You may know that two-thirds of people in North America consume dairy milk or non-dairy alternatives (like Soy, Almond, and Cashew). But, how often do they use milk and their non-dairy alternatives? which types of milk do they usually consume? In this Peekage CPG insights, you will find out consumers' milk-related behavior and preferences.

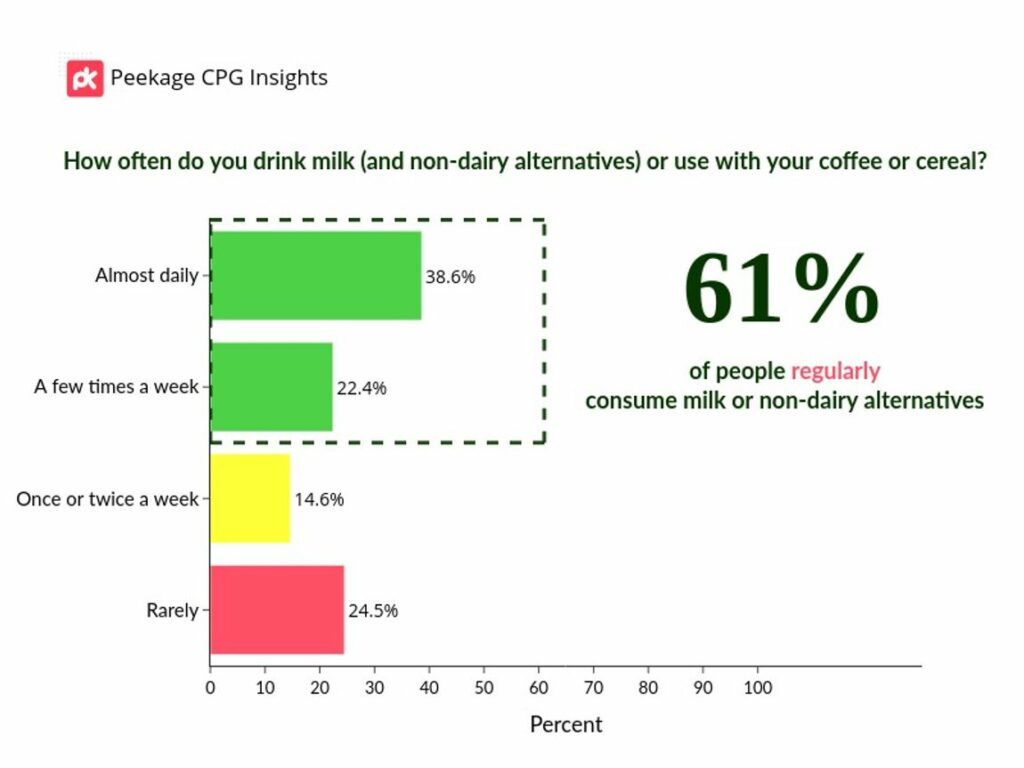

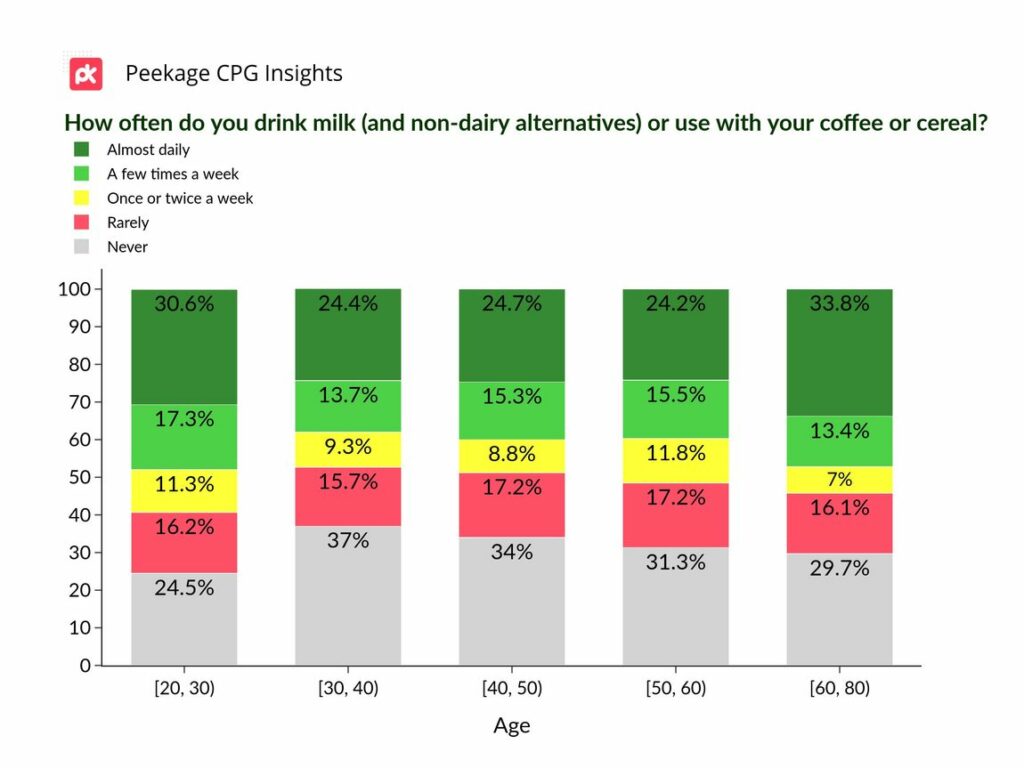

More than 60% of milk consumers regularly use it

- About two-fifths of consumers use milk (and non-dairy alternatives) almost daily.

