Navigating Sustainability: Consumer Awareness and Action

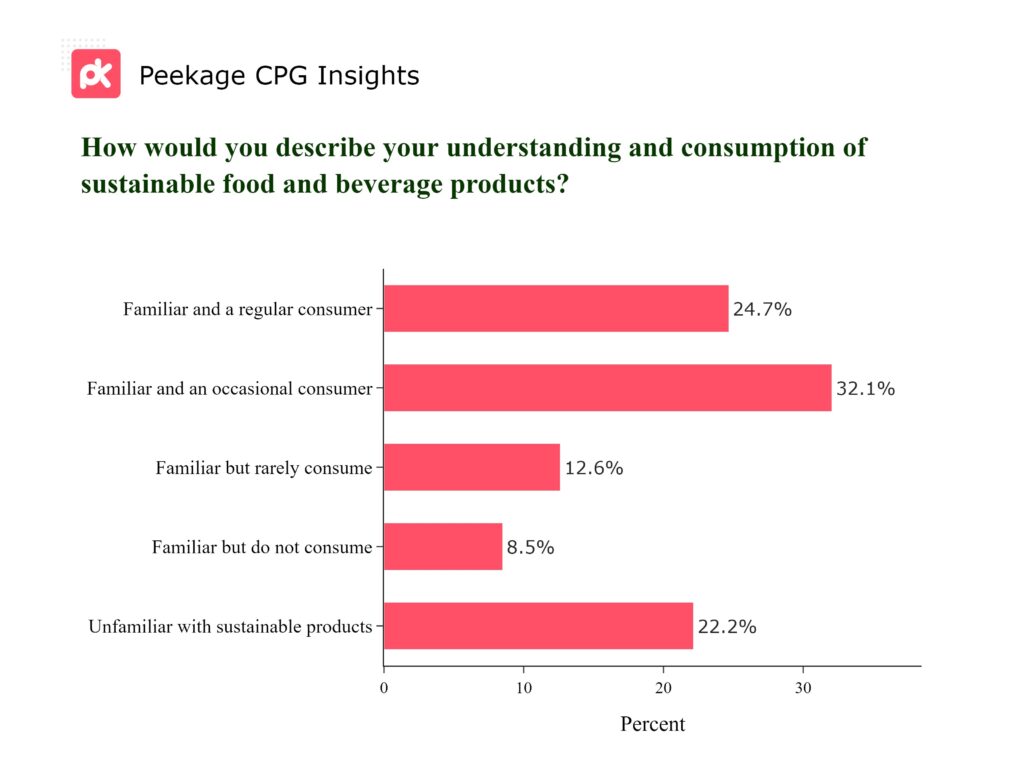

The landscape of sustainable food and beverage consumption is varied, with a majority (59%) engaging as occasional or regular consumers, indicating a solid and growing market. However, the data also reveals a significant portion is still unfamiliar or not consuming, highlighting the need for increased awareness and engagement.

There is a great opportunity to create a large segment (about 56.8% of people) of regular sustainable food and beverage consumers. To address this, focusing on educational marketing that demystifies sustainable products and showcases their benefits could help. For those already on board, reinforcing their habits with rewards or information on the broader impact of their choices is an option.

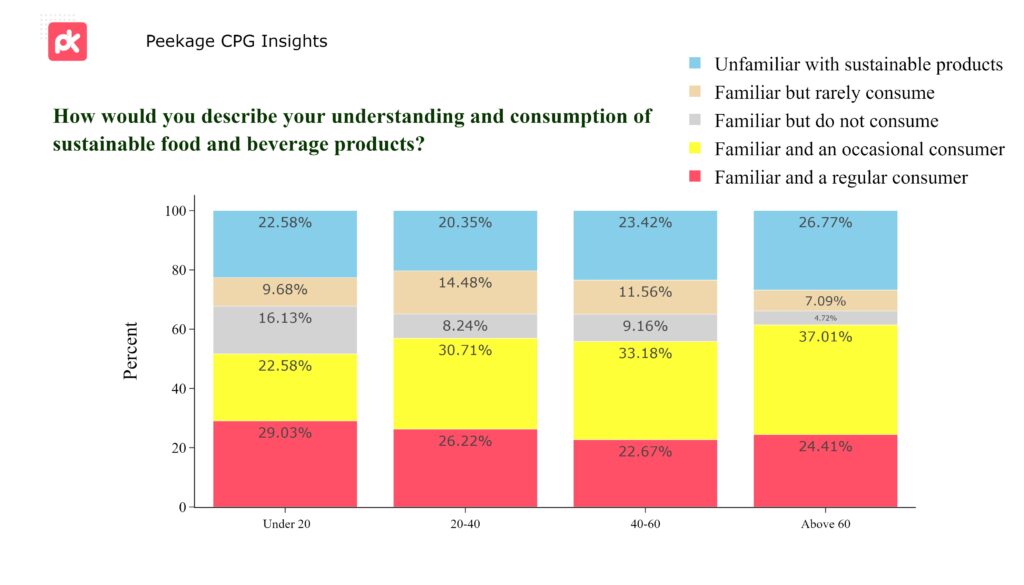

Sustainable Savvy: Age-Related Consumption Patterns

As consumers age, there's a notable shift in familiarity and consumption habits with sustainable products. The older the demographic, the greater the portion of individuals who are unfamiliar with sustainable options. Concurrently, the number of regular consumers of sustainable products decreases, while occasional consumption sees an uptick. Interestingly, the group that is familiar with but actively chooses not to consume sustainable products diminishes with age.

This trend highlights a critical need for targeted education and engagement strategies across age groups. For younger, more regular consumers of sustainability, maintaining and innovating in product offerings is key. Conversely, for older demographics, increasing accessibility and awareness, along with emphasizing the relevance and benefits of sustainable products, can help convert occasional consumers into regular ones and increase overall familiarity with sustainable options.

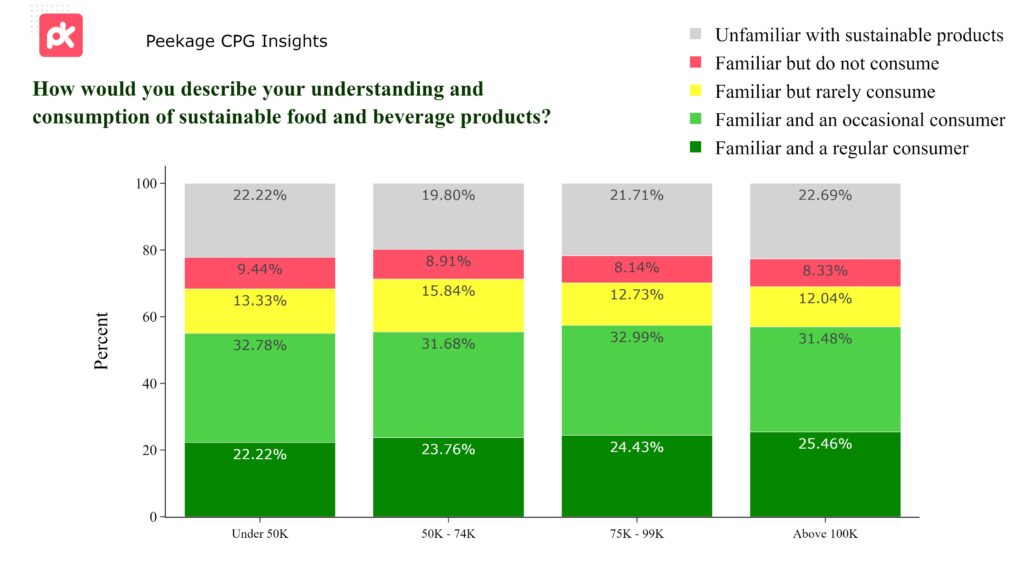

Universal Understanding: Sustainability Across Income Tiers

The awareness and understanding of sustainable foods and beverages appear to be uniformly distributed across different income segments, suggesting that the concept of sustainability has penetrated broadly and deeply into consumer consciousness. This universal familiarity presents a solid foundation for brands to build upon, regardless of their target income demographic.

