During covid pandemic, breakfast had a resurgence and became a standard part of the morning routine for most Americans. A lot of on-the-go consumers switched to in-home options like cereals. In fact, more than 80% of Americans consume cereals. But, how often do they eat them? which cereal brands/products do they use the most? which flavors/tastes do they like more? And which factors affect their cereals shopping choice? In this Peekage CPG insights report, we will review some of the consumers' cereal-related behavior and preferences.

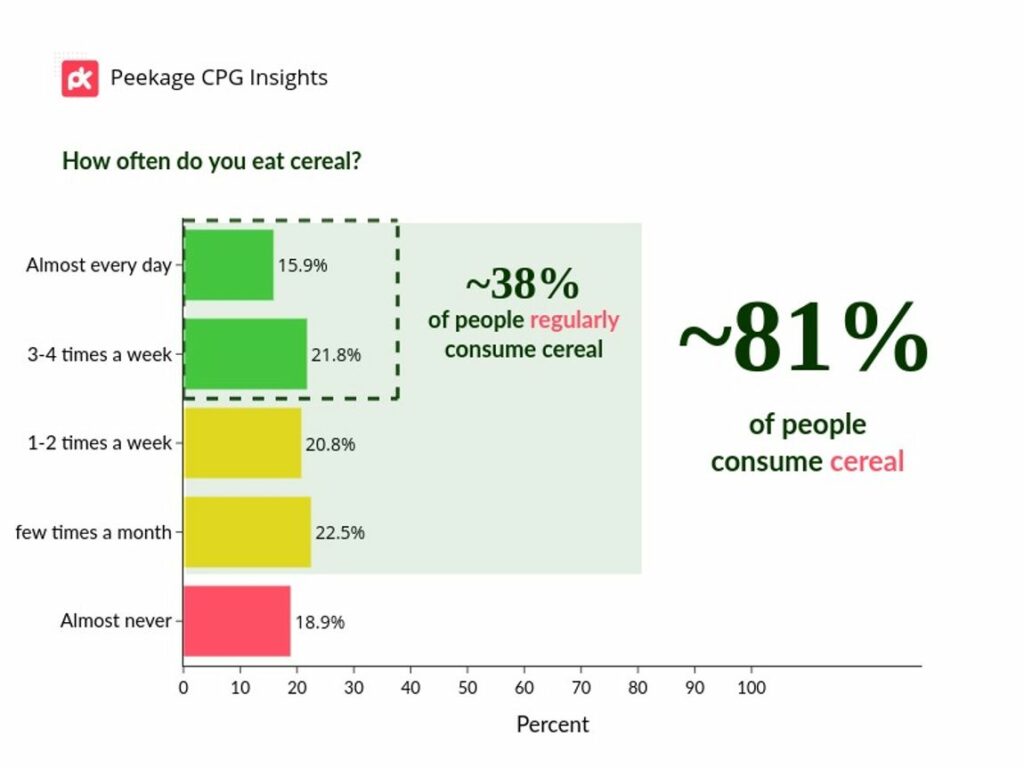

Nearly two-fifths of cereal consumers eat them regularly

- ~81% of people consume cereals.

- ~38% of consumers eat cereals more than 3-4 times a week

- ~58.5% of consumers eat cereals at least once a week.

- ~22.5% are occasional cereal consumers.

