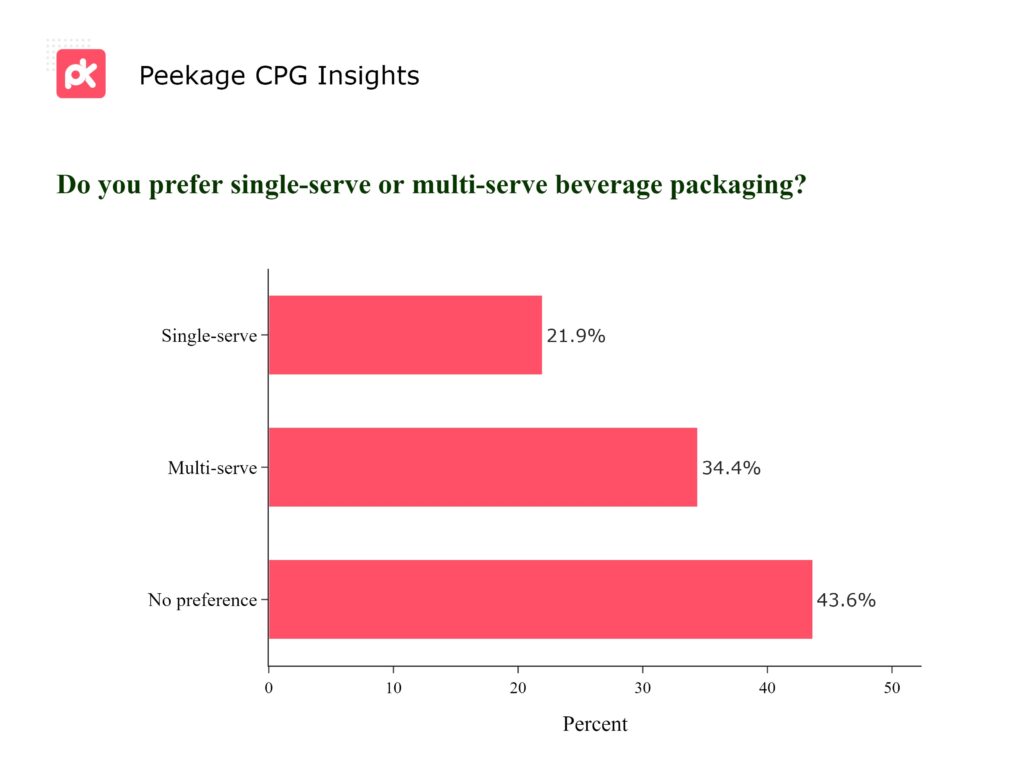

Packaging Preferences

When it comes to beverage packaging, consumer preferences reveal a clear pattern. Multi-serve packaging is notably popular, with 34.4% of consumers favoring it for its cost-effectiveness and reduced waste. It's notable that over 75% of consumers are either satisfied with single-serve options or have no preference, which appeals to those seeking convenience and portion control.

Takeaway: Since a large segment is open to either option, consider offering a range of both single and multi-serve packages to cater to all preferences. However, with a substantial interest in multi-serve options, emphasize bulk packaging for home consumption and value-focused buyers. Single-serve should not be overlooked though, especially for on-the-go consumption and targeting individual preferences.

