About 40% of people in North America have tried CBD products. CBD products are helpful for chronic pain, anxiety, depression, focus, sleep, well-being, and more. But how often do consumers use them? why do they use them? and how much are they willing to spend on it? This Peekage CPG insights report will examine consumers' CBD-related behavior and preferences.

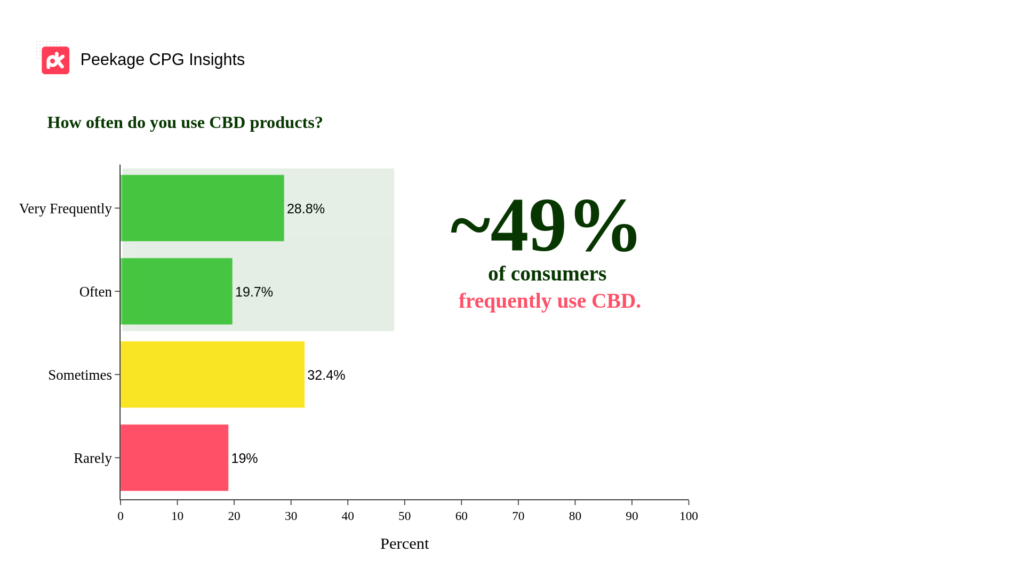

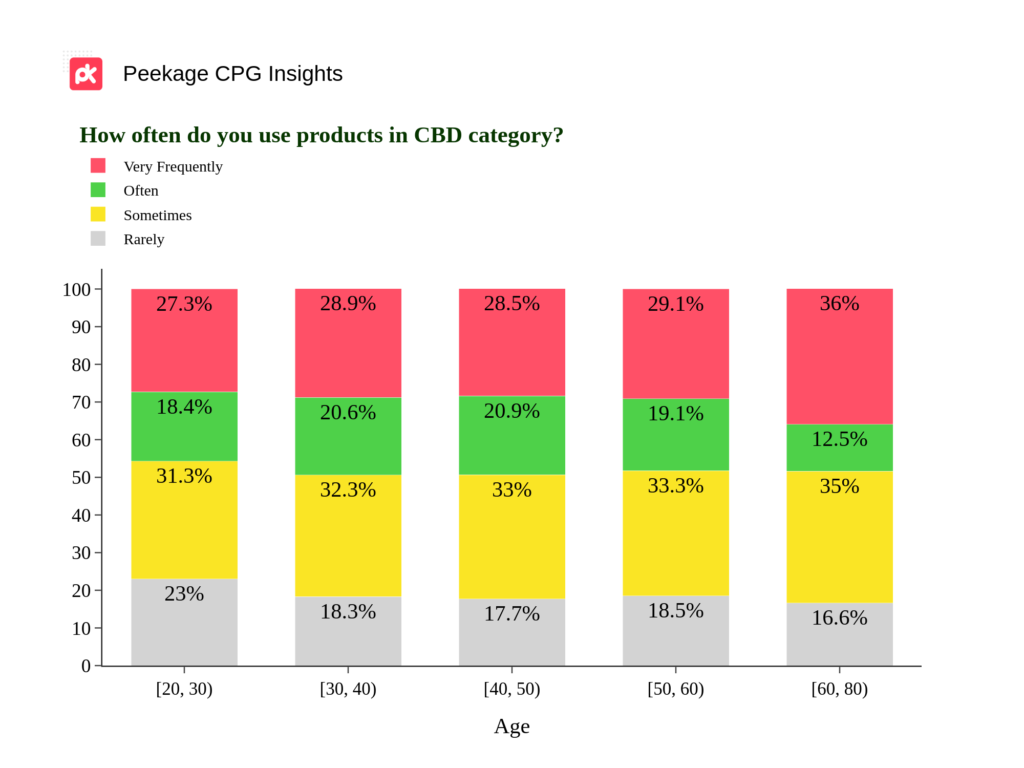

Almost half of CBD consumers frequently use CBD

- Surprisingly, more than a quarter of CBD users use them very frequently.