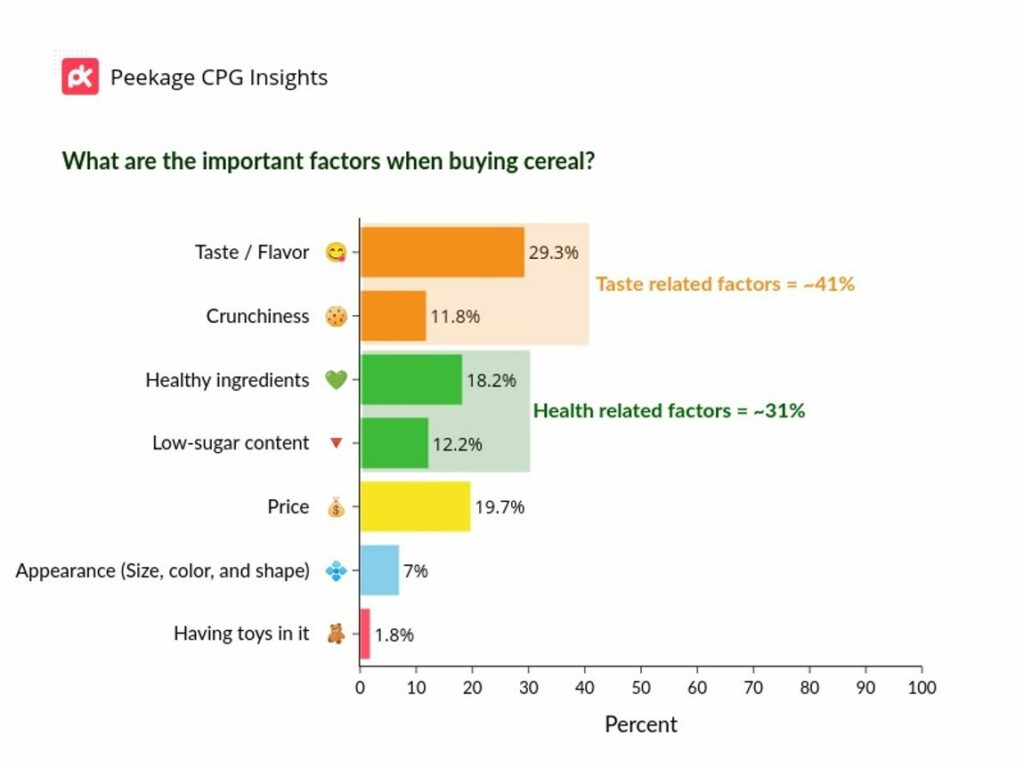

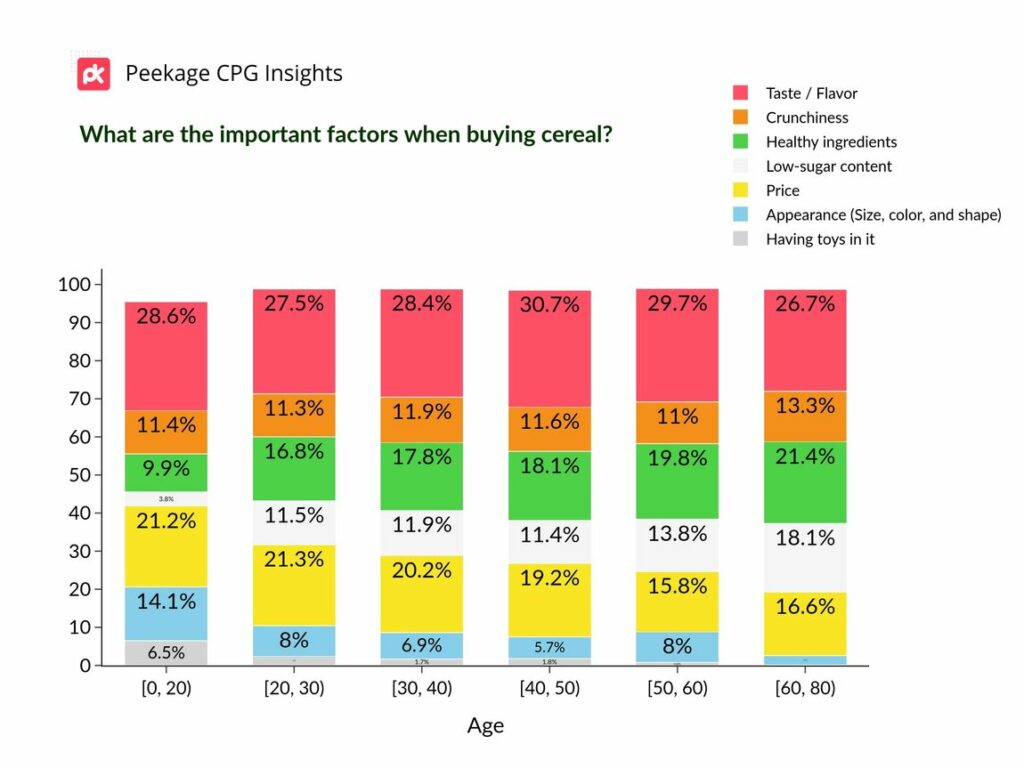

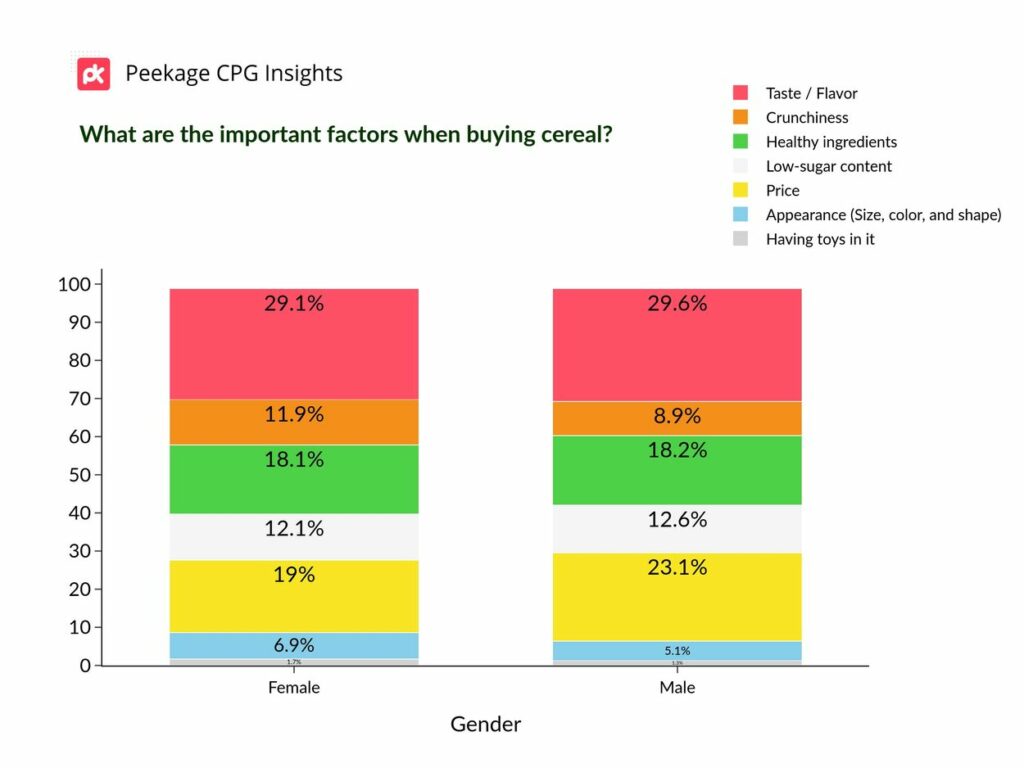

Taste and healthiness are the most important factors

- Taste-related factors (Taste, flavor, and crunchiness) are the most important factors for ~41% of consumers when buying cereals.

- Interestingly, having healthy ingredients and low-sugar content of cereals were the most important factors of ~31% of consumers.

- Price is an important factor for 19.7% of consumers buying cereals.

- Appearance and having toys are important for less than 10% of cereal consumers.

