What if the secret to skyrocketing your brand's success was hiding in plain sight, inside the minds of your customers?

Far too often, brands launch products, campaigns, or messages based on assumptions rather than actual consumer behavior. The result? Missed connections, wasted budgets, and products that fall flat. You may think you know your audience, but without true brand insights, you're essentially flying blind.

Here's the good news: You don't need a crystal ball to predict what your customers want. Consumer insights give you a front-row seat to your audience's motivations, preferences, and pain points. It's like unlocking a cheat code to build deeper connections, better products, and smarter strategies.

In this guide, you'll learn how to uncover meaningful brand insights, put them to work, and avoid the common mistakes that leave even major brands guessing.Â

Ready to stop guessing and start knowing? Let's dive into the power of brand insights.

Understanding Brand Insights

Brand insights are deep, actionable understandings of how your audience thinks, feels, and behaves in relation to your brand. Unlike surface-level demographics or click data, they uncover the why behind customer choices; the emotional and psychological drivers that influence behavior.

Think of brand insights as a flashlight, shining into the hidden corners of your customer's mind. They help illuminate emotional triggers, motivations, frustrations, and unmet needs, allowing you to position your brand not just as a product, but as a solution.

What Makes an Insight "Insightful"?

Not all data qualifies as an insight. A true brand insight typically meets the following criteria:

- Emotionally driven: Reflects feelings, not just actions.

- Strategically relevant: Ties back to your business objectives.

- Unexpected: Challenges assumptions or uncovers blind spots.

- Actionable: Leads to smarter decisions or new opportunities.

The best insights don't just tell you what customers want; they reveal what they didn't even realize they needed.

Brand Insights vs. Market Research: What's the Difference?

While both are valuable, here's how they differ:

| Aspect | Brand Insights | Market Research |

| Focus | Emotional drivers, brand perception, customer behavior | Market trends, competition, pricing, product demand |

| Depth | Deeper, often qualitative | Broader, often quantitative |

| Outcome | Strategic storytelling, emotional resonance | Data for tactical decisions |

| Example | "Customers feel disconnected from our brand. They don't trust what we say." | "60% of buyers prefer eco-friendly packaging." |

In essence, market research tells you what is happening, while brand insights explain why it's happening.

Benefits of Leveraging Brand Insights

Brand insights aren't just data points; they're a strategic superpower. When applied correctly, they can transform how you market, innovate, and connect with your audience on a deeper level. Instead of guessing what might work, you start making informed decisions that resonate, convert, and build long-term loyalty.

Here's how brand performance insights drive real business impact:

- Sharper Marketing Campaigns

Brand insights reveal what truly matters to your audience, emotionally, culturally, and behaviorally. Instead of relying on assumptions or trends, you craft messages that stick.

- Speak your customers' language with clarity and confidence

- Choose the right channels based on real behavioral data

- Create campaigns that resonate faster and convert better

- Better Product-Market Fit

Understanding what your customers value, even when they can't fully express it, helps you build products they actually want.

- Prioritize features that solve specific, validated problems

- Avoid wasting resources on low-impact features

- Uncover unmet needs or hidden market opportunities

- Stronger Competitive Advantage

Market trends are visible to everyone, but true insights are proprietary. They help you go beyond surface-level differentiation.

- Build emotionally resonant brand positioning

- Identify the whitespace that others overlook

- Compete on value, not just price or features

- Increased Customer Loyalty and Trust

When people feel understood, they stick with you. Brand insights help you tailor experiences, refine your voice, and show up consistently.

- Deepen customer relationships with personalization

- Improve retention and reduce churn

- Inspire word-of-mouth and organic advocacy

- Smarter Decisions Across Teams

Brand purpose insights benefit every corner of your organization, not just marketing.

| Department | How Brand Insights Help |

| Product | Design features that address real pain points |

| Marketing | Craft high-converting messaging and creative strategies |

| Customer Service | Anticipate concerns and proactively improve satisfaction |

| Leadership | Make decisions based on real-time customer sentiment |

Methods for Gathering Brand Insights

Knowing the value of brand insights is one thing; gathering them effectively is another. It's not just about collecting data; it's about tuning into meaningful human signals across multiple touchpoints.