With sustainability awareness nearly uniform across income segments, brands can universally target their eco-conscious products. This even distribution means there's potential in every market tier. By focusing on innovative and sustainable offerings, brands can captivate a broad audience, transcending income barriers. It's a strategic opportunity to connect with consumers universally, harnessing the power of sustainability as a key driver of appeal and loyalty.

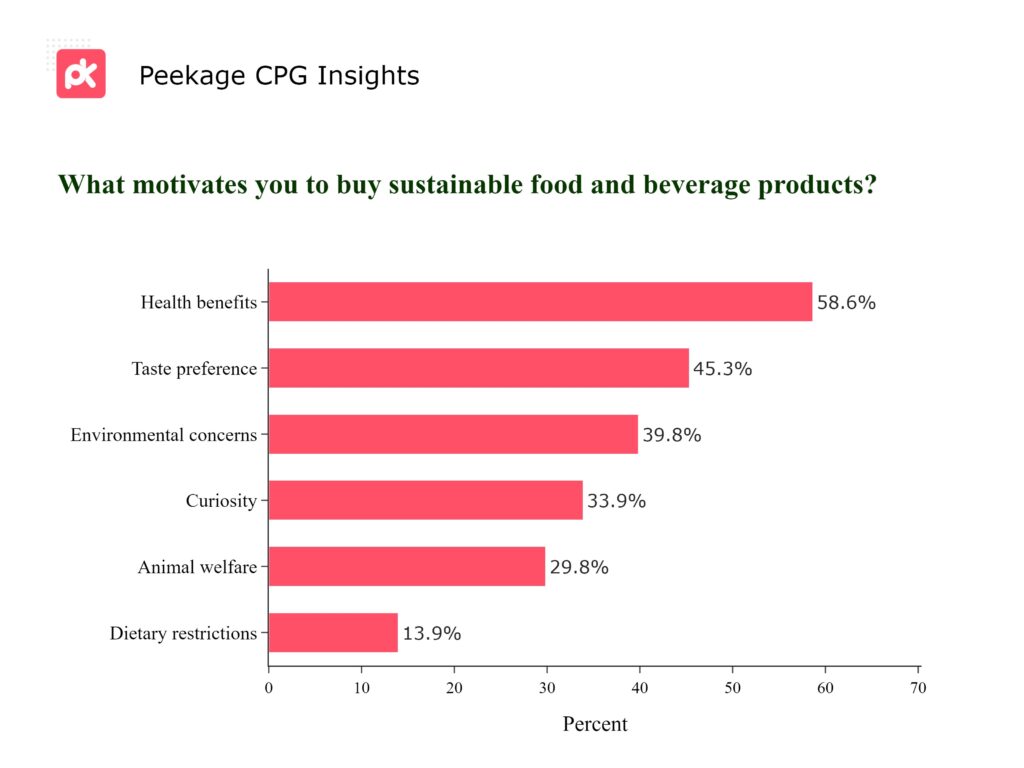

Motivation Mix: Driving Sustainable Choices

Consumers are motivated by a rich tapestry of reasons to choose sustainable food and beverage products, with health benefits (58.6%), environmental concerns (39.8%), and taste preference (45.3%) leading the charge.

Capitalizing on the growing trend, savvy brands can harness the powerful association between sustainability and health. Highlight the variety of benefits your products offer to cater to these motivations. Emphasize delicious tastes, healthy advantages, and the positive impact on animals and the environment in your messaging.

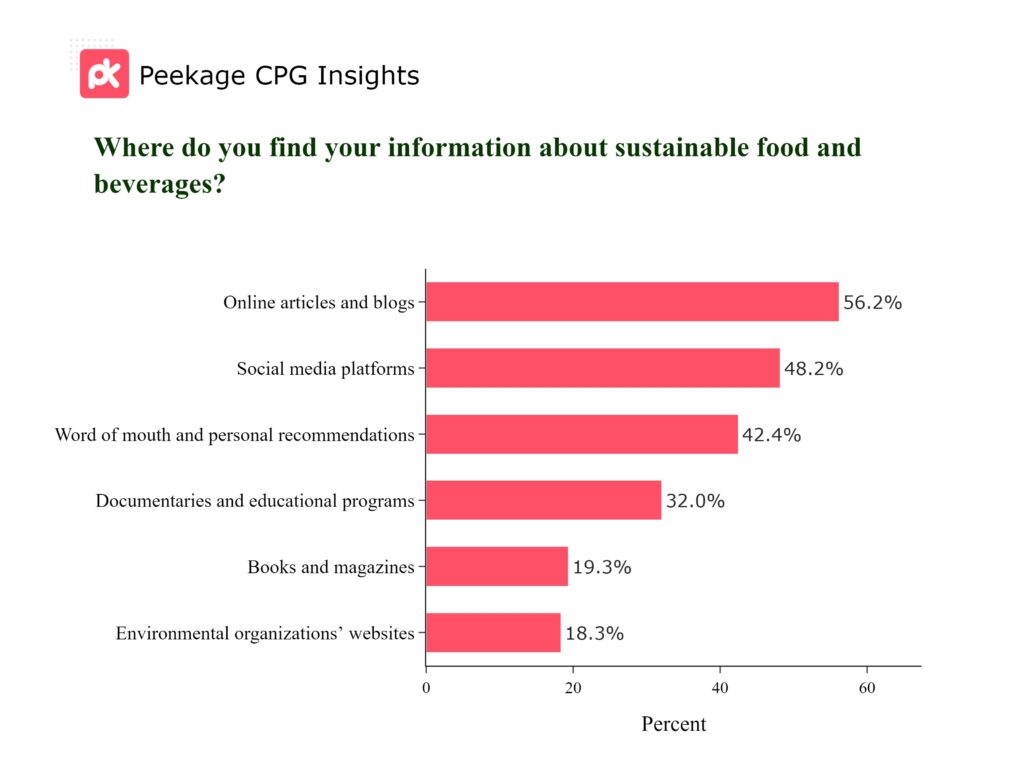

Green Info Hunt: Where Consumers Learn

The quest for information on sustainable food and beverage is predominantly digital, with online articles, blogs (56.2%), and social media platforms (48.2%) serving as the primary sources. Documentaries, educational programs, and personal recommendations also play significant roles, reflecting a diverse set of channels through which consumers educate themselves and make informed decisions.