- More than a third of consumers use milk (and non-dairy alternatives) weekly.

- Almost a quarter of milk (and non-dairy alternatives) consumers use them rarely.

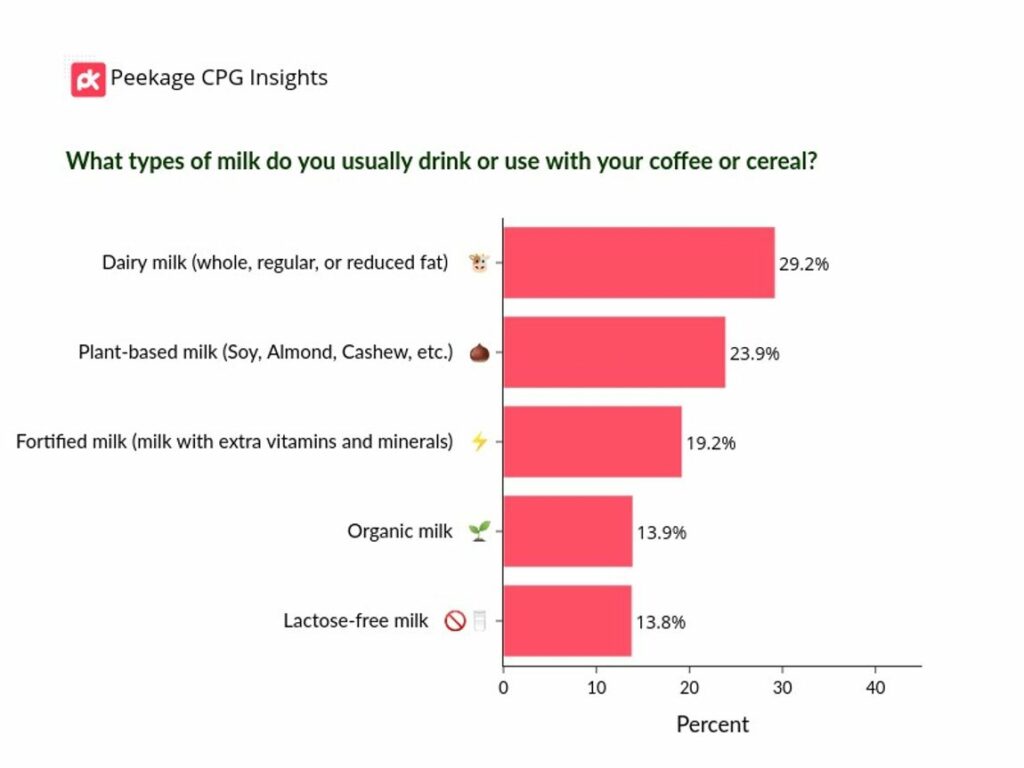

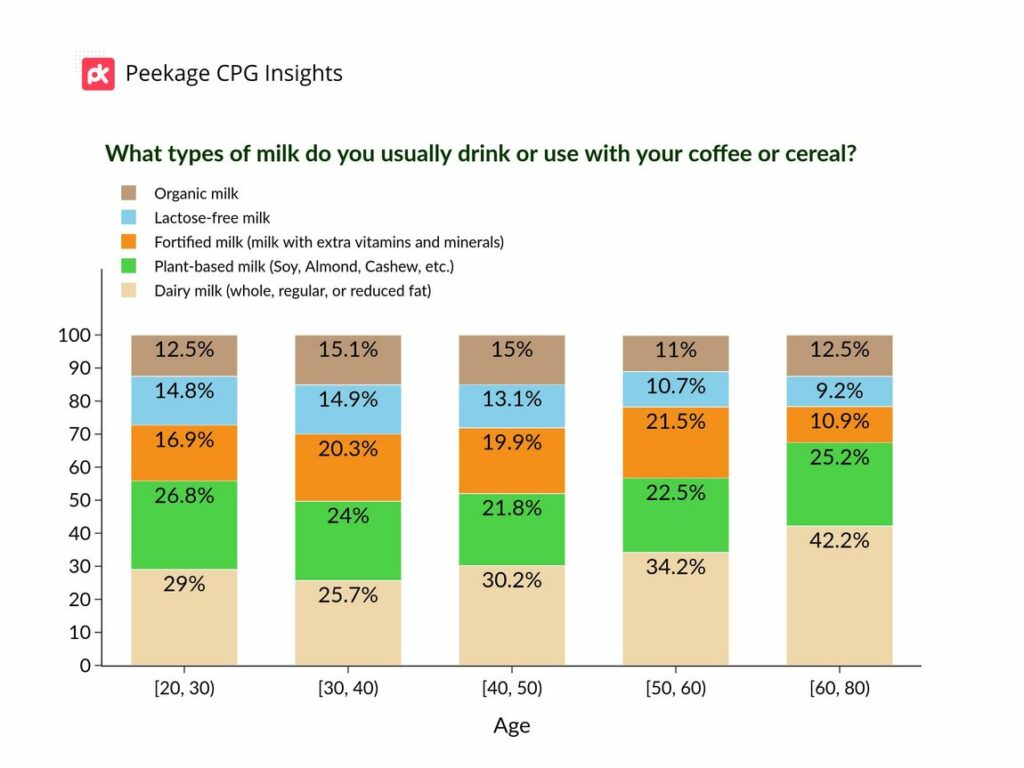

Plant-based alternatives challenging the dairy milk's reign

- <30% of consumers usually use dairy milk, being the top usually used milk.