From direct conversations to silent behavioral cues, here are the most effective methods used by top brands to uncover actionable brand strategy insights.

a) Direct Consumer Feedback

If you want to know how your customers feel, ask them. Direct feedback methods are essential for understanding opinions, emotions, and motivations in the customer's own words.

- Online Surveys

Quick to launch and easy to scale, online surveys allow you to gather large volumes of structured insights from your target audience.

- Use a mix of closed and open-ended questions

- Segment responses by demographics or behavior

- Ideal for testing brand perception, messaging, or product preferences

Keep surveys short (under 10 minutes) and use visuals where possible to boost completion rates.

- In-Depth Interviews (IDIs)

These are one-on-one, open conversations that dive deep into personal attitudes, brand associations, and emotional reactions.

- Great for uncovering why people feel the way they do

- Ideal for early-stage product or messaging development

- Best conducted by experienced moderators

- Focus Groups

Gather small focus groups of target consumers to discuss your brand, product, or campaign. Group dynamics often trigger ideas or objections that participants wouldn't share alone.

- Useful for brand storytelling, positioning, or creative feedback

- Can reveal subconscious or social behaviors

- Best paired with a skilled facilitator

b) Social Media Mining

Your customers are talking about you, whether you're listening or not.

Social media platforms are goldmines for unsolicited, honest feedback. Tools like Brandwatch, Sprout Social, or Hootsuite can help you track brand mentions, sentiment, and trends over time.

What to Look For:

- How people describe your brand in their own language

- What content gets shared and why

- Influencer engagement and user-generated content (UGC)

- Recurring pain points or praise

You can always use AI-powered sentiment analysis to dig deeper into emotional tones.

c) Behavioral Data

Behavior speaks louder than words. By analyzing how customers interact with your brand, on your website, app, or in stores, you can extract powerful behavioral insights.

- Website & App Analytics

Track clicks, scroll depth, conversions, and bounce rates to understand:

- Which pages convert the most

- Where users drop off or get stuck

- What products or content they love most

- A/B Testing

Want to know which headline, product description, or CTA works better? A/B testing gives you real-time insight into customer preferences through controlled experiments.

- Compare two variations of content or UX

- Measure which one leads to higher engagement or conversion

- Great for refining messaging based on actual behavior

- Heatmaps and Session Recordings

Tools like Hotjar or Crazy Egg visualize where users are clicking, hovering, or dropping off.