Embrace a multi-channel approach to reach your audience where they're already seeking information. Invest in engaging online content, partnerships with influencers, and educational campaigns to amplify your product's visibility and appeal.

Cultivating Change: Consumer Visions for a Greener Market

Consumers are clear in their desire for a more affordable and available sustainable food and beverage market. Top priorities include more affordable pricing (71%), wider availability (48.9%), and a greater variety of products (44.9%). Additionally, there's a strong call for better taste and quality, along with increased transparency and stronger safeguards against misleading marketing.

To meet these needs, consider strategies such as adjusting pricing, expanding distribution, diversifying offerings, providing varied options, and clearly communicating your sustainable practices. Enhance trust and appeal by partnering with local producers, offering incentives, and actively participating in regulatory conversations.

Navigating the Green Barrier: Understanding Consumer Hesitations

The journey to sustainable consumption is not without its hurdles, with the higher cost of sustainable products (64.6%) leading as the main barrier, followed by limited availability (41.7%) and concerns about authenticity (27%). Lack of awareness and information also contribute to hesitancy, alongside concerns about variety and perceived quality.

Addressing these barriers head-on, brands can prioritize transparent communication about the value and authenticity of their sustainable offerings. Strategies to reduce cost, increase availability, and broaden the variety will significantly lower these barriers.

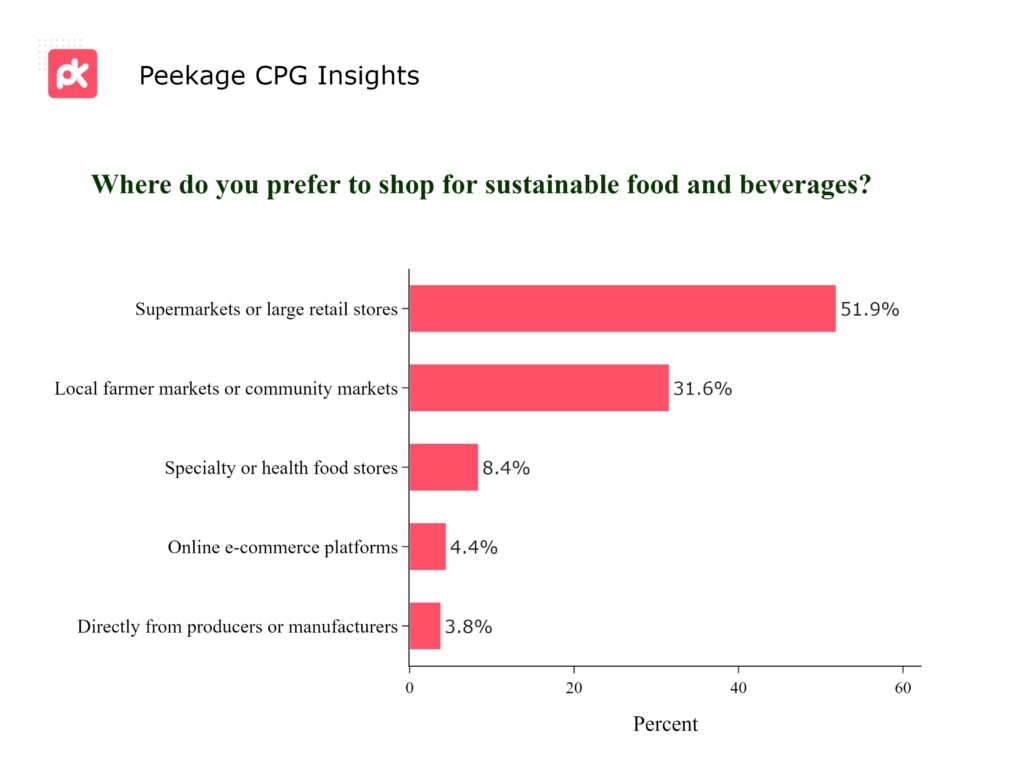

Navigating Green Aisles: Shopping for Sustainability

Consumers' preferred shopping venues for sustainable goods are diverse, with supermarkets or large retail stores taking the lead, followed by local farmers markets. This trend showcases the mainstreaming of sustainable products as well as a desire for community and quality through local purchasing.

Enhance your presence in the leading outlets while exploring partnerships and storytelling opportunities in local and specialty markets. Emphasize convenience and community in your messaging to align with consumer preferences.

Age-Related Shopping Trends: Diverse Preferences in Sustainability

When breaking down the preferred shopping venues for sustainable products by age, it's evident that younger and older consumers favor the convenience and variety offered by large supermarkets and online retailers. On the other hand, those in the mid-age range show a preference for local farmers markets or community markets, perhaps valuing the quality, community aspect, or the direct relationship with producers these venues offer.

This distinction in shopping preferences suggests that brands should consider multi-channel strategies that cater to the different values and habits of each age group. For younger and older demographics, strengthening the online presence and ensuring availability in large retail environments are key. Meanwhile, for the mid-range age group, forming partnerships with local markets and emphasizing community and local sourcing might be more effective in aligning with their preferences.

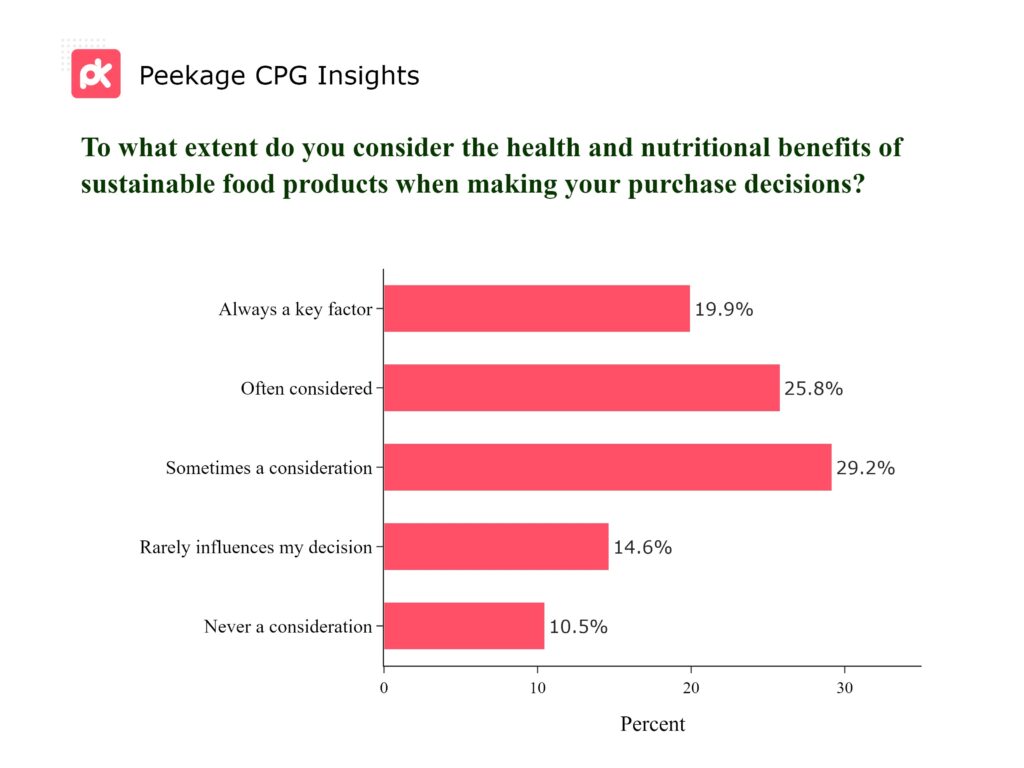

Healthy Bites, Happy Planet

Consumers are increasingly weighing health and sustainability in their food choices, with a significant portion often making it a priority. While a diverse group remains, many are open to being swayed by the right health-focused messaging.