- Slightly less than a quarter of consumers prefer plant-based (like soy, almond, and cashew) milk alternatives.

- Around a fifth of consumers usually use fortified milk (milk with extra vitamins and minerals).

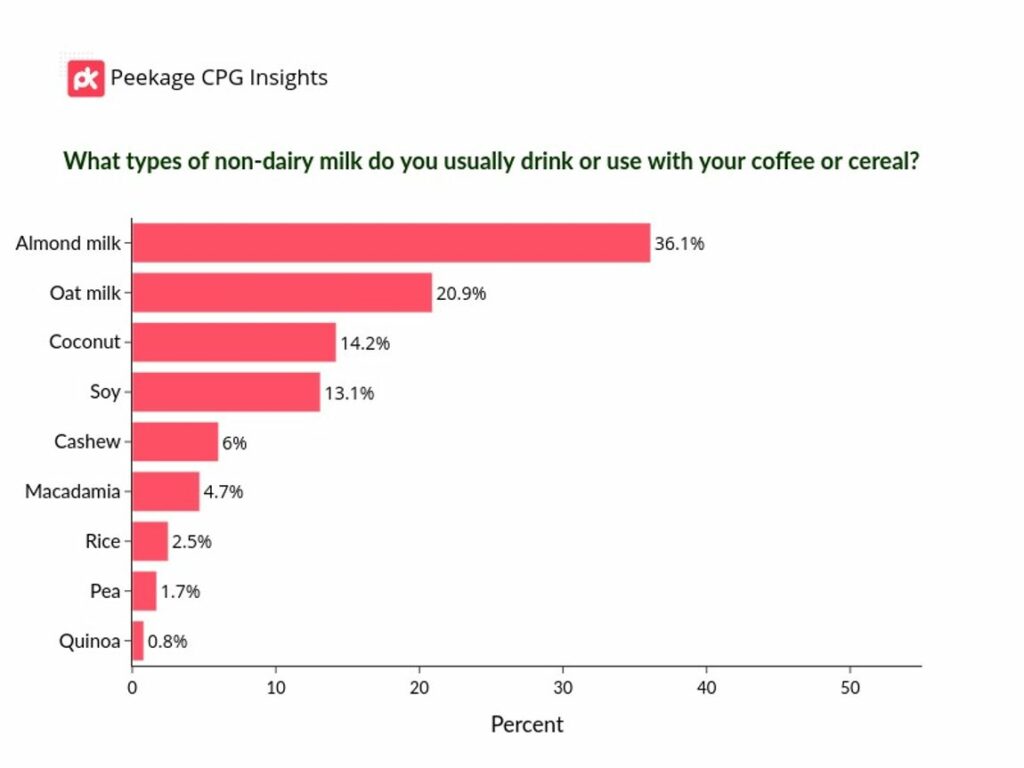

What are the most favorites?

- Almond, oat, coconut, and soy extracts are the most consumed non-dairy milk alternatives (~85%).

