Our mission at Peekage is to help CPG executives stay on top of market trends and track shifts in consumer behavior to make informed decisions. Our regular CPG insights reports aimed at that. We hope you find it as useful as we do!

In this report, we've deep-dived into 2023 CPG forecasts and consumer behavior, uncovering insights on inflation, changing consumer behaviors, and consumer willingness to pay. Join us as we unlock the secrets of the upcoming year.

What do the CPG consumers expect in 2023?

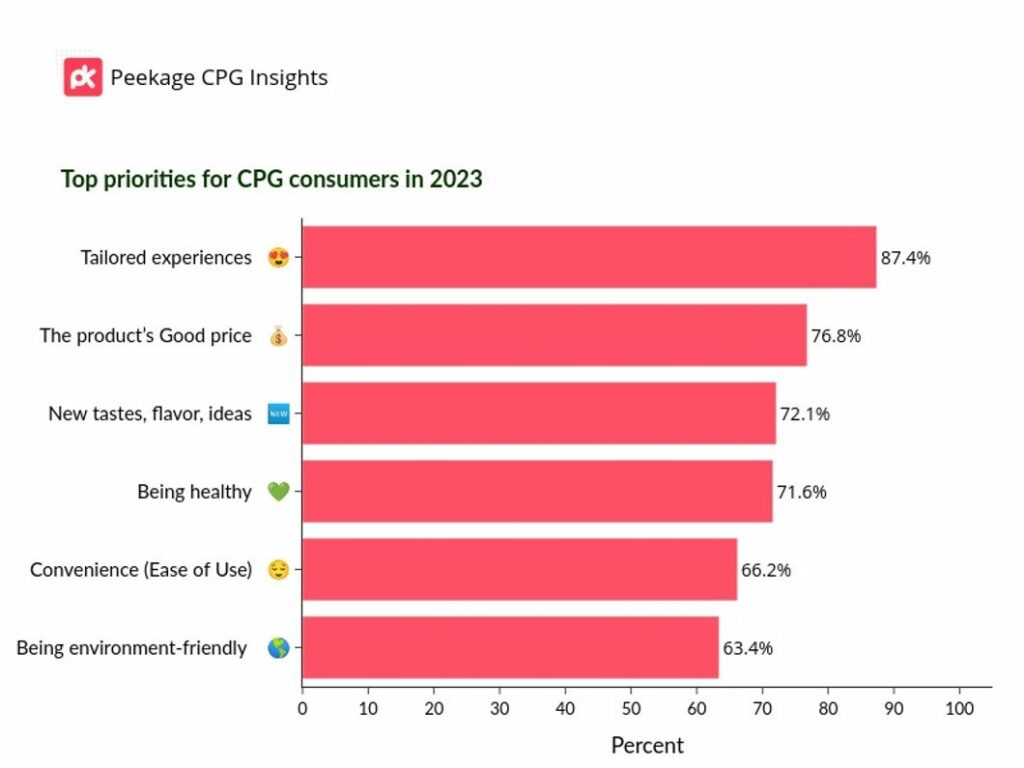

Consumer preferences are evolving, with personalized experiences, affordability, innovation, and healthy alternatives at the forefront. According to our study:

- Around 87% of consumers prioritize personalized experiences and tailored products to their needs.

- More than 75% of consumers prioritize good prices.

- Over 70% of consumers seek new tastes, flavors, and ideas.

- More than 60% of consumers prioritize health, eco-friendliness, and ease of use in their purchases.