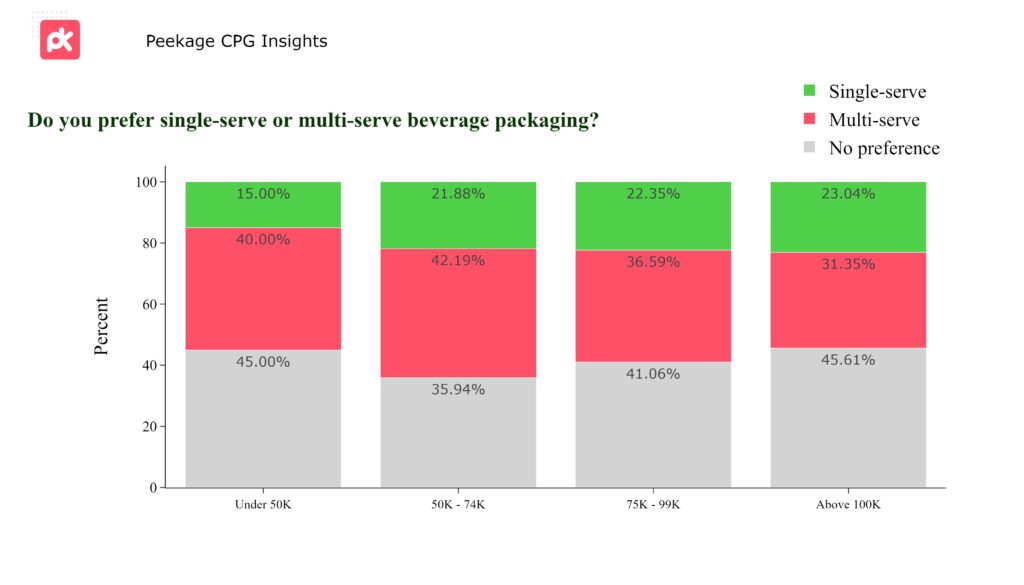

Income and Packaging

Income levels significantly influence preferences in beverage packaging. For those earning $50K - $74K, multi-serve packaging serves well for over 77% of consumers. The $75K - $99K bracket shows a similar trend, with a higher inclination for no preference. Interestingly, as income rises above $100K, preference for multi-serve decreases to 31.3%, while no preference climbs up.

Takeaway: When deciding on packaging strategies, focus on the income level of your targeted segment. Lower-income consumers show significant openness to both packaging types, as do mid-range income consumers. Interestingly, as income increases, focus on diversifying options to cater to a more split preference. Offering both single and multi-serve options can ensure you meet the varied demands of all income segments.

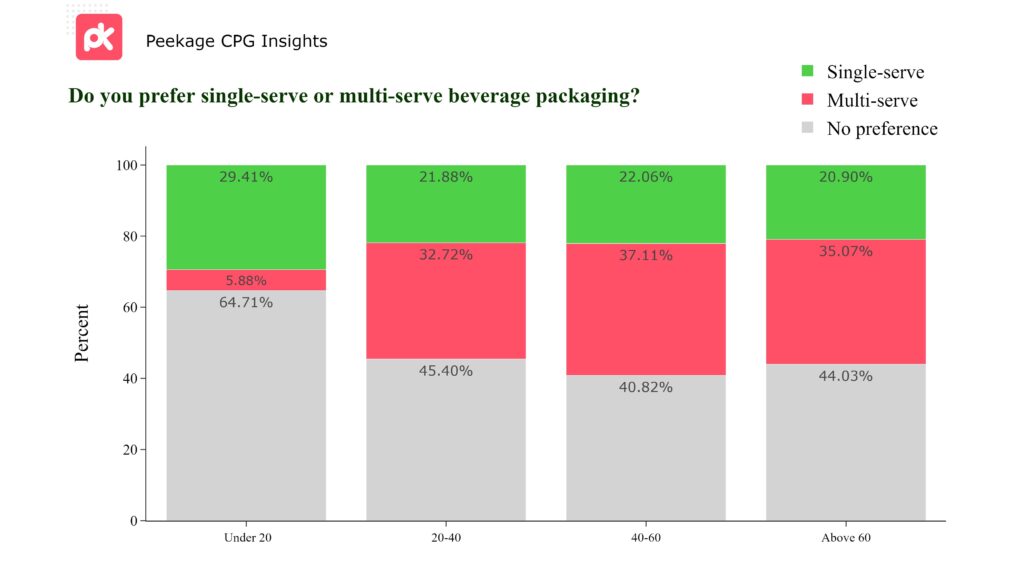

Age and Convenience

A significant portion of young people under 20 (around 94%) don't have a specific preference for multi-serving packaging. As people age, they become more opinionated about packaging, with about 35% of those over 20 preferring multi-serving packages and around 40% still indifferent to packaging.

Takeaway: Age-related preferences mirror income-related trends. Younger consumers are more flexible with packaging types. As people get older, it's important to offer a range of packaging options to suit their specific tastes. Providing both single and multi-serve packages can effectively meet the diverse needs across different age brackets.