- Nearly one-third of consumers are occasional CBD users.

- Around a fifth of CBD consumers rarely use them.

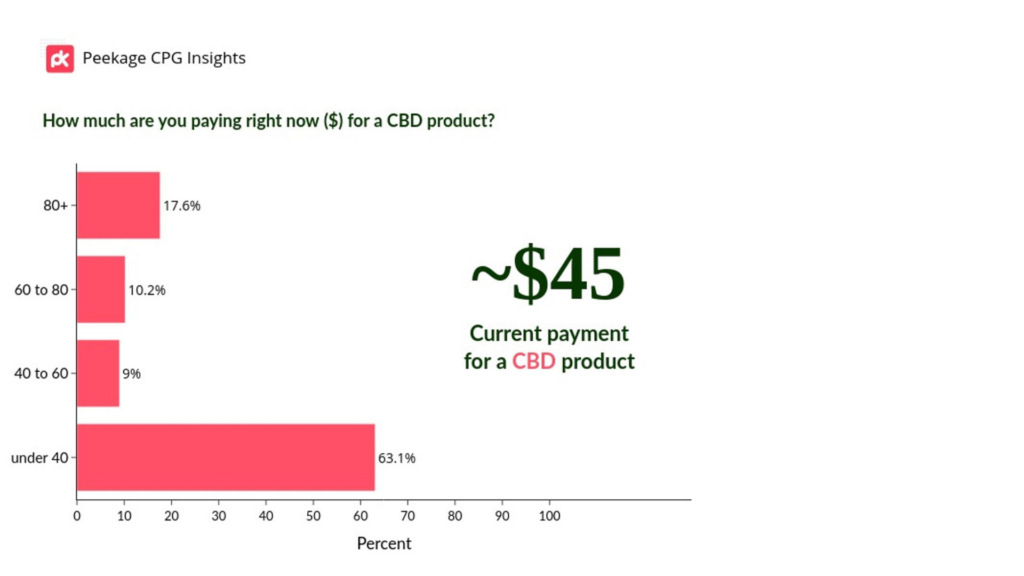

Current payment for a CBD product: About $45

- On average, current CBD consumers are paying ~$45 per CBD product.

- ~18% of current CBD consumers are paying more than $80 per product.

- One-fifth of current CBD consumers are paying $40 - $80 per product.

- More than half of current CBD consumers are paying less than $40 per product.