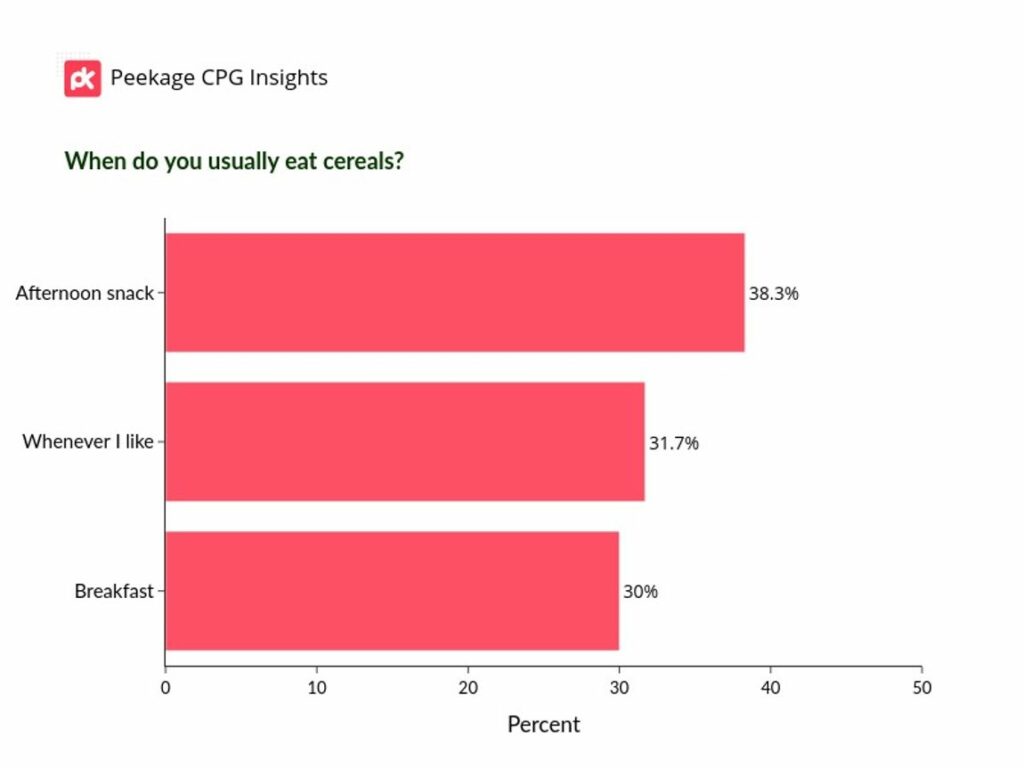

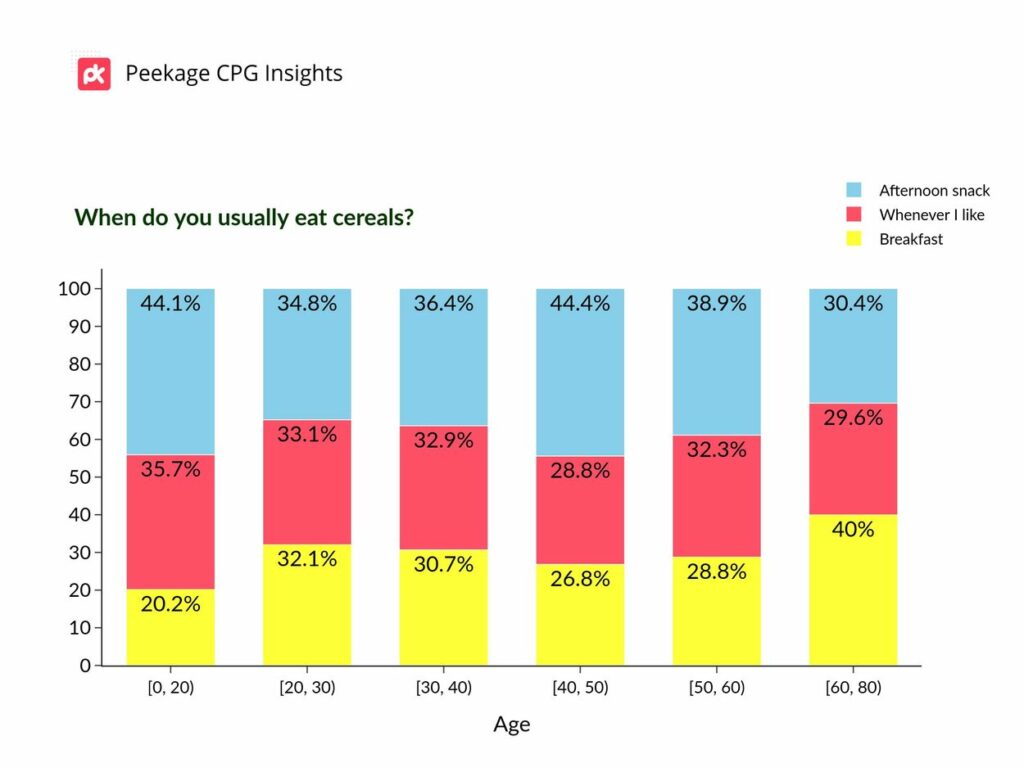

Breakfast is not the most common time of day when people consume cereals!