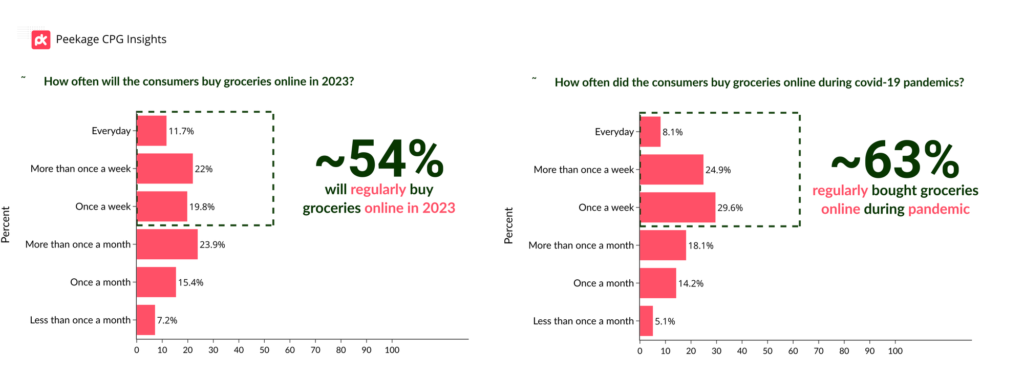

More than half of consumers will shop online at least once a week

Despite initial predictions that in-store shopping will get back to pre-pandemic levels, more than 54% of consumers still opt to shop for groceries online at least once a week.

- ~75% will shop online more than once a month, >90% will shop online at least once a month.

- The number of consumers who buy groceries online every day has slightly increased (from 8.1% to 11.7%)

How will consumers deal with inflation?

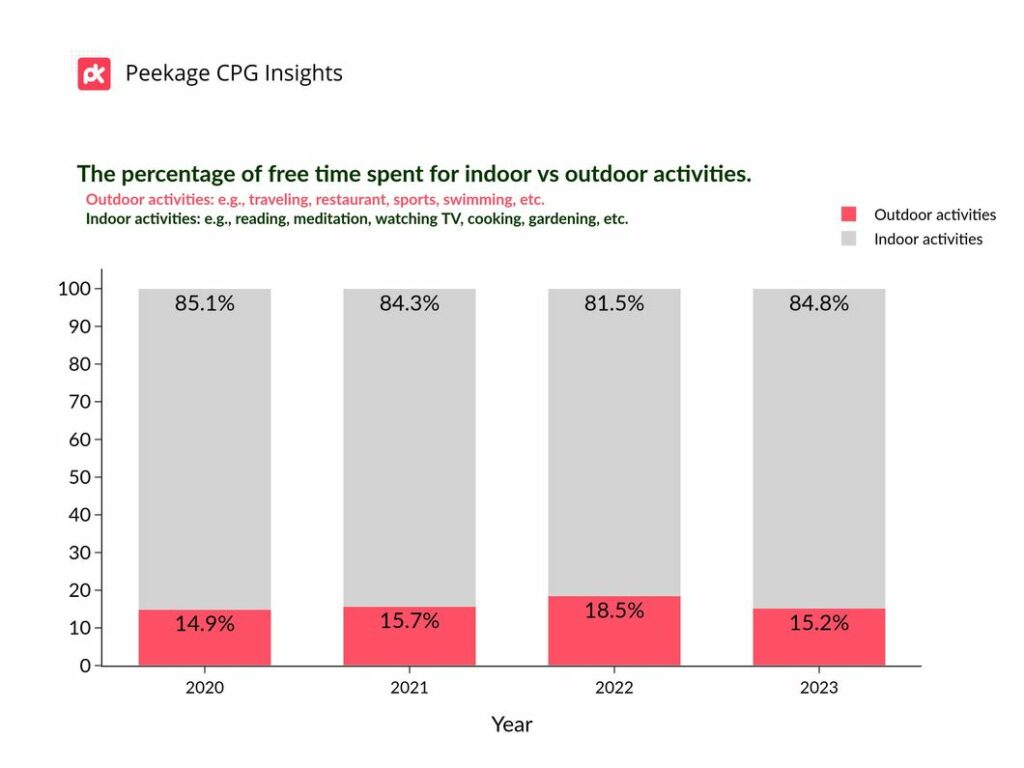

- In 2023, the amount of time spent on outdoor activities such as traveling, sports, concerts, and restaurants will decrease to pandemic levels despite an increase in such activities in 2022. This is due to the long-term effects of inflation and the rising costs of transportation, fossil fuels, and outdoor experiences.