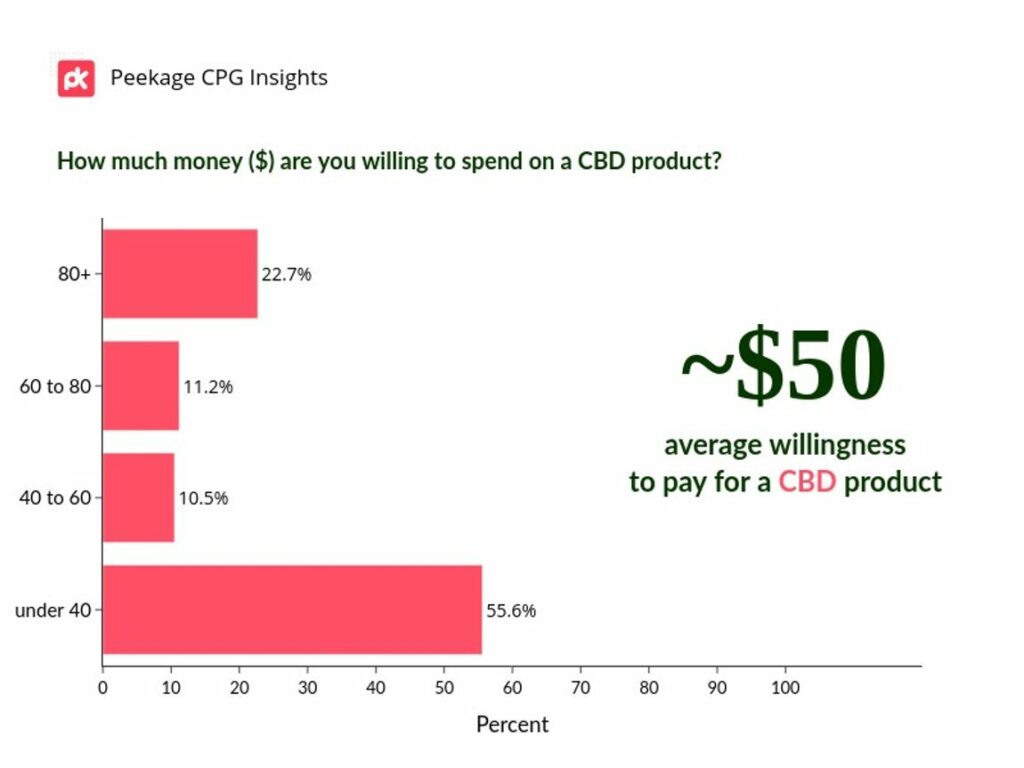

Willingness to pay for a CBD product: ~$50

- On average, people are willing to pay ~$50 per CBD product.

- Slightly less than a quarter of CBD consumers are willing to pay more than $80 for a CBD product.

- One-third of consumers will pay less than $60 for a CBD product.

- More than half of consumers will pay <$40 for a CBD product.

Men consume CBD more frequently.

Men consume CBD more frequently (~54%) than women (~45%).

Older-age CBD consumers use CBD very frequently.

- >35% of CBD consumers aged between 60 and 80 years use CBD very frequently.

- <30% of CBD consumers aged between 20 and 60 years use CBD very frequently.