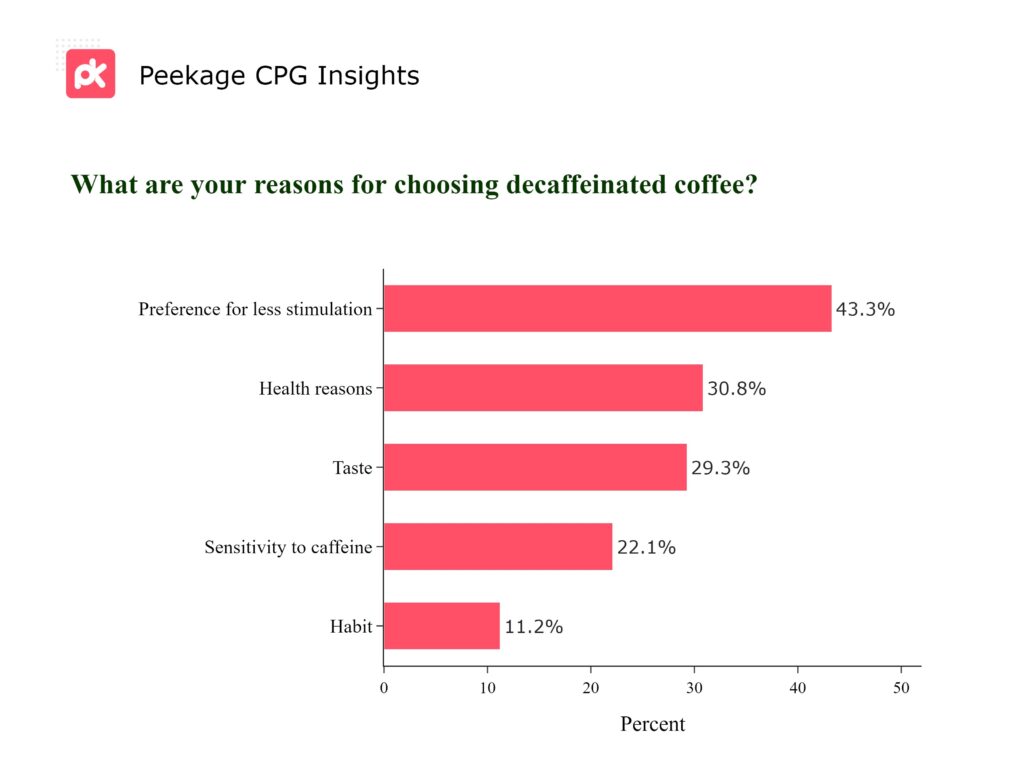

Decoding Decaf

A significant portion of customers (43%) choose decaf coffee to avoid caffeine-induced stimulation. Health reasons are also crucial for nearly 31% of respondents. Sensitivity to caffeine (22.1%) and habit (11.2%) are additional factors influencing consumer decisions.