- ~47% of consumers will be cooking more at home while over 40% are actively trying to reduce grocery waste and save costs.

- While people may not be going out as much, they are still seeking new tastes, healthier food options, and ethnic and indulgent experiences.

- Approximately ~20% of consumers will completely cut their premium purchases and shopping from specialty stores.

- Less than 40% of consumers mentioned they will purchase more from promotions, discount offers and wholesalers.

Sustainability is key in 2023

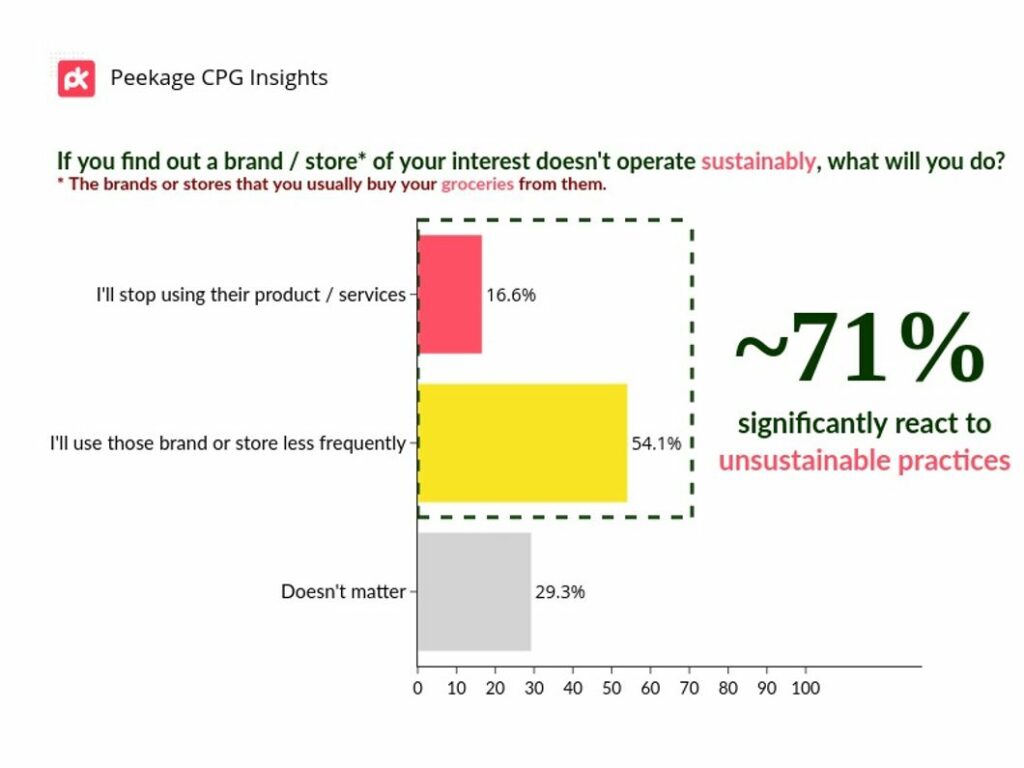

- Less than 70% of North American consumers will either stop or reduce their usage of services or products from CPG brands or stores that do not operate sustainably.

- Consumers have different interpretations of sustainable practices for CPG brands or stores with Reusable/long-lasting products (mentioned by 61%) and being energy-efficient (mentioned by 54%) being the most common.