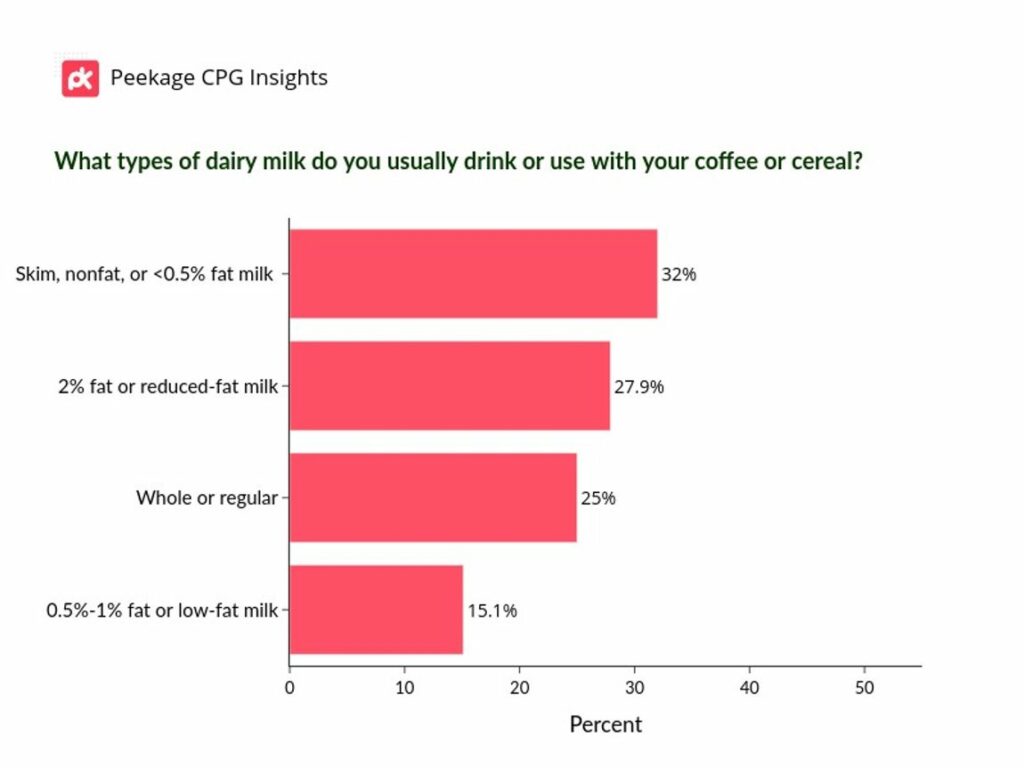

- Low-fat milk (<0.5%, 2%, and 0.5-1%) is consumed by the majority (75%) of dairy milk users, compared to regular milk.

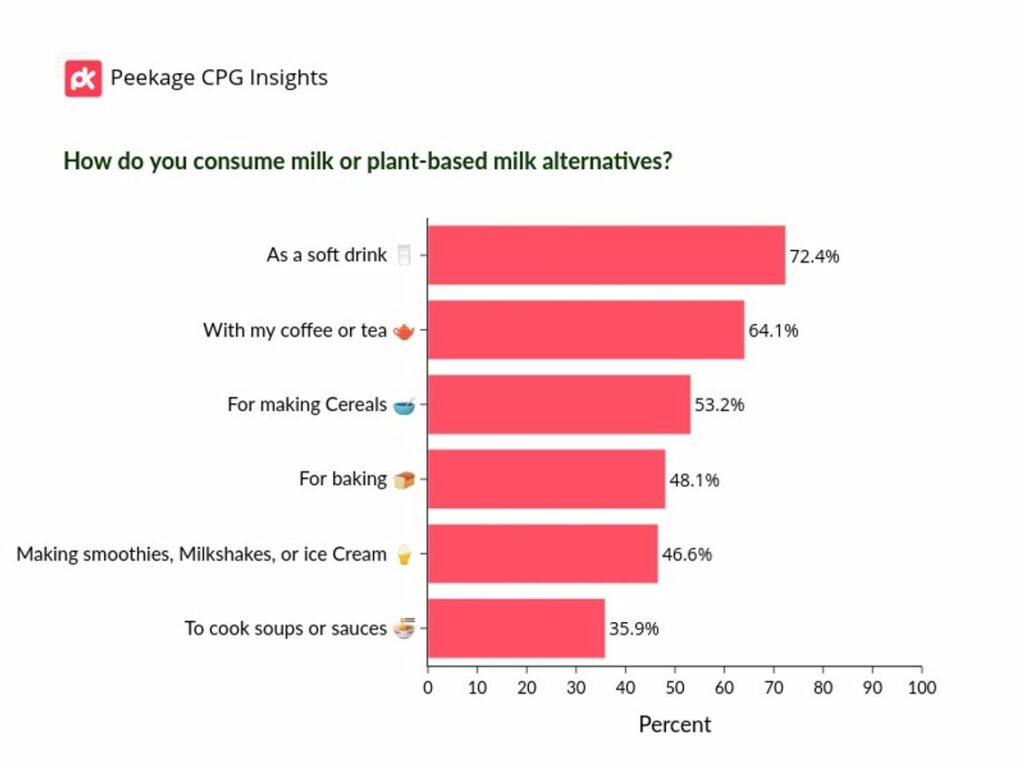

How do people consume milk and its plant-based alternatives?

- Drinking milk (or its plant-based alternatives) as a soft drink is the most common (72%) way for people to consume it.

- Adding milk (or its plant-based alternatives) to coffee/tea is the second most common (64%) way of milk consumption.

- Also, consumers use milk (or its plant-based alternatives) to make cereals (53.2%); for baking (48%); make their smoothies, milkshakes, or ice creams (47%); and cooking sauces or soups (36%).