- ~40% of cereal consumers want their cereals as afternoon snacks

- ~30% of consumers eat cereals as breakfast

- ~30% of consumers eat cereals whenever they like

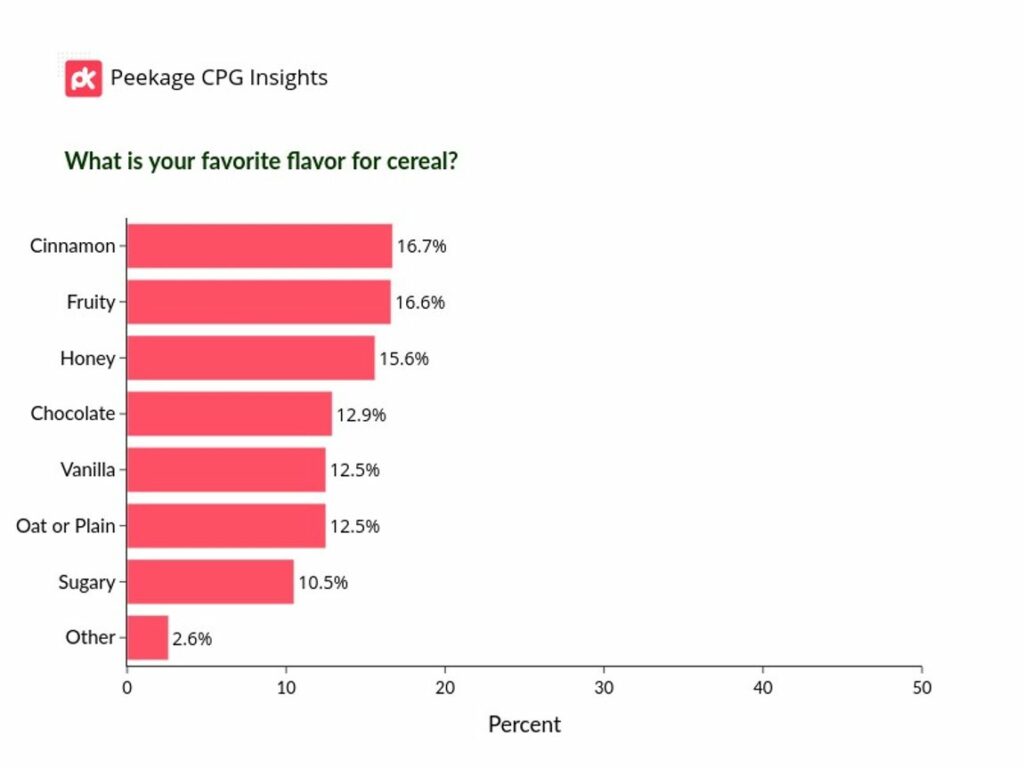

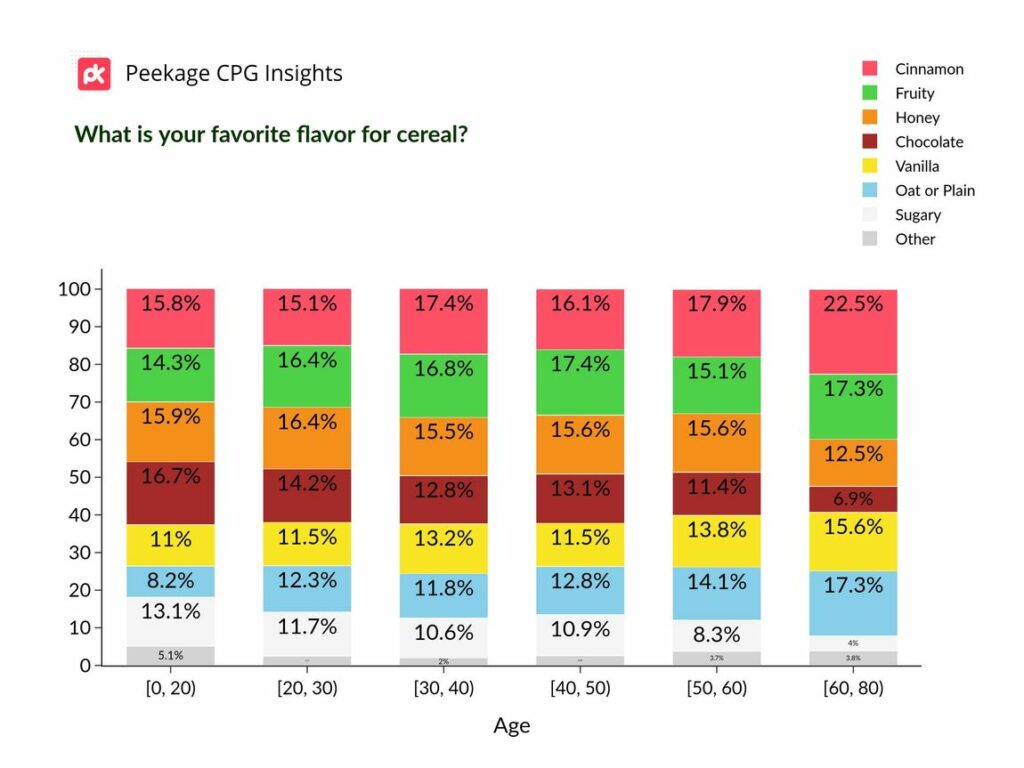

People prefer less strong flavors in their cereal.

- Cinnamon, fruity, and honey flavors are the top three favorite flavors liked by cereal consumers.

- Sugary taste is the least (~11%) liked flavor of cereals.