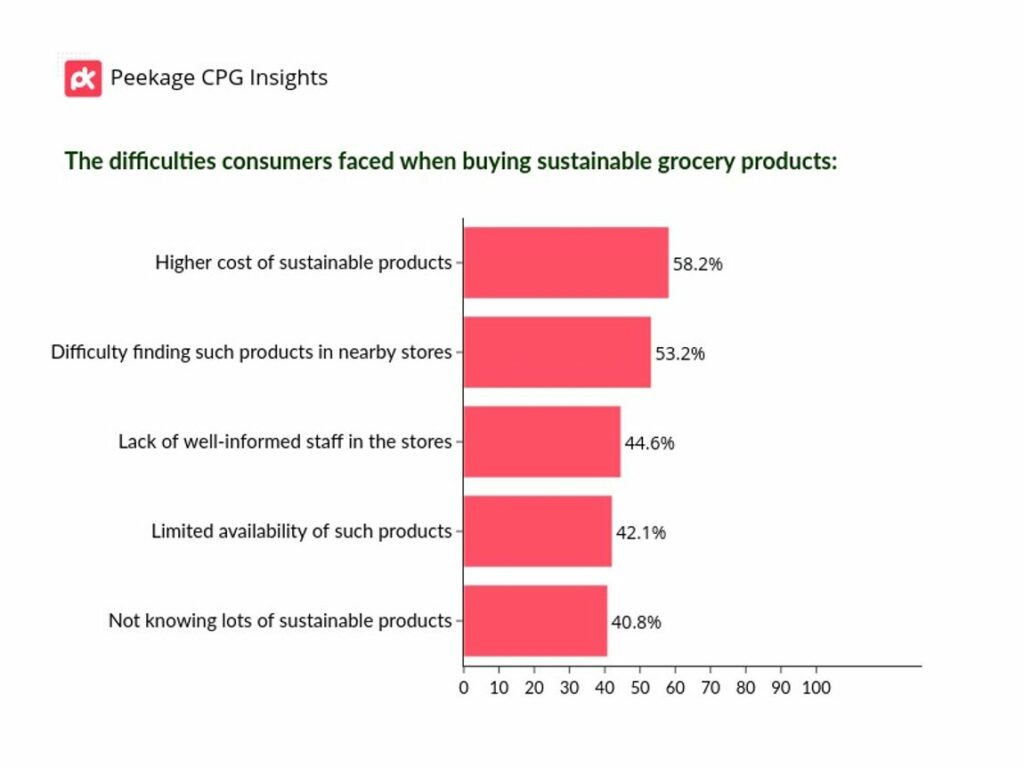

- The majority of consumers cited higher costs of sustainable grocery products and difficulty finding them in nearby stores as the main barriers to buying sustainable groceries.