Capture the 45.7% health-conscious market by highlighting your product's nutritional benefits and sustainability. Entice the occasional buyers by integrating health into your branding narrative. Drive sales and build loyalty by aligning with the growing trend of mindful eating.

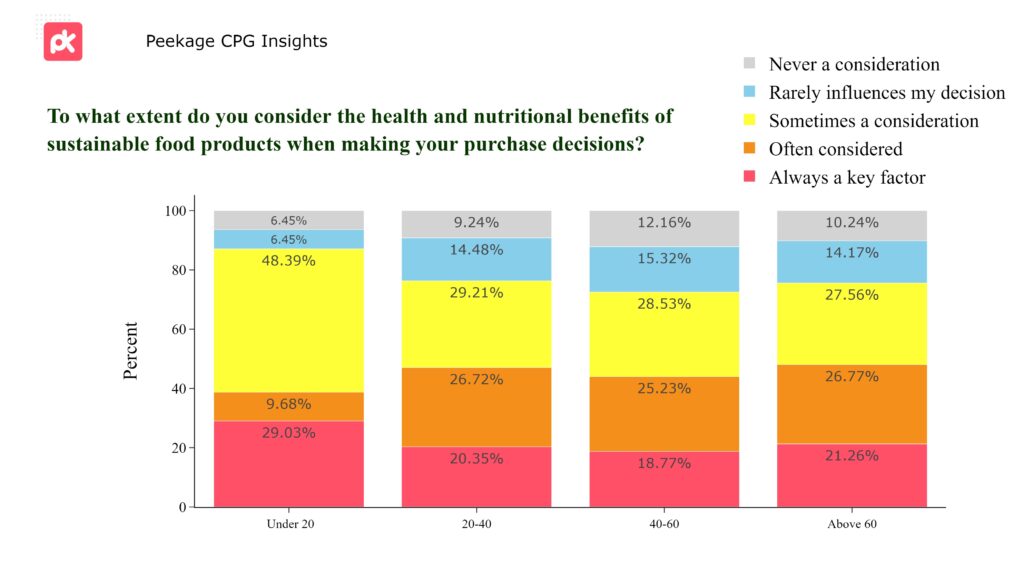

Youthful Insight: Nutritionally Conscious

Younger consumers show a heightened awareness of the nutritional benefits associated with sustainable food products, indicating a more health-conscious stance and a keen interest in the intersection of diet and sustainability. This awareness is likely fueled by increased access to information and a growing cultural emphasis on health and well-being alongside environmental responsibility.

For brands, this trend suggests an opportunity to emphasize the health and nutritional aspects of sustainable products in marketing efforts targeted at younger demographics. By aligning with their health priorities and providing clear, accessible information on the nutritional advantages of sustainable choices, brands can engage this aware and motivated segment of consumers more effectively.

Sustainable Shifts: Consumer Trends Unveiled

A dynamic shift is evident in sustainable consumption, with a notable majority (74.8%) moving towards more sustainable choices over the past year. This change reflects a growing consciousness and market opportunity for brands that prioritize and communicate their commitment to sustainability.

Seize this moment by reinforcing and expanding your sustainable offerings. Engage the 22% non-consumers with compelling reasons to switch, emphasizing the personal and global benefits of sustainable products and lead the charge towards a greener future.

Green Tide Rising: America's Sustainable Step-Up

While both Americans and Canadians are riding the sustainability wave, with about 70% increasing their consumption of green products last year, Americans have edged about 5% ahead in amping up their sustainable purchases. This subtle but significant boost reflects a sharpening appetite for eco-friendly products in the U.S.

For brands, this trend underscores the importance of not only maintaining but intensifying sustainable practices and offerings. In a market where the demand for green is growing, distinguishing your brand with innovative, sustainable solutions can capture the attention and loyalty of an increasingly eco-engaged American audience. Keep riding the green tide and watch your impact and customer base grow!

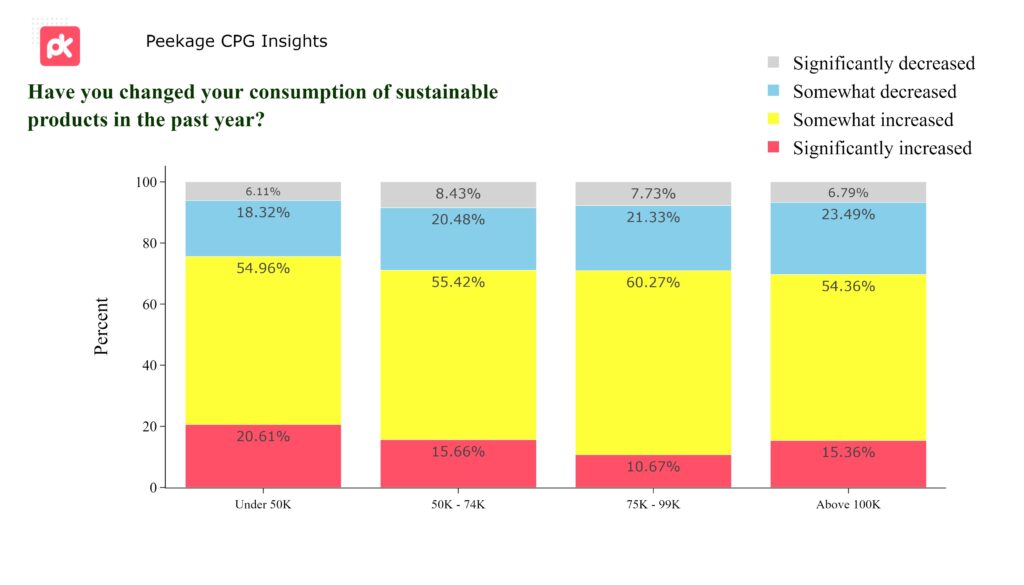

Rising Green: The Surprising Shift in Low-Income Consumer Behavior

Despite traditionally being perceived as a market more constrained by price, there's an encouraging trend among lower-income consumers, with an even more significant portion reporting an increase in sustainable product usage compared to the previous year. This shift indicates a broader acceptance and commitment to sustainability that transcends income barriers, perhaps driven by a growing awareness of sustainability's long-term benefits or increased availability of affordable sustainable options.

This trend presents an opportunity for brands to further engage with and support this segment, perhaps through cost-effective sustainable product lines or educational initiatives that highlight the value and impact of their sustainable choices.