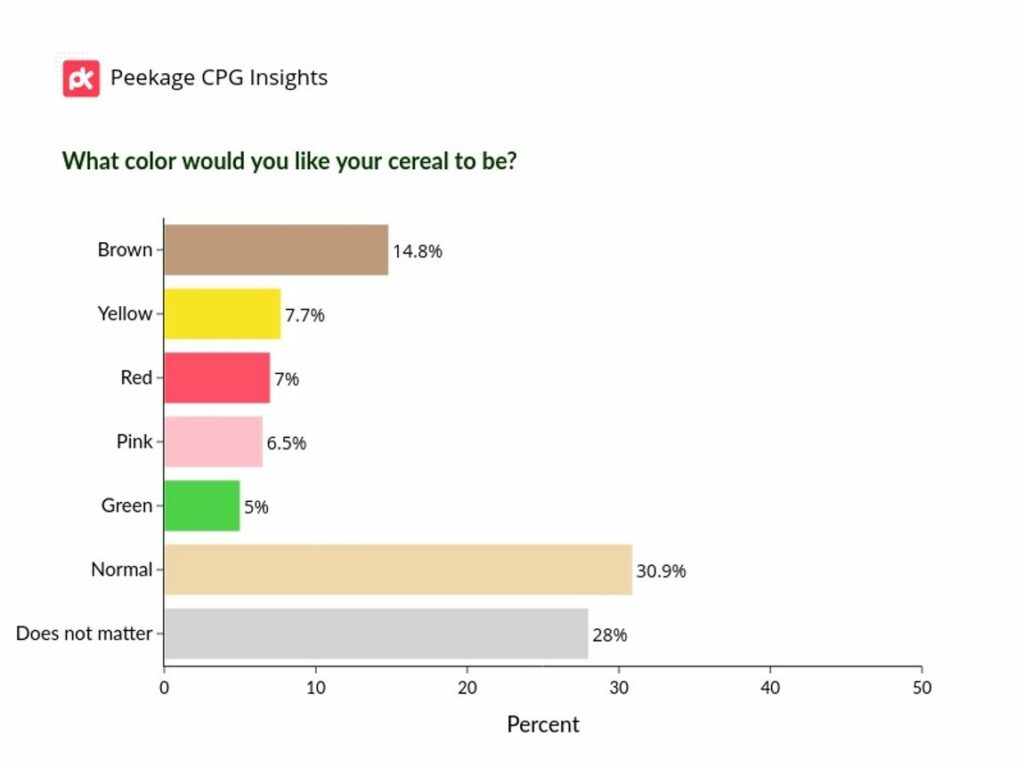

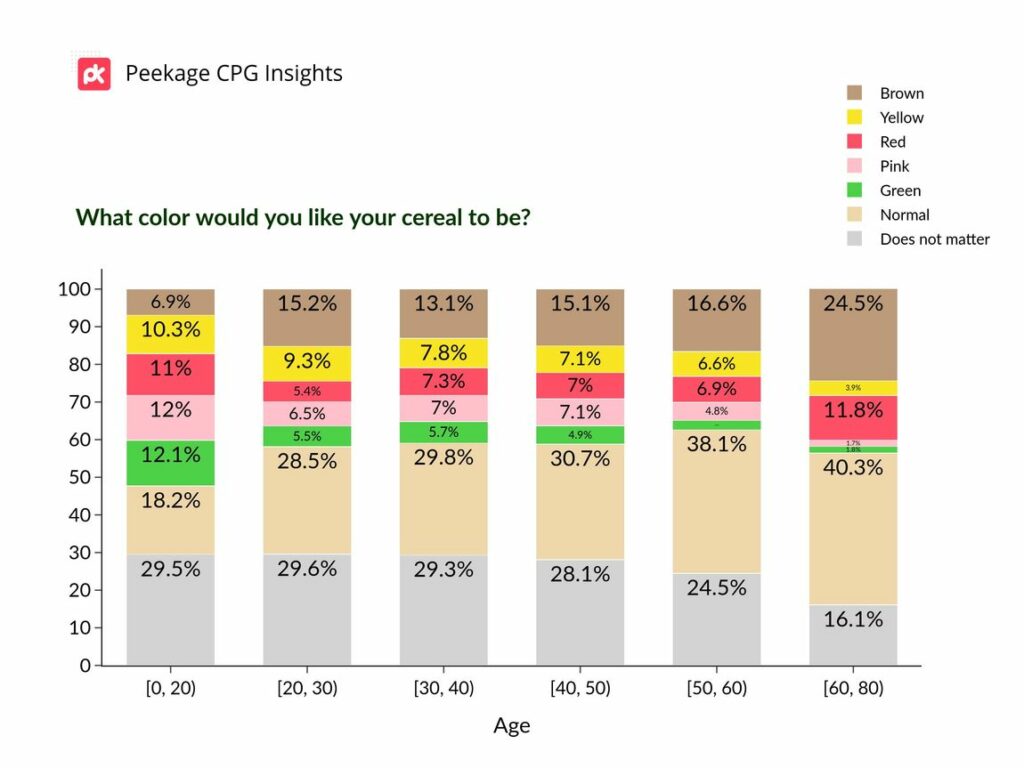

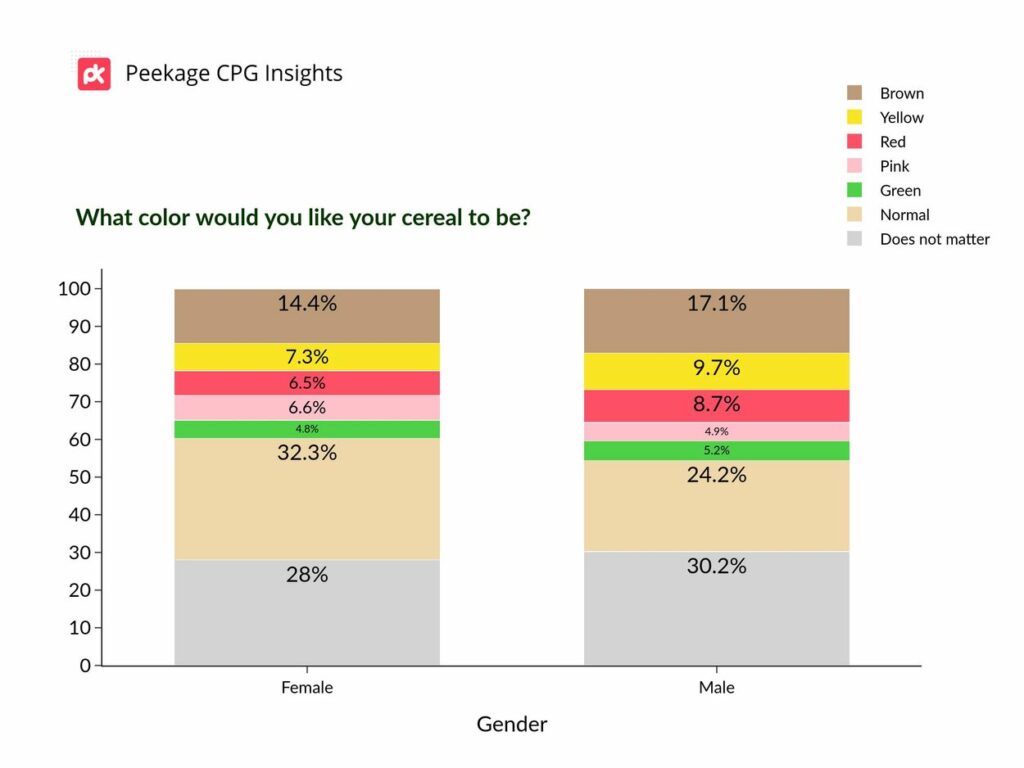

What color do the cereal consumers like for their cereals?