- Identify UX friction or confusion points

- Reveal attention patterns for better content placement

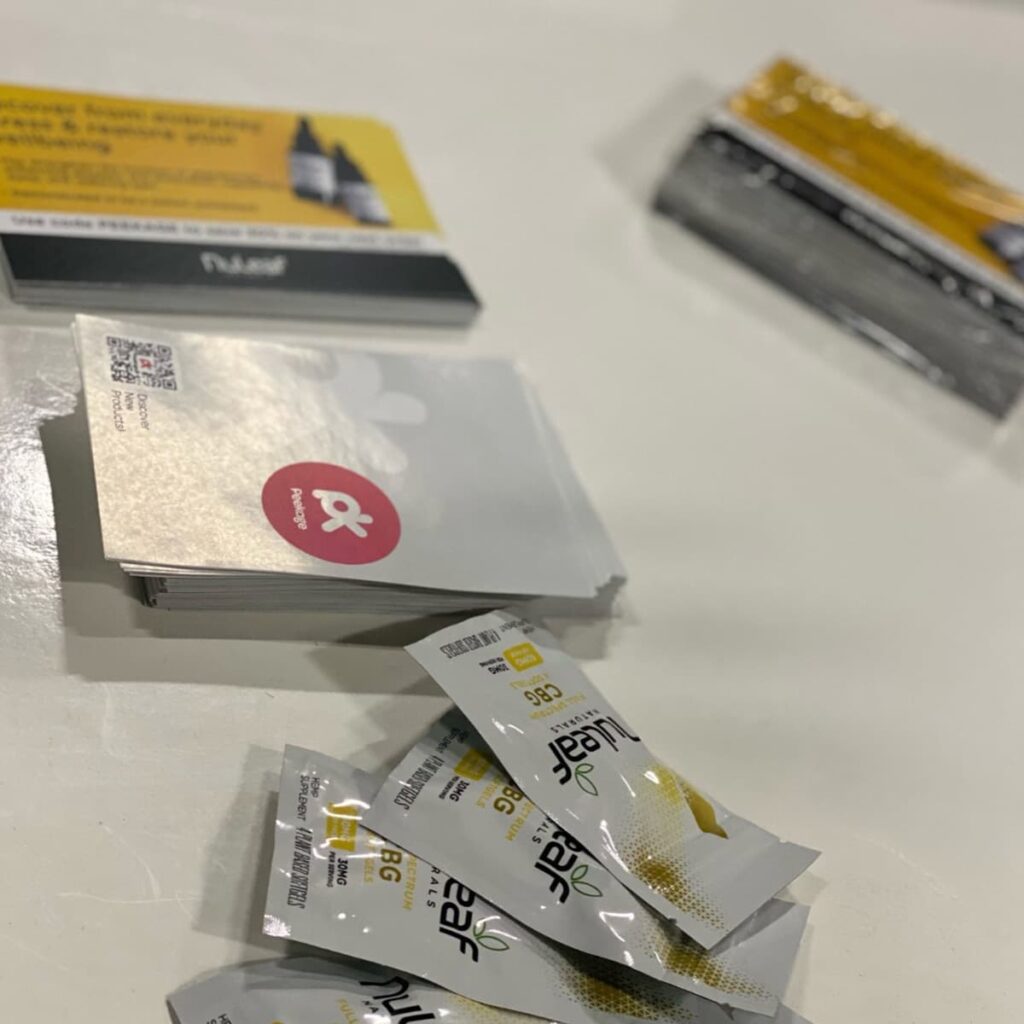

d) Product Sampling & Trial Programs

Letting people experience your product before buying is one of the most effective ways to gather feedback and observe natural reactions.

Peekage, for example, offers brands the ability to run targeted in-home product sampling and collect consumer feedback directly, merging physical trial with digital insights.

- Test new product formulations, packaging, or messaging

- Get feedback from highly specific audiences (location, lifestyle, etc.)

- Ideal for CPG, beauty, health, and wellness brands

Insight from trial feedback often uncovers emotional drivers that traditional research misses.

e) Customer Support & CRM Analysis

Don't underestimate the power of your own inbox. Your support tickets, chat logs, and CRM notes are packed with unscripted, real-world insights.

- Analyze support tickets, chat logs, and CRM notes

- Spot recurring complaints, feature requests, or confusion

- Track tone, urgency, and emotional triggers

This method is especially valuable when paired with text analysis tools or categorized by topic and sentiment.

f) Review & Rating Analysis

Online reviews are brutally honest and extremely insightful. Scraping platforms like Amazon, Google, Yelp, or Trustpilot can reveal:

- Surface your perceived strengths and weaknesses

- Spot competitor comparisons and unmet expectations

- Highlight the language customers use to describe value

Create a word cloud from reviews to quickly spot repeated keywords.

g) Usage & Attitude (U&A) Studies

While individual methods like surveys and analytics give you focused insights, Usage & Attitude (U&A) studies connect the dots. They combine both quantitative and qualitative research to map how people interact with your product and how they feel about it.

Rather than just collecting data points, U&A studies aim to answer questions like:

- Who uses your product, how often, and in what context?

- What beliefs, habits, or attitudes influence their decisions?

- How do perceptions differ across segments or competitors?

What makes U&A unique:

- It explores usage and emotional context side by side.

- It's ideal for shaping brand positioning and messaging, or segmentation strategies.

- It often serves as the foundation for larger brand strategy projects.

Use U&A to validate insights from social listening, CRM analysis, or A/B testing, and build a holistic picture of your audience.

Bringing It Together

The key to success? Triangulate your insights.