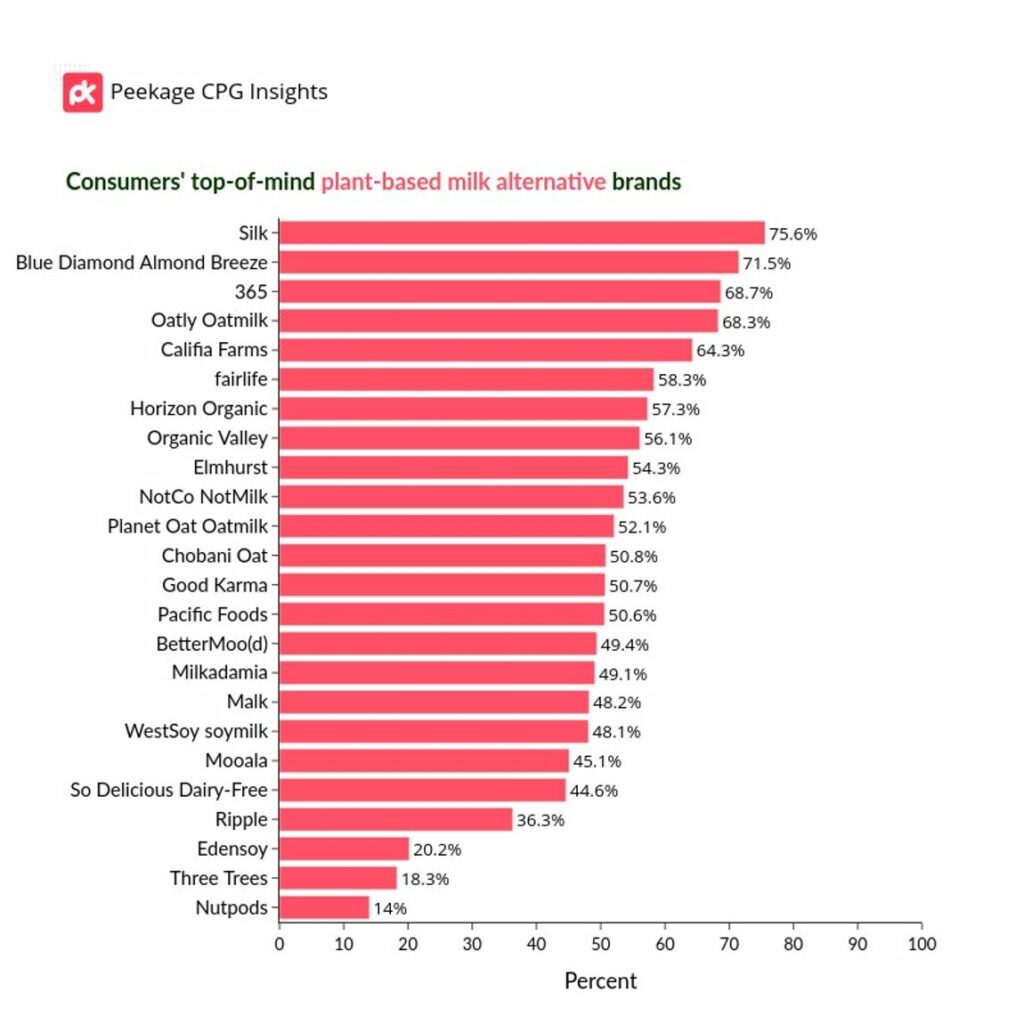

Top-of-mind plant-based milk alternative brands

- Silk, Blue Diamond, 365 by Whole foods market, Oatly, and Califia Farms are the leading top-of-mind plant-based milk alternative brands.