- Interestingly, ~50% of cereal consumers don't care about the color or want it to be a natural cereal flake's color.

- Chocolate brown is the most liked (~15%) color for those who want it to be colorful.

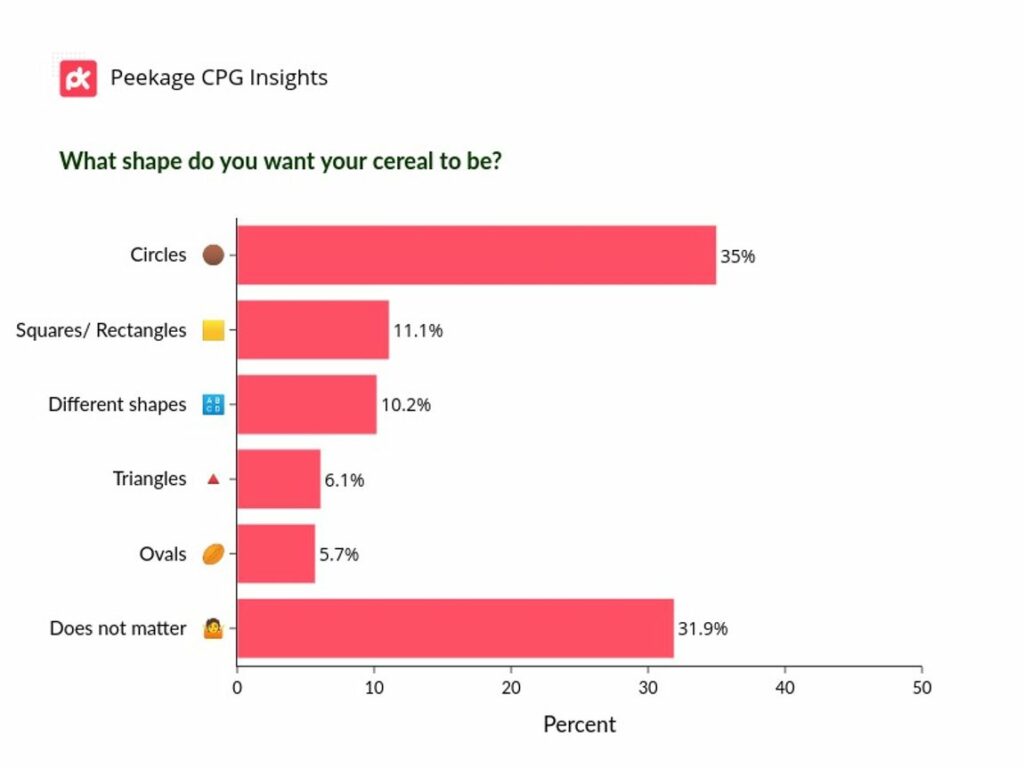

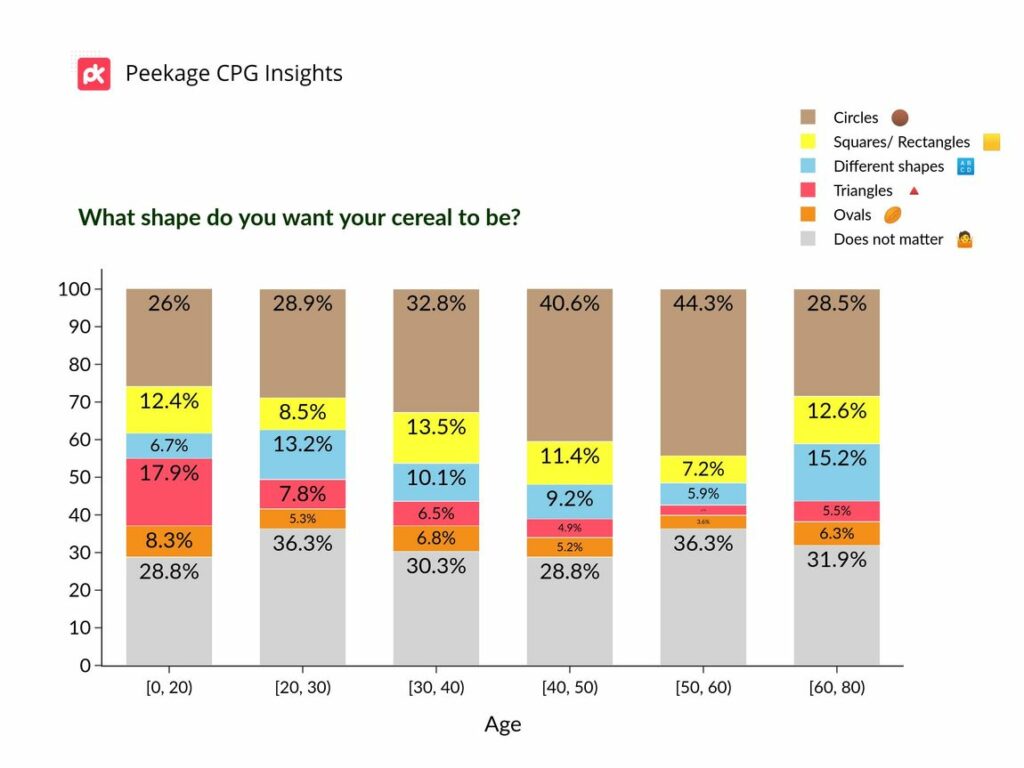

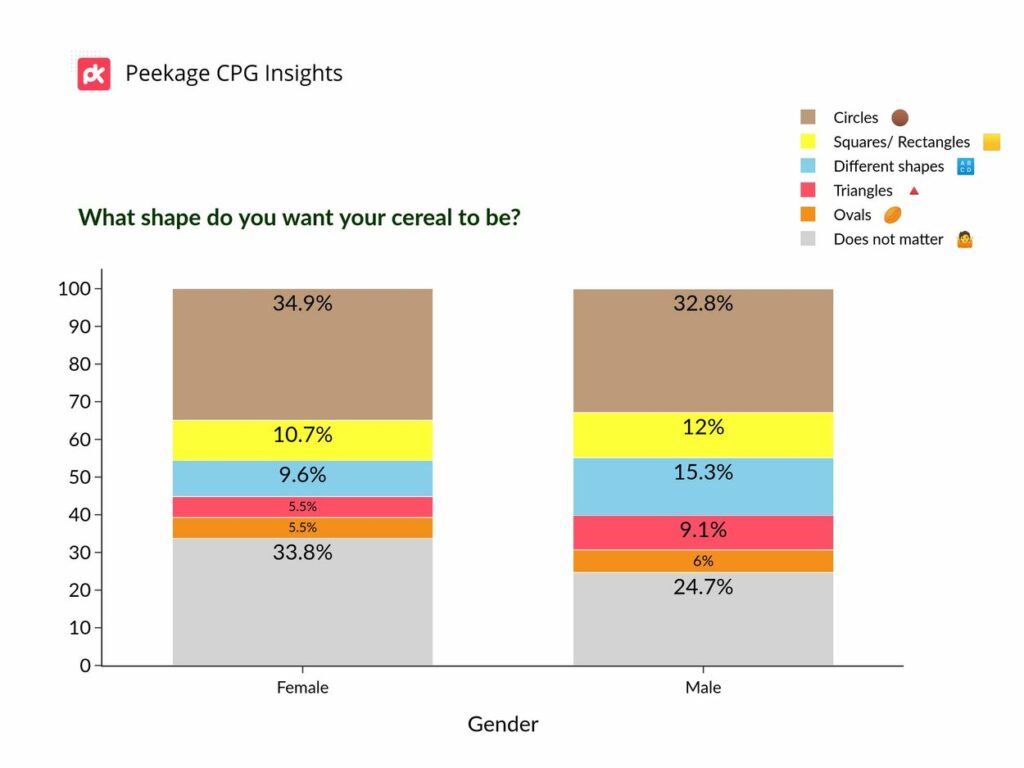