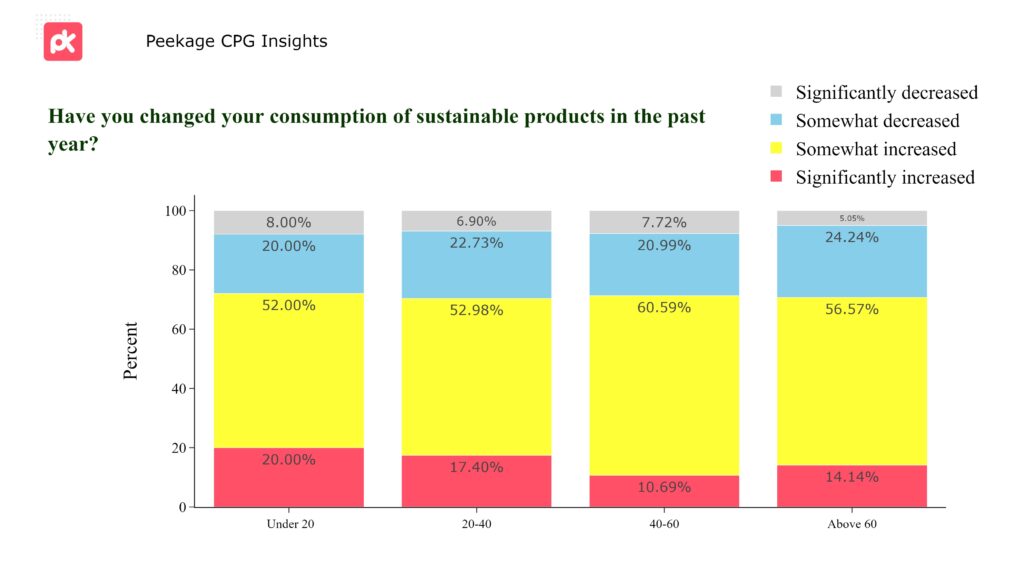

Green Gradient: Age's Influence on Sustainable Shifts

A clear age-related pattern emerges in sustainable product consumption: the younger the consumer, the larger the portion reporting a significant uptick in sustainable buying. Notably, 20% of those under 20 have significantly increased their eco-friendly purchases, compared to a tapering off among older demographics, with 14% of those over 60 reporting a significant decrease. This trend indicates a vibrant, growing commitment to sustainability among younger generations, suggesting that they are not only aware but are actively integrating green choices into their lifestyles.

Brands should capitalize on this enthusiasm by targeting younger demographics with innovative, sustainable products and messages that resonate with their values and lifestyle. Simultaneously, consider strategies to re-engage and educate older consumers, reinforcing the value and impact of sustainable choices at every age.

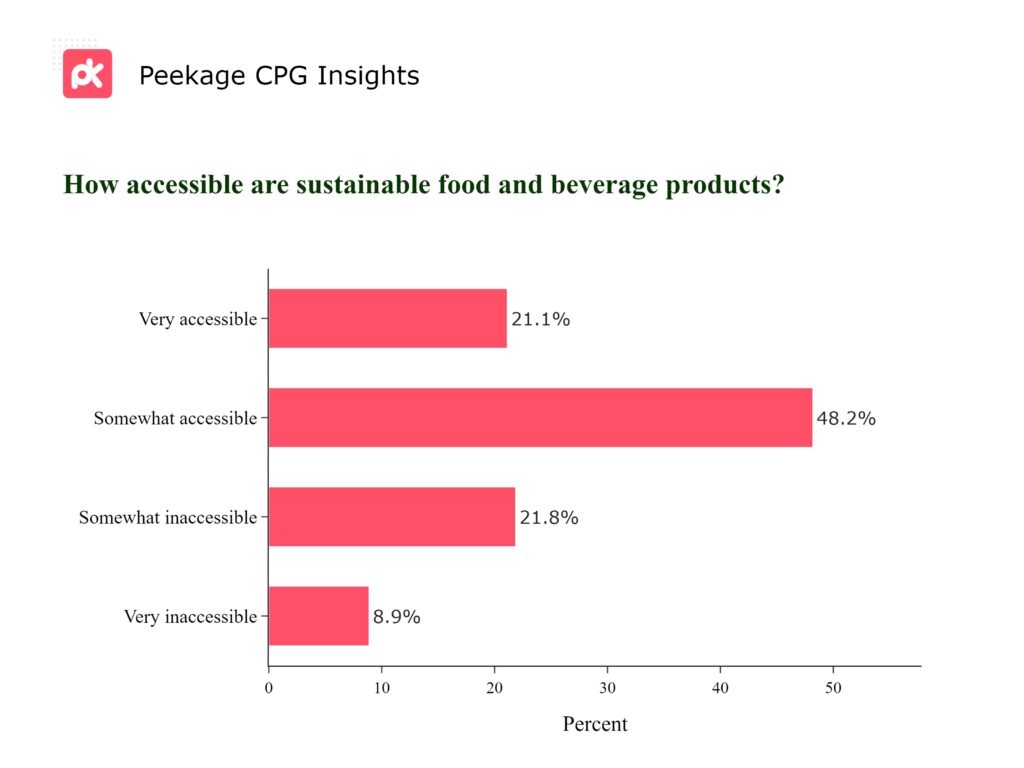

Accessibility Matters: Opening the Green Gateway

The accessibility of sustainable food and beverage products is a mixed bag, with nearly half of consumers finding them somewhat accessible, yet a significant portion still perceives barriers. This presents a unique opportunity for brands to bridge the gap and make sustainability the convenient choice.

Strategize to improve the accessibility of your products, whether through broader distribution, competitive pricing, or clear communication about the benefits. By making it easier for consumers to choose green, you enhance your brand's appeal and contribute to a healthier planet.

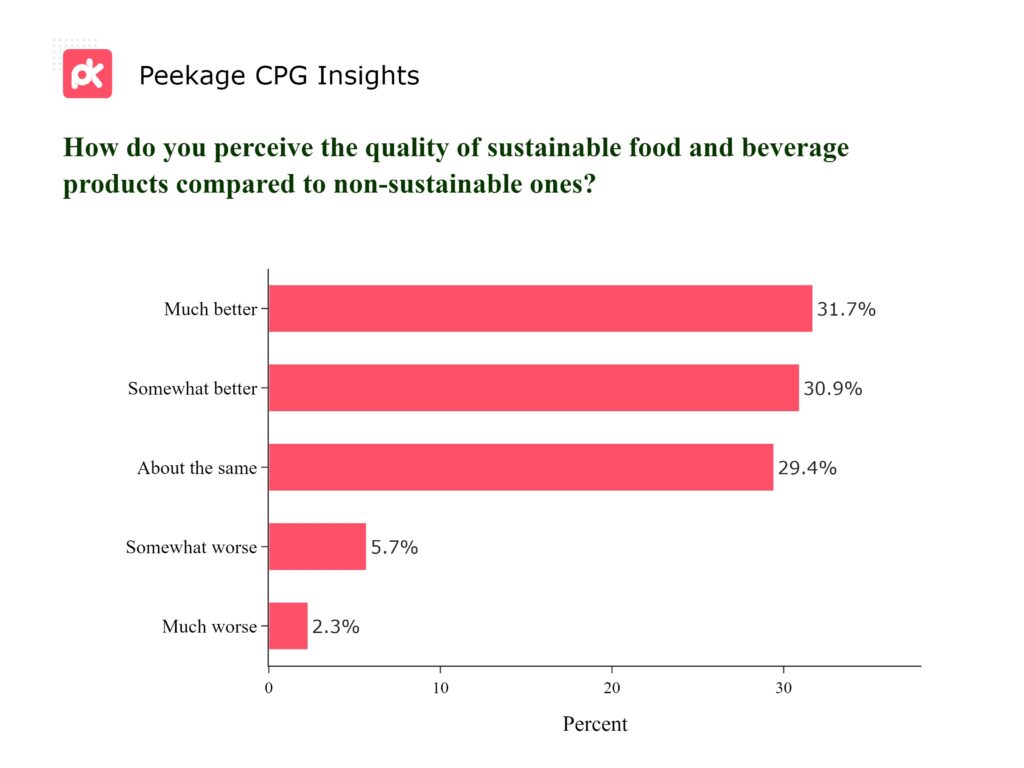

Quality in Sustainability: Perceptions & Potentials

Perceptions of the quality of sustainable food and beverage products are generally positive, with a notable 66.2% viewing them as better than non-sustainable alternatives.