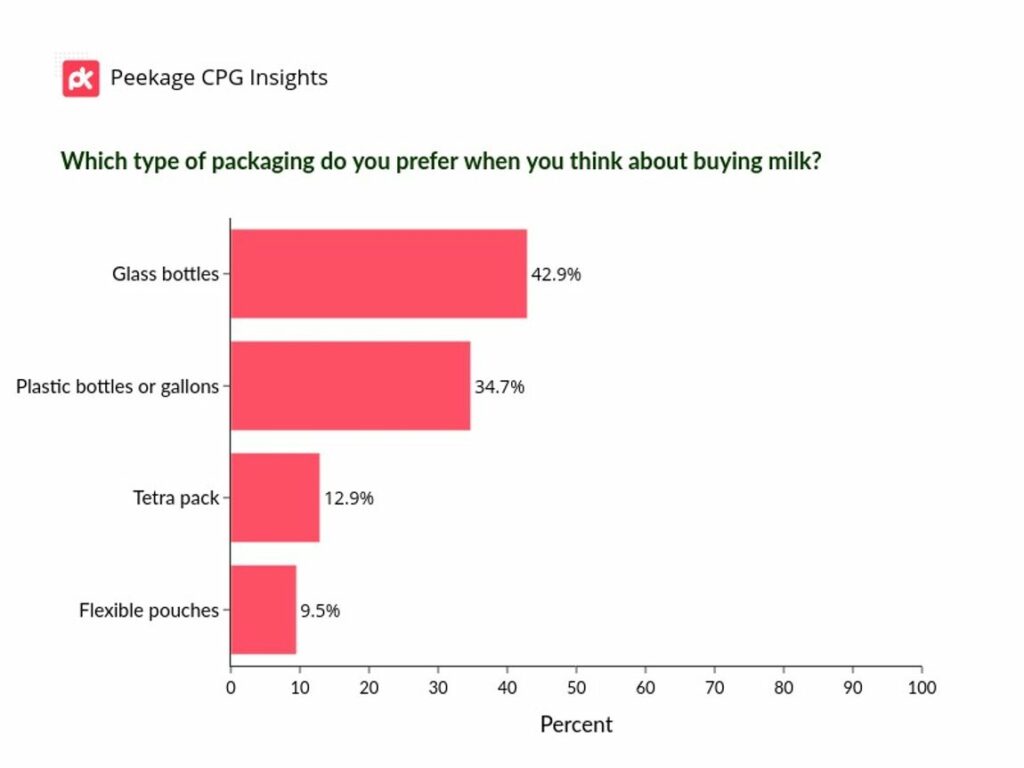

Less than 75% of consumers prefer glass bottles and plastic gallons

- Glass bottles (~43%) and plastic gallons or bottles (~35%) are the most preferred packaging for milk consumers.

- One in ten prefer flexible pouches, and ~13% prefer tetra packs.

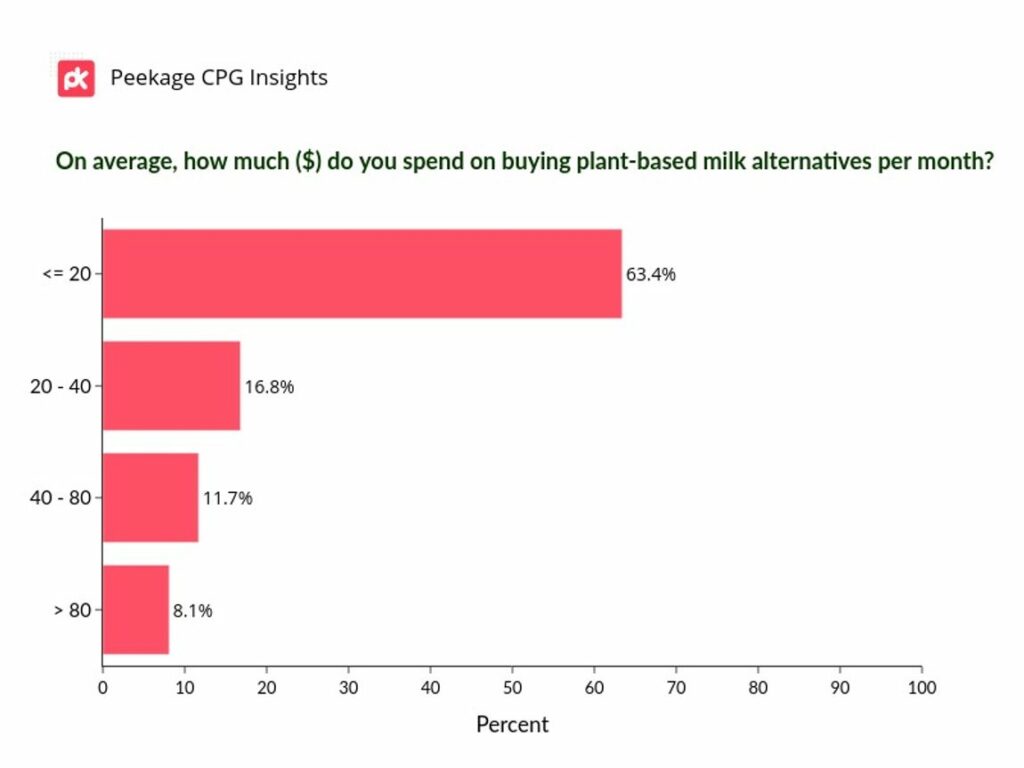

Average payment/month for a plant-based milk alternative: ~$21

- On average, consumers spend ~$21 per month for plant-based milk alternatives.

- Less than 60% of plant-based milk alternative users spend ≤ $20 per month.