What shape do consumers want their cereal to be?

- 35% of consumers prefer the classic circle cereals.

- Cereal shape does not matter for approximately one-third of consumers.

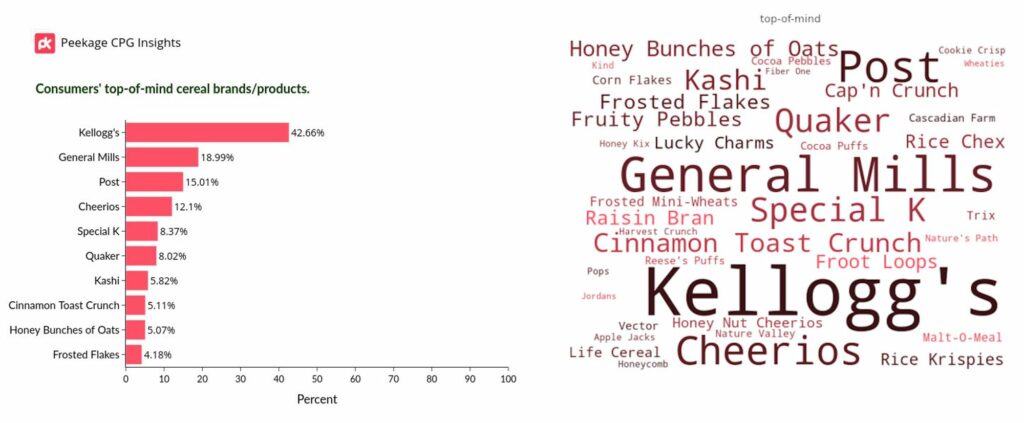

Top-of-mind cereal brands

Kellogg's, General Mills, Post, Cheerios, and Special K are the top 5 brands consumers remembered when asked about buying cereals.