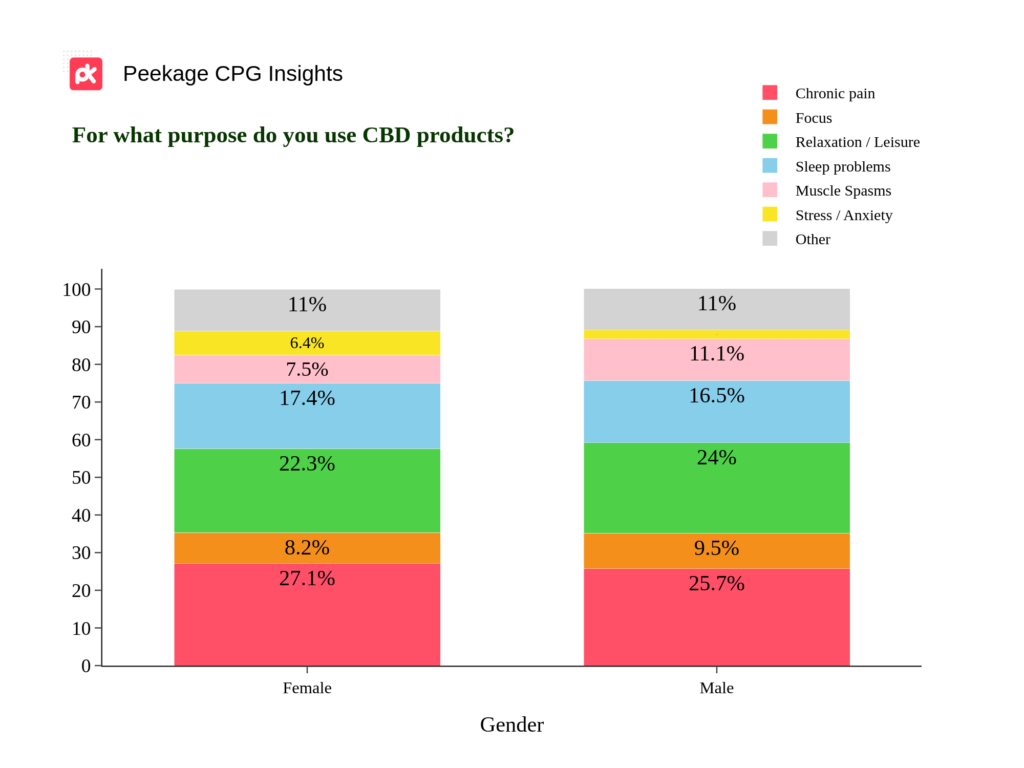

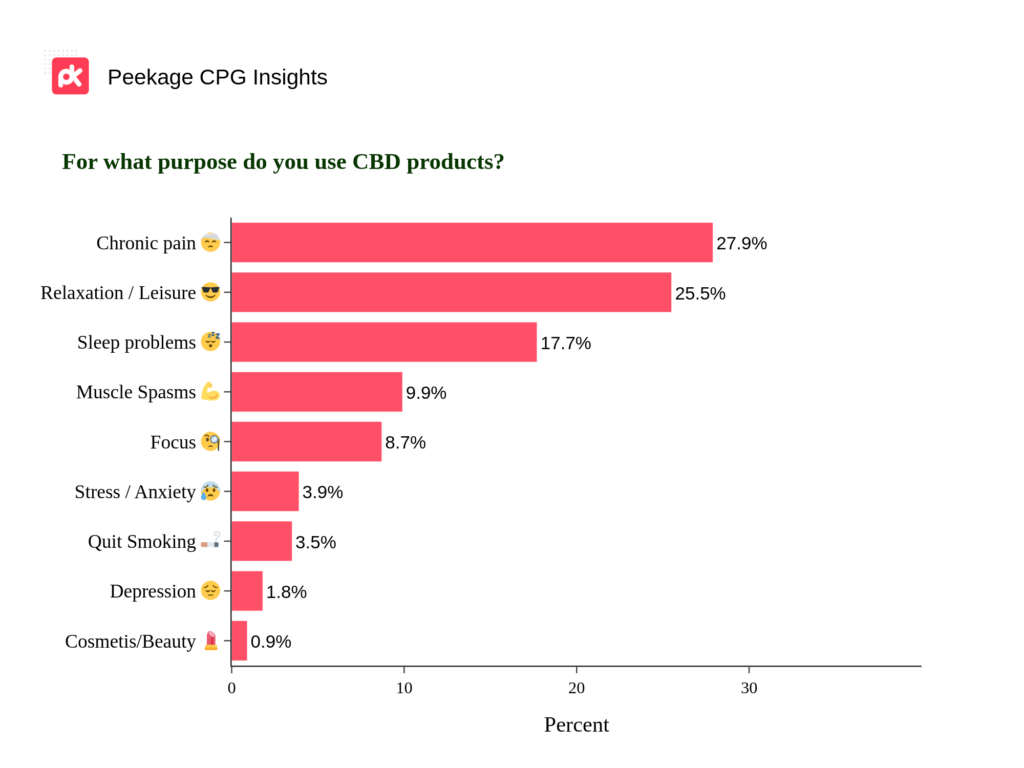

For what purposes do CBD consumers use them?

- More than a quarter of consumers use CBD for chronic pain.

- ~25% of CBD consumers use them for relaxation/leisure.

- Just under a fifth of consumers use CBD for their sleep problems.

- Surprisingly, just ~10% of consumers use CBD for cosmetics and beauty, stress, anxiety, depression, or quitting smoking.

- Less than 10% of CBD consumers use them for improving their focus.