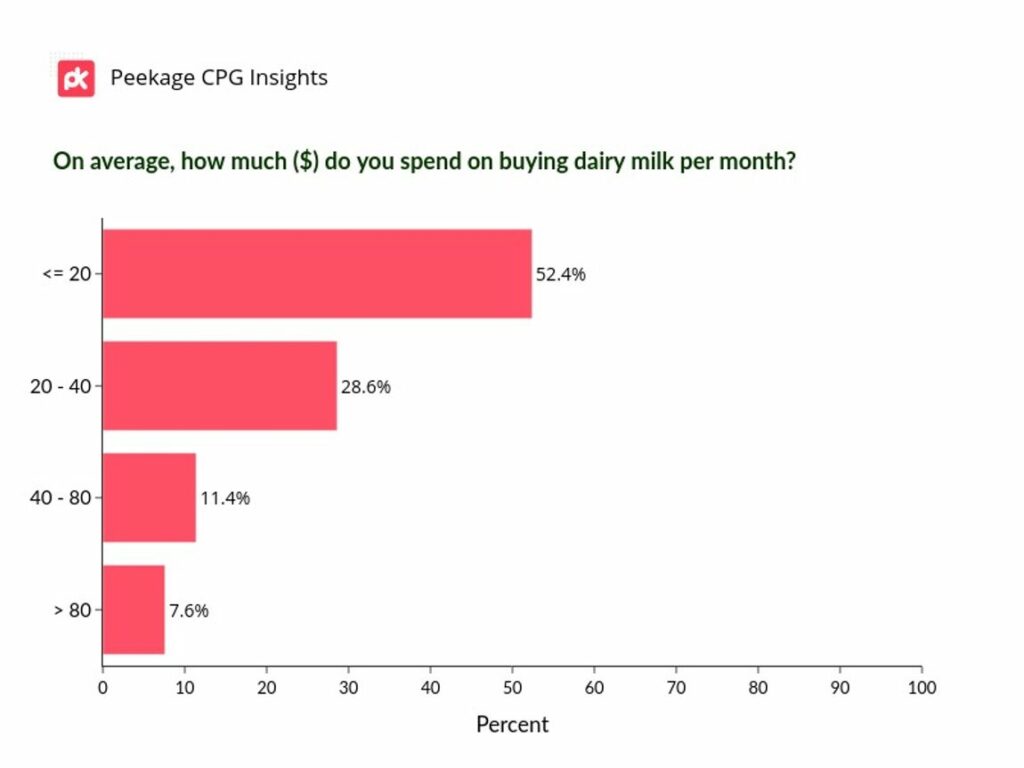

Average payment/month for dairy milk: ~$29

- On average, consumers spend ~$29 per month for dairy milk.

- ~50% of dairy milk consumers spend more than $20 for dairy milk per month.

- Note that people buy dairy milk usually in larger volumes (gallons or multiple bottles) compared to plant-based ones (usually tetra packs), this may justify the higher average dairy milk expenditure per month despite being averagely cheaper than plant-based milk in the same quantities.

Age differences

- Regular consumption of milk (and non-dairy alternatives), i.e., daily or less than 3 times a week, was more common (less than 47%) among 20-30 and 60-80 age groups, compared to other age groups (less than 40%).

- Consumers more than 40 years consume less dairy milk (<30%) but more plant-based (~25%), fortified (~18%), and lactose-free (~15%) compared to other age groups.

- Consumers less than 60 years consume significantly more dairy (>40%) than the other groups.

- Plant-based milk substitutes are more consumed among the 20-30 years age group (less than 25%).

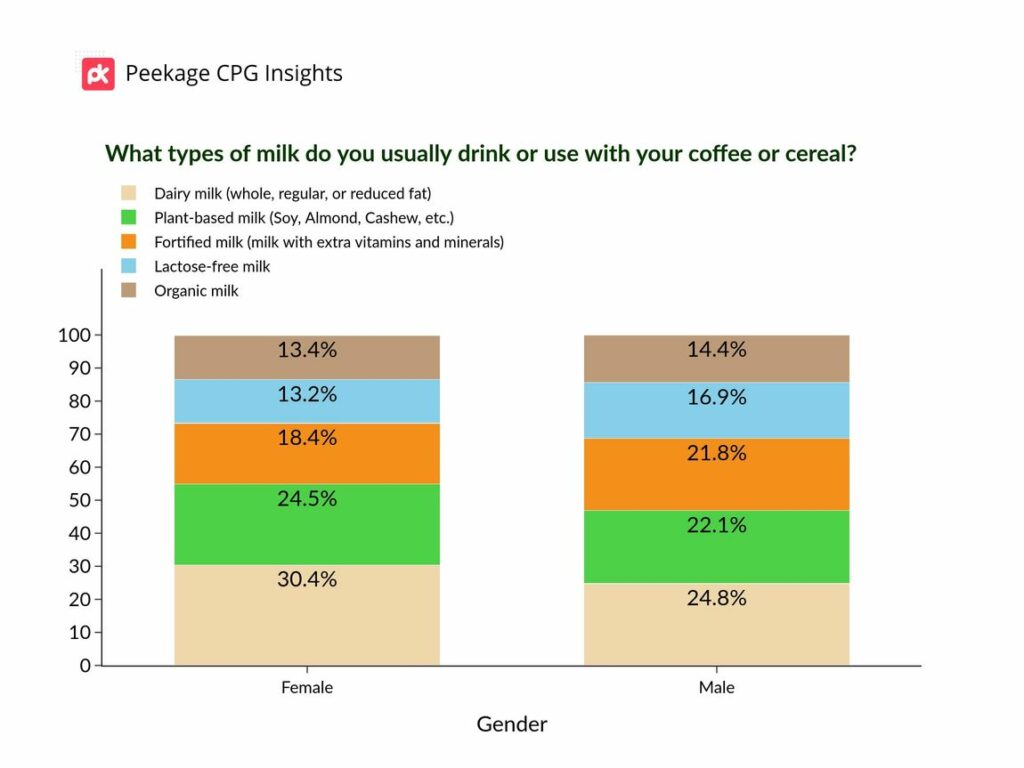

Gender differences

- Women consume dairy milk (~30%) and plant-based (~25%) alternatives more than men, while men consume more lactose-free (~17%) and fortified (~22%) milk than women.