Leverage the positive perception by emphasizing the superior quality and benefits of your sustainable products. Address the uncertainties by providing clear, compelling information and testimonials. Aligning quality with sustainability can not only enhance brand perception but also drive informed and loyal consumer choices.

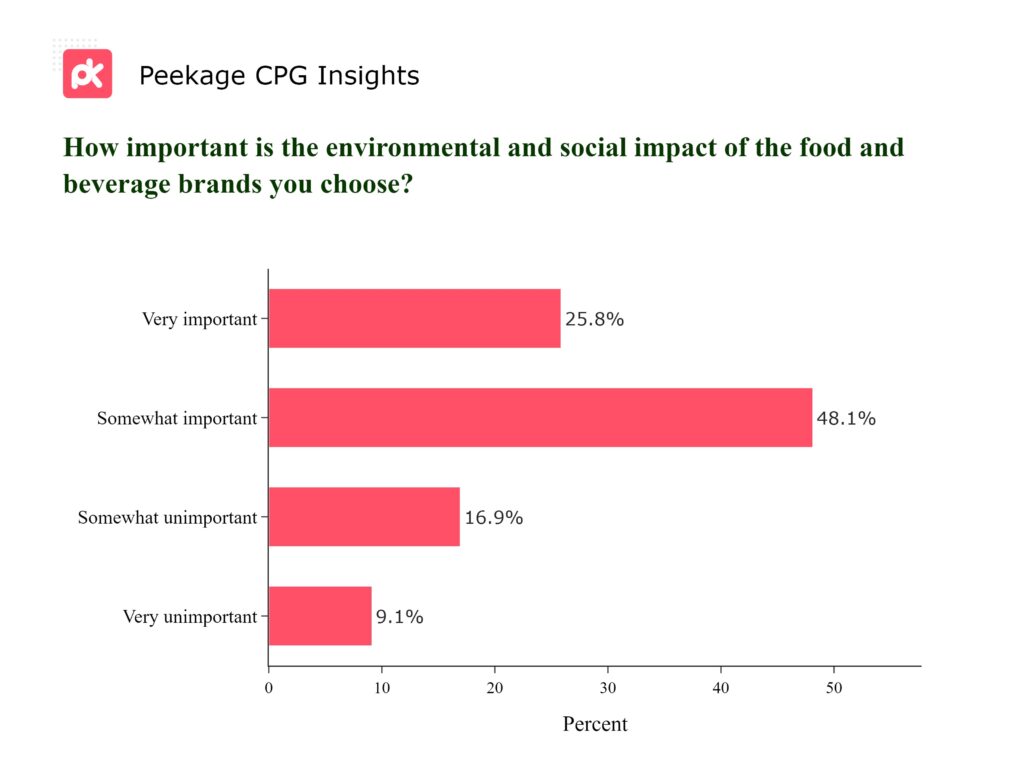

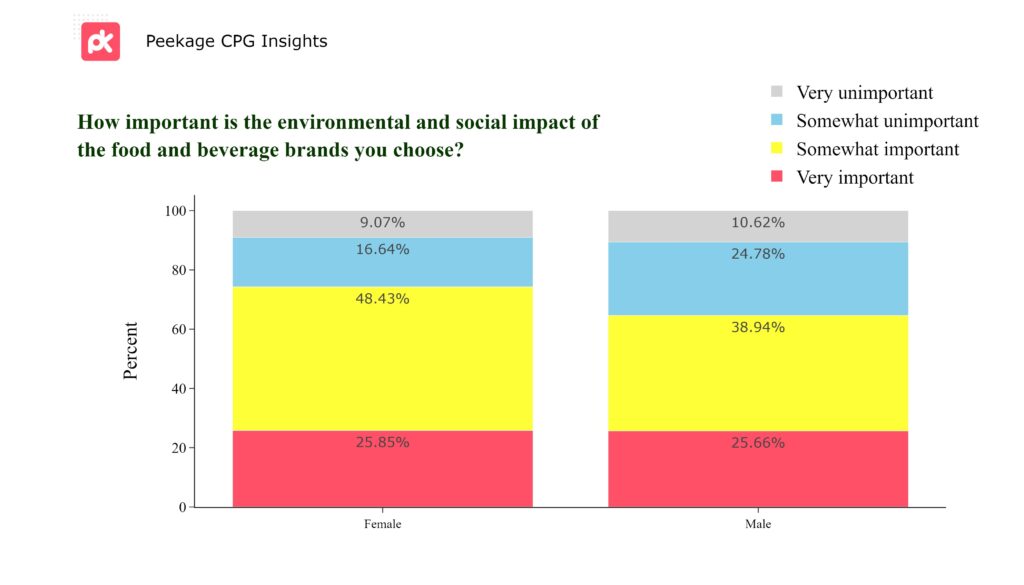

Impact Choice: The Eco-Social Connection

Consumer consciousness around the environmental and social impact of their food and beverage choices is on the rise, with a combined 73.9% deeming it important to some degree. This sentiment highlights a significant market trend towards ethical consumption and provides a clear directive for brands to amplify their eco-social initiatives.

Capitalize on this shift by prominently featuring your brand's environmental and social commitments. By making an impact a key part of your narrative, you not only cater to consumer values but also differentiate your products in a crowded market, driving both sales and positive change.