Don't rely on just one method; use a mix to uncover the full picture.

| Source | Type of Insight | Best For |

| Online Surveys | Quantitative | Brand perception, preference, trends |

| Interviews/Focus Groups | Qualitative | Emotional drivers, messaging feedback |

| Social Media Monitoring | Behavioral + Emotional | Brand sentiment, trending topics |

| Website Analytics | Behavioral | UX performance, content success |

| Sampling Programs | Experiential | Real-world product reactions |

| CRM/Support Analysis | Operational + Emotional | Pain points, customer language |

| Usage & Attitude (U&A) | Behavioral + Attitudinal | Segmentation, product strategy, brand positioning |

Integrating Brand Insights into Your Strategy

Gathering comprehensive brand insights is only half the battle; the real impact comes when you turn those insights into strategic action. Whether you're building a brand from scratch or refining your existing positioning, integrating brand positioning insights ensures your marketing, messaging, and product decisions align with what your audience truly wants and needs.

Here's a step-by-step framework to bring insights into the heart of your brand strategy.

1. Start with a Clear Research Goal

Every brand insights initiative should begin with a focused objective. Ask yourself: What are you trying to uncover or validate?

- Strengthen brand positioning?

- Uncover emerging customer needs?

- Test new campaign concepts or creative?

- Optimize messaging for specific channels?

A sharp objective will anchor every other decision, from methodology to analysis.

2. Design a Research Program Aligned to Your Goals

With your objective in place, the next step is building a research program that delivers the insights you actually need. That starts with choosing the right audience and the right research method.

Choose a Strategically Relevant Audience

Target the people whose feedback will drive the most value:

- Are you looking at current customers or potential ones?

- Is your focus broad (e.g., all millennials) or narrow (e.g., eco-conscious Gen Zs in urban areas)?

- Use demographic or behavioral screeners (like age, lifestyle, or purchase behavior) to ensure you're hearing from the right voices.

Select the Right Methodology

Your research method should match the kind of decision you want to inform:

- Brand association: To understand how your brand is perceived (consider implicit or explicit association tests)

- Message/channel optimization: Tools like TURF analysis help you identify the mix that maximizes reach

- Attitude and usage tracking (U&A): Explore how people interact with your category and how they evaluate competing brands

- Brand awareness and affinity: Measure unaided recall and emotional connection to your brand

3. Analyze and Translate Insights in Real Time

Gone are the days of waiting weeks for data. With automated platforms, you can track responses live and make decisions faster.

Real-Time Monitoring Tips

- Draft early dashboards as responses roll in

- Leverage automated statistical testing to identify meaningful differences or shifts

- Keep a close eye on brand health metrics, such as:

- Brand awareness (aided and unaided)

- Brand preference and favorability

- Campaign/channel attribution

- Net Promoter Score (NPS)

Once the data is in, move from charts to strategy.

Turn Data Into Strategic Insights

- Write headline-style insights your team will remember

- Focus on the “why†behind behaviors, not just the “whatâ€

- Map each insight to brand pillars, audience personas, or messaging frameworks

4. Activate Insights Across Teams

Brand insights shouldn't stay siloed in marketing; they should fuel decisions across your organization. For example:

- Marketing: Refine messaging and creative based on emotional drivers

- Product: Prioritize features or experiences tied to unmet needs

- Sales: Customize pitches based on what customers value most

- Leadership: Use insights to steer innovation, brand investments, or market expansion

Host a cross-functional insights session. Present findings visually and through storytelling to help teams internalize the impact.

5. Continuously Iterate Through Brand Tracking

Brand perception is dynamic. That's why brand tracking isn't a one-off; it's a continuous feedback loop.

- Run quarterly or biannual trackers to monitor brand health over time

- Compare trends across waves to spot shifts, threats, or momentum

- Revisit segmentation regularly as new needs or audiences emerge

Insight-driven brands don't just respond to the market, they anticipate it.

Integrating brand insights into your strategy is about more than collecting data; it's about becoming a consumer-powered brand. When insights guide your decisions, every campaign, product, and message becomes sharper, smarter, and more aligned with what people actually want.

And in today's crowded market? That alignment is your competitive edge.

Brand Insights Case Studies and Examples

Real-world applications of brand insights show just how powerful data can be in shaping and strengthening brand strategy. From aligning with cultural moments to adapting product offerings, brands that invest in consumer intelligence are able to innovate, stay relevant, and foster lasting loyalty.

Below, we highlight two powerful brand insights examples, Nike and Coca-Cola, that demonstrate how leveraging brand insights can drive impactful campaigns and product development on a global scale.