Plant-based products are on the rise

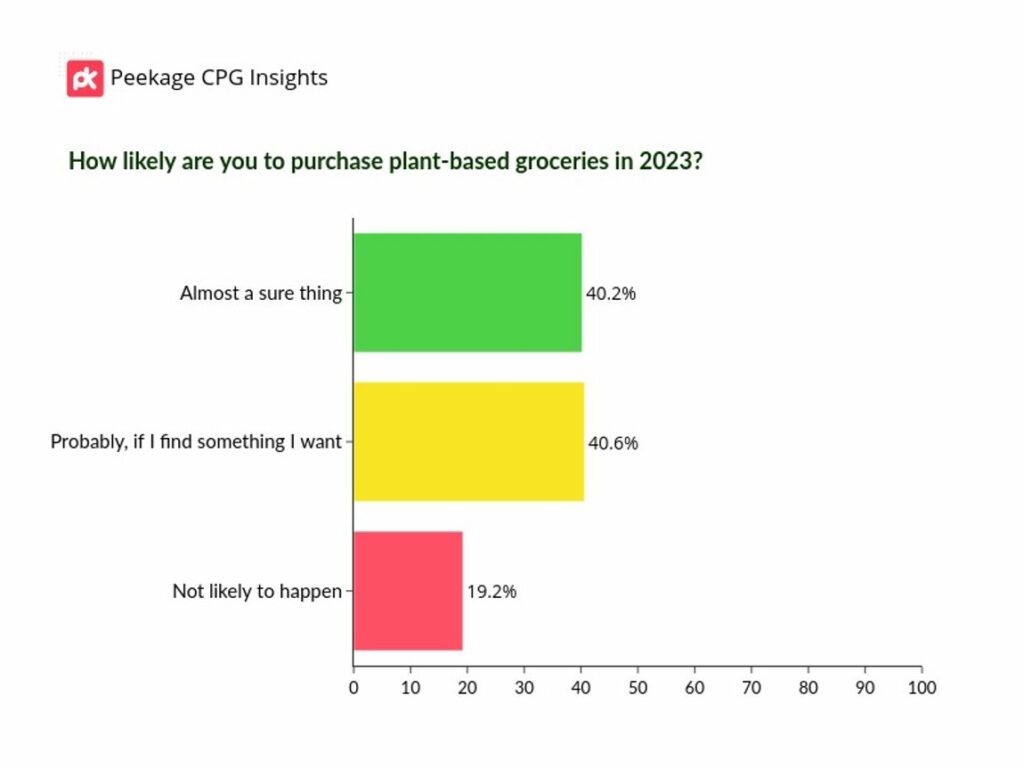

- Less than 40% of consumers plan to purchase plant-based grocery products (e.g, meat, egg, milk plant-based substitutes) in 2023

- Less than 40% of consumers probably purchase plant-based groceries products (e.g, meat, egg, milk plant-based substitutes) in 2023, if they find their desired products.

- less than one-fifth of consumers don't have plans to buy plant-based grocery products in 2023

Driving more profitability in 2023

To increase profitability in 2023, CPG brands can benefit from implementing the following strategies:

- Boosting supply chain capabilities: CPG companies can use data and AI initiatives to reduce costs and improve their supply chain by collecting more detailed information, increasing transparency with customers and other parties, and securely sharing data with partners.

- Direct-to-Consumers understanding: CPG brands will benefit from connecting with consumers to understand their needs and create tailored experiences through product innovation and prioritizing new product introduction to expand better-for-you claims.

- Increasing market share: CPG brands, particularly small and private-label brands, can benefit from employing strategies such as price optimization, maintaining ingredient integrity, and innovation in marketing and advertising to continuously gain a share over larger competitors. SMEs can leverage their advantages in sustainable, environment-friendly, and healthier products. Additionally, they can win by employing strategies for timely data collection and proper data analysis. This can happen in a variety of ways, especially hypothesis testing for new products and ingredients, hyper-segmentation, optimization of supply chain, and continuous brand tracking.

Highlights

- More than half of the consumers will still continue to regularly shop online in 2023.

- Indoor activities will be as high as pandemic era: People may not be going out as much, but they are still looking for ways to have a good time and are willing to cook more at-home, trying new tastes, healthier food, and ethnic and indulgent experiences. That's why more than 85% of consumers finding personalized offers and products tailored to their needs is a top priority for them when shopping in this year.

- Less than 40% of consumers mentioned they will purchase more from promotions, discount offers and wholesalers.

- ~47% of consumers will cook more at-home and less than 40% reported they're trying to reduce groceries waste and save costs.

- Sustainability is key in 2023: more than 70% of North American consumers will stop or reduce using services or products from CPG brands or stores who does not operate sustainably.

- Plant-based products are on the rise: more than 40% of consumers plan to purchase plant-based grocery products (e.g, meat, egg, milk plant-based substitutes) in 2023, also another 40% of consumers may buy plant-based alternatives if they find their desired products.

- CPG brands will strive to drive more profitability in 2023: more than two-thirds of North Americans believe we are currently in a recession. That's why initiatives and innovations will try to leverage their supply chain advantages, improved direct-to-consumers understanding to expand better-for-you claims, and increasing market share.

Thank you for reading this report. If you have a burning question or want to know how to boost your sales among specific segments, stores, or geo-locations, reach out to us, and our CPG experts will guide you with the best strategies.