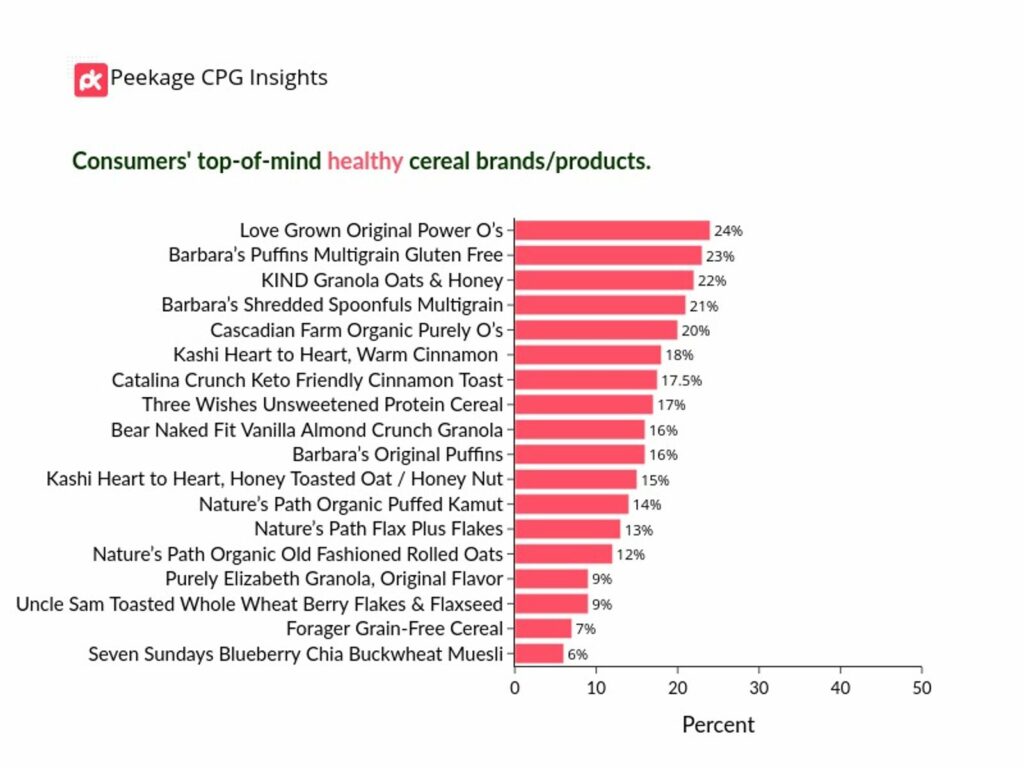

Top-of-mind healthy cereal products

- when we asked the health-conscious cereal consumers (~31% of cereal consumers) of what names come to their mind when buying healthy cereals:

- Love Grown Original Power O's, Barbara's Puffins, and KIND Granola Oats and Honey were the top 3 healthy products

Age differences

- Younger consumers liked chocolate, honey, and sugary flavors more than senior consumers.

- Cinnamon, fruity, and plain flavors were more liked by senior consumers.

- Younger consumers care more about the appearance and price of cereals.

- Low-sugar content is more important for senior consumers.

- Colorful cereals (i.e., Pink, Red, Yellow, and Green) are more liked by more than 20 yrs consumers.

- Senior cereal consumers (less than 60 yrs) liked normal cereal flakes color, red, and chocolate brown more than other age groups.

- Consumers more than 20 yrs want their cereals mostly in circles, triangles, and squares; but less prefer a mix of shapes or ovals.

- Consumers aged between 40 and 60 yrs want their cereals to be circles (>40%), significantly more than other ages (<30%).

- Cereals being consumed as an afternoon snack is more common (~45%) among more than 20 yrs and 40-50 yrs consumers.

- Senior consumers (40%) and 20-40 yrs consumers (less than 30%) eat cereals in their breakfast more than other age groups.

Gender differences

- Price is a slightly more important factor for men (~23.%) in buying cereals than women (19%).

- Women care about the crunchiness (~12%) of cereals slightly more than men (~9%)

Women like their cereals to be the color of normal cereal flakes (~32%) significantly more than men (~24%).

- A mix of shapes and triangles are significantly more liked by men (~25%) compared to women (~15%).

- The shape of cereals is more important for men (~75%) than women (~66%).

Highlights

Cereal Consumption Frequency and Timing

- ~81% of people in North America consume cereals, of whom, ~38% eat cereals more than 3-4 times a week, and ~58.5% of consumers eat cereals at least once a week.

- ~40% of cereal consumers want their cereals as afternoon snacks, ~30% as breakfast, and ~30% of consumers eat cereals whenever they like.

- Cereals being consumed as an afternoon snack is more common (~45%) among more than 20 yrs and 40-50 yrs consumers.

- Senior consumers (40%) and 20-40 yrs consumers (less than 30%) eat cereals in their breakfast more than other age groups.

Contributing factors for buying Cereals

- Taste, flavor, crunchiness, low-sugar content, and healthy ingredients are the most important factors for the ~70% of consumers when buying cereals.

Cereals Flavor and Taste

- People prefer less strong flavors in their cereal.

- Cinnamon, fruity, and honey flavors are the top three favorite flavors liked by cereal consumers.

- Younger consumers liked chocolate, honey, and sugary flavors more than senior consumers, and care more about the appearance and price of cereals.

- Low-sugar content is more important for senior consumers.

- Women care about the crunchiness (~12%) of cereals slightly more than men (~9%).

Cereals Color

- Interestingly, ~50% of cereal consumers don't care about the color or want it to be a natural cereal flake's color. Chocolate brown is the most liked (~15%) color for those who want it to be colorful.

- Colorful cereals (i.e., Pink, Red, Yellow, and Green) are more liked by more than 20 yrs consumers.

- Senior cereal consumers (less than 60 yrs) liked normal cereal flakes color, red, and chocolate brown more than other age groups.

- Women like their cereals to be the color of normal cereal flakes (~32%) significantly more than men (~24%).

Cereals Shape

- Cereal's shape does not matter for approximately one-third of consumers. 35% of consumers prefer the classic circle cereals.

- The shape of cereals is more important for men (~75%) than women (~66%). A mix of shapes and triangles is significantly more liked by men (~25%) compared to women (~15%).

- Consumers more than 20 yrs want their cereals mostly in circles, triangles, and squares; but less prefer a mix of shapes or ovals.

- Consumers aged between 40 and 60 yrs want their cereals to be circles (>40%), significantly more than other ages (<30%).

Cereals top-of-mind brands

- Kellogg's, General Mills, Post, Cheerios, and Special K are the top 5 brands consumers remembered when asked about buying cereals.

- Love Grown Original Power O's, Barbara's Puffins, and KIND Granola Oats and Honey were the top 3 healthy products that came to mind of our health-conscious cereal consumers (~31% of cereal consumers).

Pricing

- Price is only important for 19.7% of consumers when buying cereals.

- Price is a slightly more important factor for men (~23.%) in buying cereals than women (19%).

Thank you for reading this report. If you have a burning question or want to know how to boost your sales among specific segments, stores, or geo-locations, reach out to us, and our CPG experts will guide you with the best strategies.