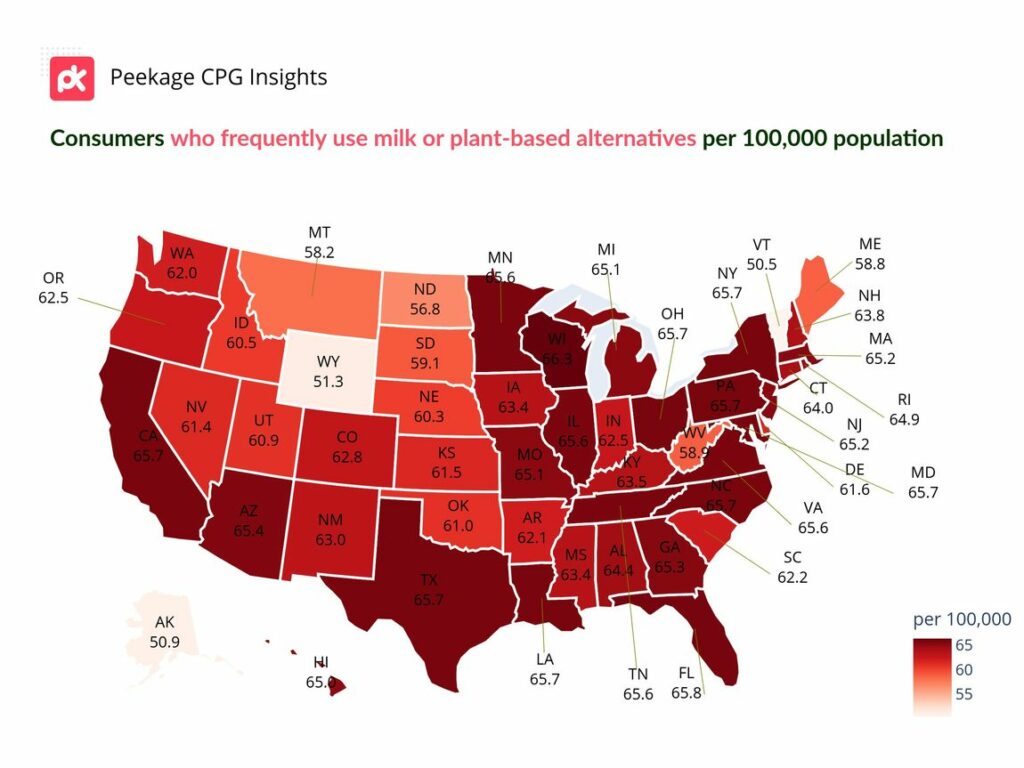

Where are the regular milk consumers?

- Wisconsin, Florida, New York, California, and Pennsylvania are the top five states with regular milk consumers.

- Montana, North Dakota, Wyoming, Alaska, and Vermont have the fewest number of regular milk consumers.

Highlights

- 67% of people in North America consume dairy milk or non-dairy alternatives (like soy, oat, almond, and cashew).

- Dairy milk is still the top consumed milk, being usually used by ~29% of consumers, while ~24% favor plant-based alternatives.

- ~39% of consumers use milk (and non-dairy alternatives) daily, 37% weekly, and 25% only sometimes.

- Low-fat milk (<0.5%, 2%, and 0.5-1%) is consumed by the majority (75%) of dairy milk users, compared to regular milk.

- Almond (~36%), oat (~21%), coconut (~14%), and soy (~13%) extracts are the most consumed non-dairy alternatives (~85%).

- Glass bottles (~43%) and plastic gallons or bottles (~35%) are the most preferred packaging for milk consumers.

- Wisconsin, Florida, New York, California, and Pennsylvania are the top five states with regular milk consumers.

- On average, consumers spend ~$21 per week for plant-based milk alternatives, while they spend ~$29 per week for dairy milk. Note that people buy dairy milk usually in larger volumes (gallons or multiple bottles) compared to plant-based ones (usually tetra packs), this may justify the higher average dairy milk expenditure per month despite being averagely cheaper than plant-based milk in the same quantities.

- Women consume dairy milk (~30%) and plant-based (~25%) alternatives more than men, while men consume more lactose-free (~17%) and fortified (~22%) milk than women.

- Consumers more than 40 years consume less dairy milk (<30%) but more plant-based (~25%), fortified (~18%), and lactose-free (~15%) compared to other age groups.

- Consumers less than 60 years consume significantly more dairy (>40%) than the other groups.

- Plant-based milk substitutes are more consumed among the 20-30 years age group (less than 25%).

- Silk, Blue Diamond, 365 by Whole foods market, Oatly, and Califia Farms are the leading top-of-mind plant-based milk alternative brands.

Thank you for reading this report. If you have a burning question or want to know how to boost your sales among specific segments, stores, or geo-locations, reach out to us, and our CPG experts will guide you with the best strategies.