Nike: Real-Time Cultural Alignment Through Social Listening

- Objective: Nike sought to stay culturally relevant during a time of global uncertainty and social unrest, particularly during the COVID-19 pandemic and the rise of the Black Lives Matter movement.

- Approach: By actively listening to consumer sentiment and analyzing trending conversations on social media, Nike developed the powerful "You Can't Stop Us" campaign to unite and inspire audiences through themes of perseverance, diversity, and collective strength.

- Outcome:

- The campaign generated $8.95 million in Media Impact Value (MIV®) from just 1,067 placements.

- It achieved a 300% increase in social media engagement.

- Within the first 24 hours, the campaign received over 32 million views.

- Takeaway: By tapping into social and emotional sentiment, Nike stays relevant while maintaining strong brand loyalty.

Coca-Cola: Product Development Fueled by Customer Preferences

- Objective: Maintain market leadership by continuously evolving based on consumer tastes.

- Approach:

- Coca-Cola conducts extensive market research using focus groups, consumer surveys, brand tracking studies, and concept testing to stay aligned with global trends.

- The company tracks brand awareness, consumer favorability, and purchase intent across multiple markets.

- Consumer insight studies are used to test reactions to new flavors, packaging, and marketing messages.

- Insights & Impact:

- Rolled out products such as Coca-Cola Zero Sugar and limited-edition flavors like Dreamworld, based directly on consumer preferences for lower sugar and novel experiences.

- Introduced more modern, minimal packaging designs to appeal to Gen Z and reflect health-conscious positioning.

- Result:

- Kantar's Brand Footprint report confirmed that Coca-Cola remains the world's most chosen brand, picked from the shelves 5.9 billion times in a year.

- The brand has held this position for 10 consecutive years, cementing its reputation as a global FMCG leader.

Unlock Deeper Brand Insights with Peekage: Understanding how consumers perceive your brand goes beyond surface metrics. Peekage, as a consumer insight platform, delivers psychographic-based feedback that helps you uncover emotional drivers, brand associations, and loyalty factors, giving you the clarity to refine positioning and strengthen brand impact.

Common Challenges in Gathering Brand Insights (And How to Overcome Them)

Even the most well-intentioned brand research initiatives can run into roadblocks. From poorly defined objectives to stakeholder misalignment, these challenges can weaken the impact of your insights—or worse, lead your strategy astray. Here's a breakdown of the most common pitfalls and how to navigate them effectively.

1. Lack of Clear Objectives:

Many insights programs start without a sharply defined goal. This leads to data overload with no clear direction, making it difficult to extract actionable insights.

The Fix:

- Anchor every project with a strategic question: What decision will this insight inform?

- Align stakeholders early on to ensure everyone agrees on the research purpose.

- Use SMART criteria (Specific, Measurable, Achievable, Relevant, Time-bound) to shape your objectives.

2. Targeting the Wrong Audience:

Insights gathered from the wrong audience can skew results, leading to misguided strategies or missed opportunities.

The Fix:

- Align audience selection with your business objective, whether it's brand repositioning, product development, or creative testing.

- Use behavioral and psychographic screeners to refine targeting.

- Consider segmenting your audience by lifecycle stage, need state, or loyalty level for more nuanced insights.

3. Choosing the Wrong Research Method:

Using the wrong methodology can result in surface-level findings that don't answer your core questions or reflect real behavior.

The Fix:

- Match methodology to intent: Use qualitative methods (e.g., interviews, diaries) for exploration and quantitative tools (e.g., surveys, TURF, MaxDiff) for validation.

- When possible, blend methods (a mixed-methods approach) to get both depth and scale.

- Consider agile tools that allow for iterative testing and adaptation.

4. Data Overload with No Strategic Synthesis:

Gathering too much data or failing to analyze it properly can leave teams overwhelmed and unable to draw conclusions that move the business forward.

The Fix:

- Focus on insight, not information: Cut through the noise to surface the “so whatâ€â€”the strategic implication behind the data.

- Use frameworks (e.g., Jobs To Be Done, Brand Pillars, Customer Journey Mapping) to organize findings.

- Summarize results in headline-style statements tied to specific business outcomes.

5. Siloed Insight Activation:

Insights often stay within the marketing or research teams, limiting their broader impact across product, sales, and leadership functions.