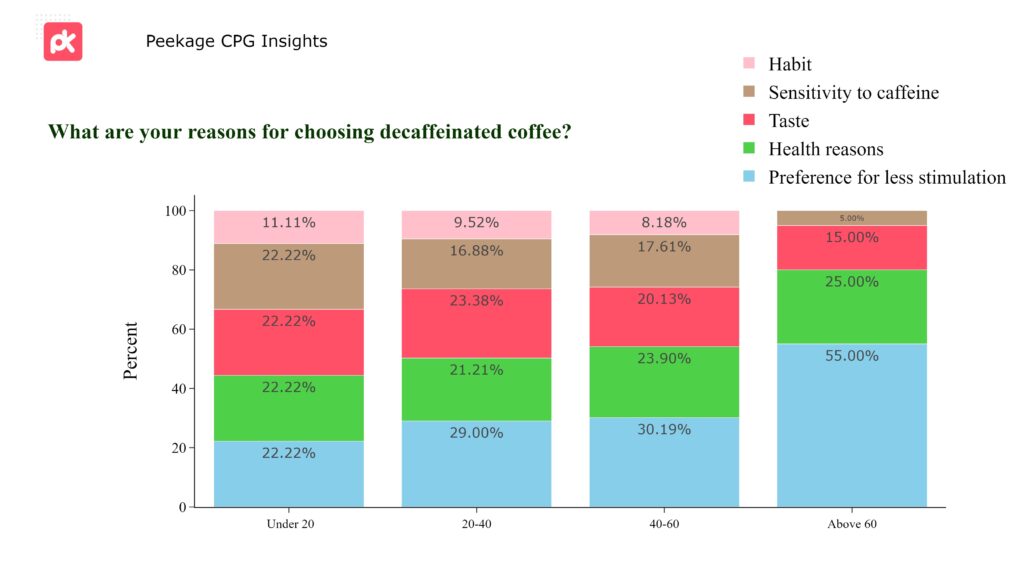

Decaf Across Decades

As people age, no eyebrows are raised to observe a growing demand for decaffeinated drinks, driven primarily by a preference for reduced stimulation. Individuals over 60 show more than twice the preference (55%) for decafs compared to those under 20 (22%), due to their sensitivity to stimulation. Moreover, older adults tend to drop caffeine habits (0%) more readily than younger generations (11% for those under 20), possibly influenced by a more relaxed lifestyle.

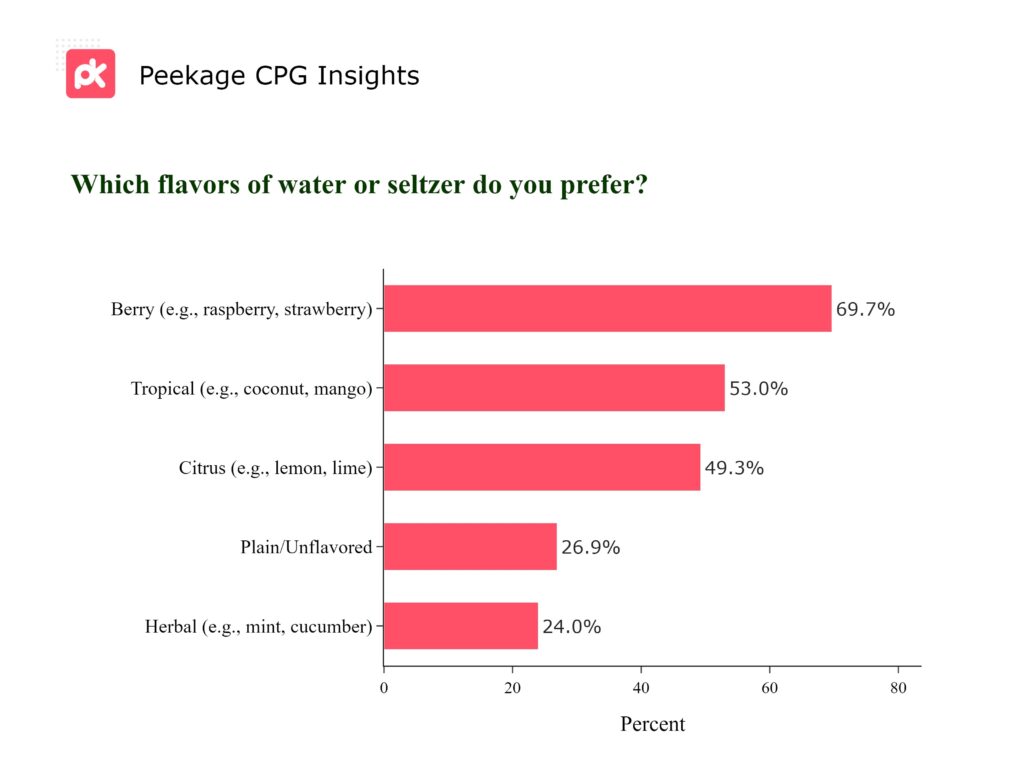

Bubble Preferences

The flavors preferred in water and seltzer beverages show distinct consumer trends. Berry flavors, including raspberry and strawberry, are a clear favorite, chosen by nearly 70% of respondents. More notably the unexpected preference (27% of customers) for plain and unflavored water and seltzers. Also, contrary to the common belief, the preference for Herbal flavors is not popular in the mix of water and seltzers. However, with warmer seasons and hotter climates on the horizon, there's potential for herbal varieties to gain popularity.