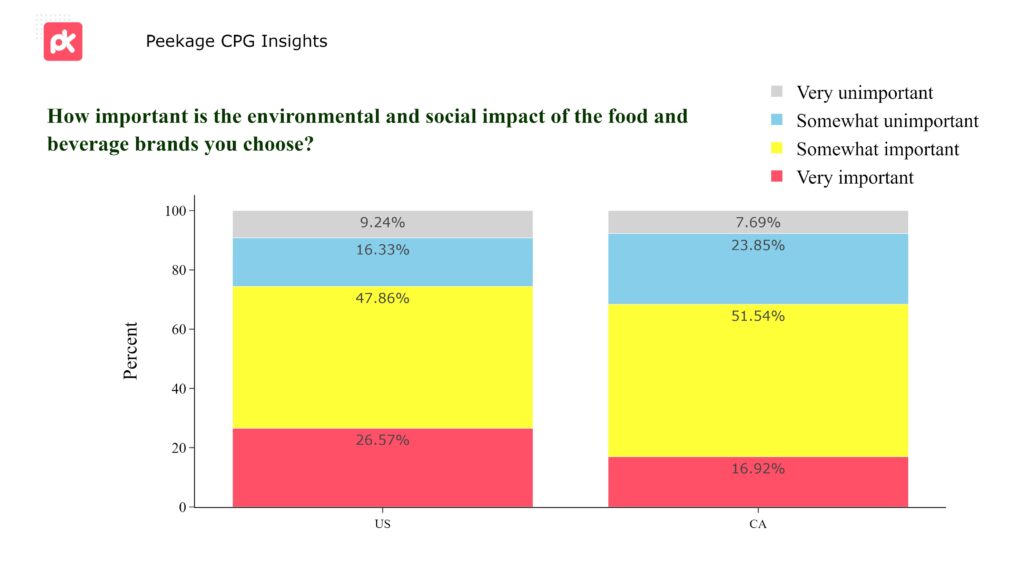

Eco-Social Edge: America's Growing Green Conscience

In the American market, the environmental and social impact of food and beverage choices weighs in at about 6% more important than it does for Canadians. Albeit there is a growing eco-social conscience among both Canadians and Americans, signaling a readiness to align with brands that share and showcase these values.

Seize this opportunity by amplifying your brand's environmental and social initiatives both in Canada and specially in the U.S. Craft stories that connect consumers with the positive impact of their purchases, making it not just a transaction, but a step towards a more sustainable and equitable world.

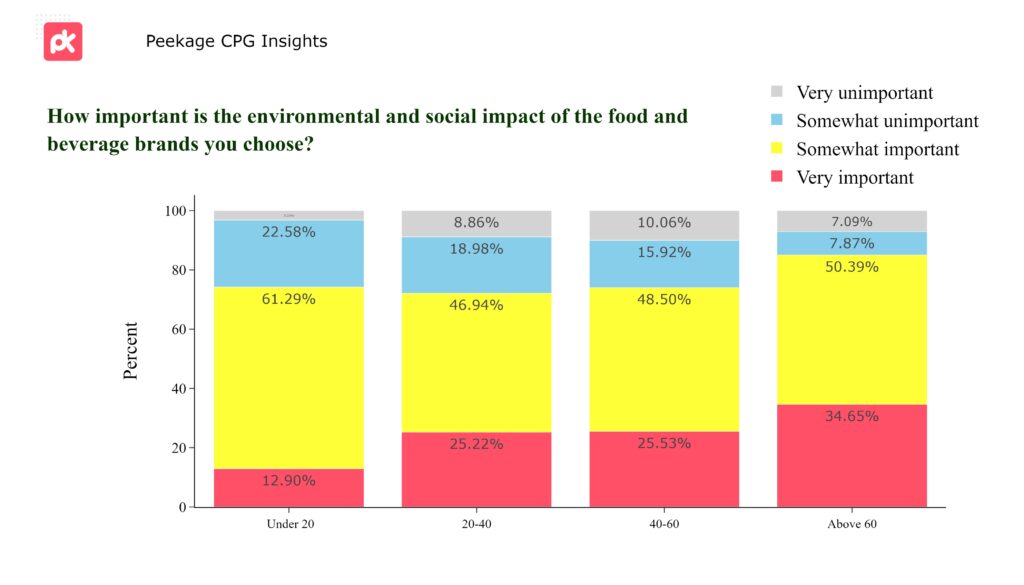

Age and Impact: Growing Eco-Social Consciousness

The importance of the environmental and social impact of food and beverage brands in consumers' decision-making processes increases with age. Starting from only 12.9% in those under 20, the concern nearly triples to 34.65% in individuals aged over 60. This progression suggests a maturing perspective on the broader implications of personal consumption choices, likely influenced by a combination of life experience, increased exposure to information, and perhaps a growing sense of responsibility towards future generations.

For brands, this indicates a need to emphasize and communicate their environmental and social initiatives more prominently as part of their marketing and branding strategy, particularly when targeting an older demographic.

Gender Perspectives: Women's Slight Edge in Eco-Social Consciousness

Women demonstrate a higher concern for the environmental and social impacts of the food and beverage brands they choose, reflecting a nuanced but important difference in gender-related purchasing behaviors. This slight edge indicates that women may be more receptive to messaging around sustainability and ethics, and they might prioritize these factors in their decision-making process.

Brands can leverage this insight by crafting targeted campaigns that resonate with women's values and by highlighting the positive eco-social impact of their products. Engaging with this demographic through community-driven initiatives or partnerships with causes that align with environmental and social sustainability can further deepen loyalty and influence purchasing decisions.

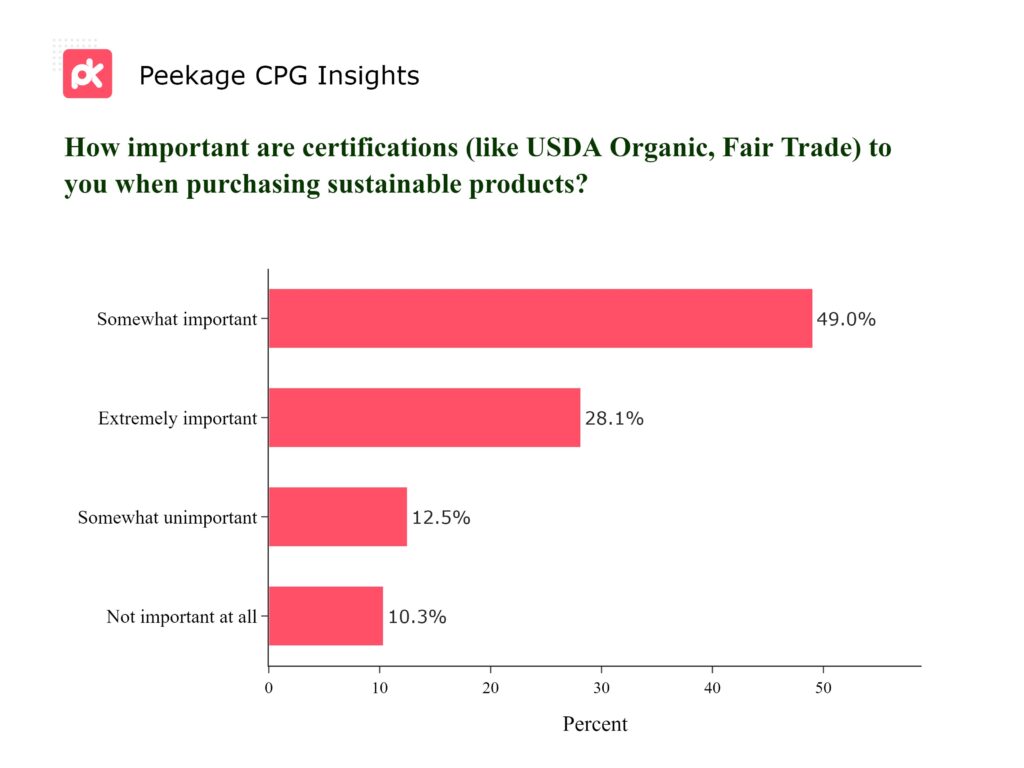

Trust in Labels: The Power of Certifications

Certifications play a pivotal role in consumer trust, with a striking 77.1% considering them somewhat to extremely important when purchasing sustainable products. This underscores the value of verified credentials in conveying quality and ethics in the sustainability market.