The Fix:

- Build cross-functional collaboration into your process from the start.

- Host regular “insights share-outs†with storytelling-style presentations to bring findings to life.

- Translate insights into functional action items (e.g., “what this means for product marketing,†“what this means for messagingâ€).

6. Stakeholder Misalignment:

When stakeholders are unclear on the research direction, or have competing agendas, insights get diluted or ignored altogether.

The Fix:

- Involve stakeholders early in the scoping process.

- Create a shared brief that outlines goals, roles, success metrics, and timelines.

- Tailor how you present findings to each stakeholder group; use strategic language for leadership, and tactical detail for product or marketing teams.

7. One-and-Done Mindset:

Some brands treat insight-gathering as a one-off task rather than a continuous feedback loop, leading to outdated assumptions.

The Fix:

- Establish ongoing brand trackers to monitor shifts in perception, awareness, and affinity.

- Supplement trackers with pulse surveys or ad hoc studies to explore emerging trends or new hypotheses.

- Encourage a culture of curiosity where insights inform not just annual plans but everyday decisions.

Overcoming these challenges requires more than better tools; it takes strategic clarity, cross-functional alignment, and a mindset shift toward continuous learning. When done right, insight isn't just an input to strategy; it becomes the strategy.

Conclusion

In an increasingly saturated and dynamic marketplace, brand insights have become more than just a competitive advantage; they're a necessity. From understanding evolving consumer behavior to informing strategic decisions and creative messaging, insights fuel every stage of brand growth and relevance.

As we've seen through real-world examples like Nike and Coca-Cola, the brands that thrive are those that don't just guess; they listen, analyze, and act. By combining quantitative research with qualitative context, and continuously monitoring shifts in perception, businesses can uncover actionable truths that shape smarter strategies and more meaningful customer connections.

Whether you're building a new brand or elevating an established one, investing in brand insights isn't just about collecting data; it's about transforming it into direction. The brands that succeed tomorrow are already learning today.

FAQs

The frequency of collecting brand insights depends on your goals and how dynamic your market is, but generally, it should be a continuous process. For most brands, conducting formal studies quarterly or biannually ensures you're keeping pace with evolving consumer behaviors and industry trends. However, real-time sources like social media monitoring, website analytics, and customer feedback should be reviewed on an ongoing basis to stay responsive and agile in your strategy.

A strong brand insight is:

- Rooted in real consumer behavior or sentiment

- Actionable (leads to a strategic decision)

- Emotionally resonant (reveals a deeper truth)

- Clear and easy to communicate

Example: "Customers don't just want quick delivery; they want reassurance that their time is valued."

Absolutely. Brand insights play a pivotal role in shaping product development by identifying unmet needs, shifting preferences, and emerging trends. For instance, if consumers show increasing concern about sustainability, a brand might develop eco-friendly packaging or reformulate products with cleaner ingredients. Likewise, if insights reveal that a particular demographic values convenience, brands may adjust portion sizes, formats, or delivery methods.

By listening to what customers truly care about, often through surveys, behavioral data, or sentiment analysis, brands can create offerings that resonate more deeply, reduce the risk of product failure, and maintain a competitive edge in a rapidly evolving market.

Even without big budgets, small businesses can:

- Use free or low-cost survey tools like Google Forms or Typeform

- Monitor social media mentions and customer reviews

- Ask loyal customers for feedback through email or interviews

- Analyze website traffic to see which messages or products perform best

Not at all. While they're critical during major brand shifts, ongoing brand insight collection ensures you stay aligned with evolving consumer expectations. They help refine positioning, identify gaps, and fuel innovation at every stage of growth.

References

- Consumer Satisfaction Insights, Quantilope,

https://www.quantilope.com/solutions/satisfaction-tracking - How Market Research Can Improve Your Brand, Drive Research,

https://www.driveresearch.com/market-research-company-blog/how-market-research-can-improve-your-brand/ - How to get feedback from customers: 8 best ways, Zendesk,

https://www.zendesk.com/blog/how-to-get-customer-feedback/ - What is customer sentiment and how do you measure it?, Qualtrics,

https://www.qualtrics.com/experience-management/customer/customer-sentiment/