To harness this trust, ensure your products meet and showcase relevant certifications. Educate consumers about what these labels mean for quality and impact, reinforcing their confidence in your brand and commitment to transparency and sustainability.

Age and Assurance: The Growing Importance of Certifications

As consumers age, the importance they place on certifications like USDA Organic or Fair Trade for sustainable products markedly increases. Starting at 70% for those under 20, the demand for these assurances climbs to an impressive 91.43% among individuals aged over 60. This trend reflects a growing desire for quality, authenticity, and trustworthiness in sustainable purchases as consumers age, likely driven by increased health, environmental, and ethical considerations.

For brands, this indicates a growing opportunity and necessity to invest in and prominently display credible certifications as part of their product offerings, especially when targeting older demographics. Engaging with and understanding the value of these certifications can be a key differentiator in attracting and retaining a mature customer base.

Seal of Trust: America's Certification Call

For Americans, the appeal of USDA Organic, Fair Trade, and similar certifications is about 6% stronger than for Canadians, underscoring a heightened American trust in and demand for validated sustainable practices.

Brands looking to thrive in the U.S., as well as Canada, should boost the visibility of these certifications in their product lines. Highlighting these seals of approval can be a game-changer, offering a clear, trusted signal of quality and sustainability that resonates with American consumers' desire for authenticated eco-friendly options.

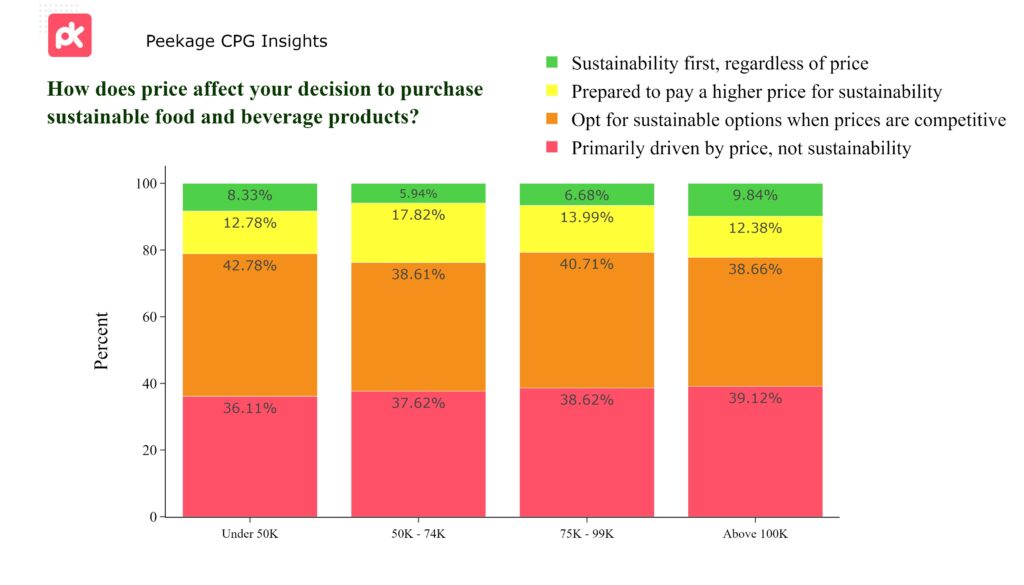

Price vs. Purpose: The Cost of Going Green

Price remains a critical factor in sustainable purchasing decisions, with nearly 40% of consumers opting for sustainable choices when the price is right. Yet, a dedicated 21.7% are willing to pay more, prioritizing sustainability regardless of cost. So, a comparable segment is mainly price-driven, underscoring the need for competitively priced sustainable options.

To appeal to a broad consumer base, consider strategies like price matching, highlighting long-term savings or value of sustainable products, and offering promotions.

Gendered Price Sensitivity: Navigating Cost in Sustainability

Women tend to be around 10% more price-sensitive than men when considering sustainable products, emphasizing the need for affordability in their decision-making process. Conversely, men are twice as likely to prioritize sustainability even at a higher cost, showing a significant variance in how each gender weighs price versus sustainability. Additionally, a substantial 40% of all customers show a preference for sustainable products when priced comparably to non-sustainable alternatives, illustrating the importance of competitive pricing in driving sustainable choices.

Brands can address these differences by offering a range of sustainable products that cater to varying levels of price sensitivity and sustainability commitment. For women, emphasizing value, quality, and affordability might be key, while for men, highlighting the exclusivity or added value of sustainability might resonate more.

Income Insights: Sustainability Spending Patterns

Interestingly, while overall willingness to pay for sustainability doesn't drastically vary across income levels, those within the mid-range income bracket, particularly those earning between $50-75k, show a pronounced readiness to invest more in sustainable products.

This indicates that focusing on mid-range earners with sustainability initiatives and product offerings could yield positive engagement and a stronger market share in this demographic.

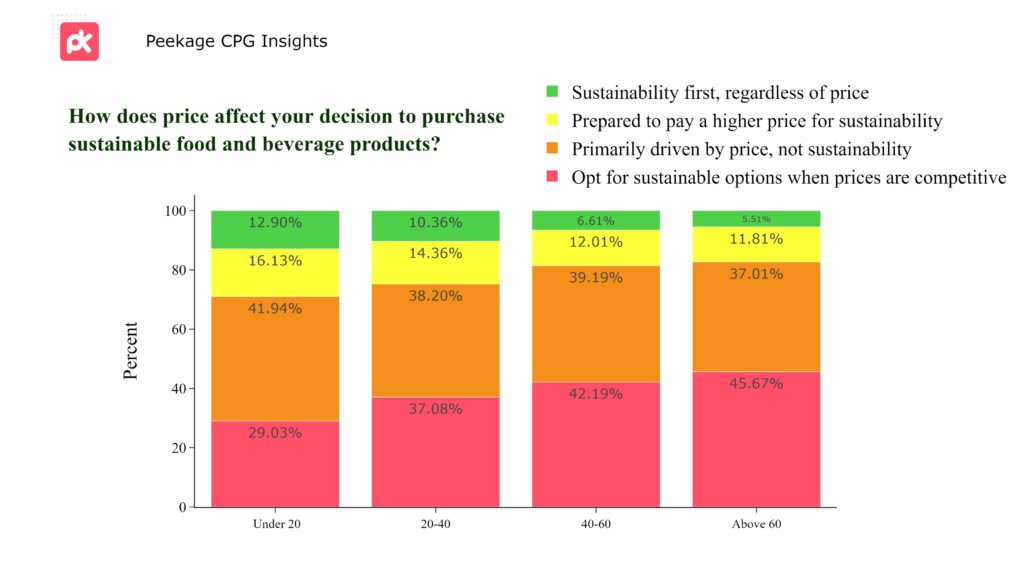

Age and Value: Shifting Priorities in Sustainable Spending

As consumers age, they slightly shift away from being primarily price-driven towards seeking value, showing a growing interest in competitively priced sustainable options. This indicates a nuanced balance between cost and ethics in their purchasing decisions.

For you as a brand, recognize the opportunity in competitively pricing your sustainable products to appeal to the evolving consumer mindset. As people mature, they're looking for that sweet spot where affordability meets sustainability.