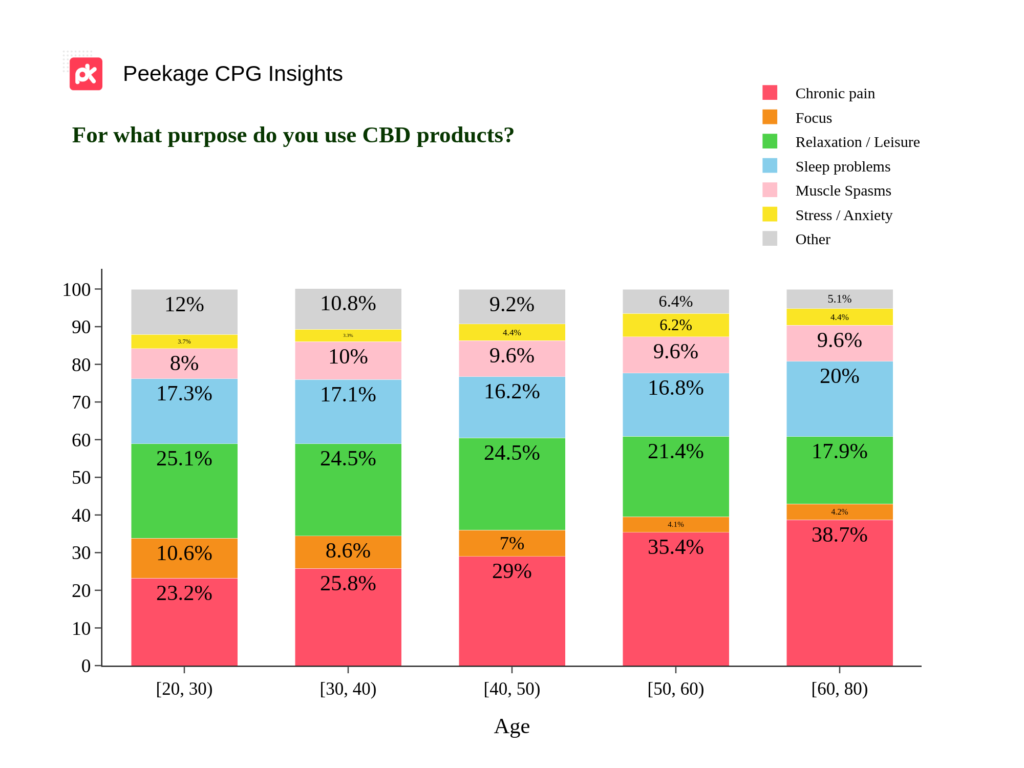

The younger the consumers the more they use it for focus and leisure.

- More than 35% of CBD consumers who are 50 years or older utilize CBD for pain relief, whereas less than 25% of CBD consumers aged 40 years or younger use it for the same purpose.

- Over 10% of consumers under 30 years old use CBD to enhance focus, while fewer than 5% of CBD consumers aged 50 years or older use it for that purpose.

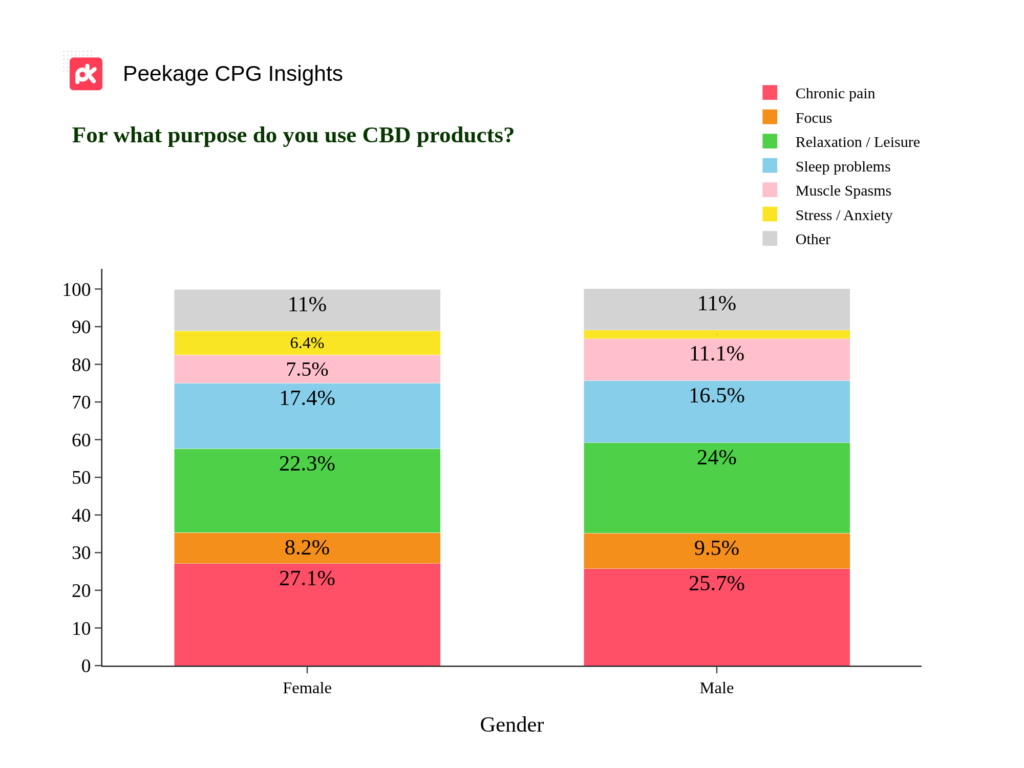

Gender differences and similarities in CBD consumption purposes.

- The same percentages of women and men consume CBD for pain, sleep, relaxation, and focus.

- Women consume CBD for stress/anxiety slightly more than men.

- Men consume CBD for muscle spasms slightly more than women.

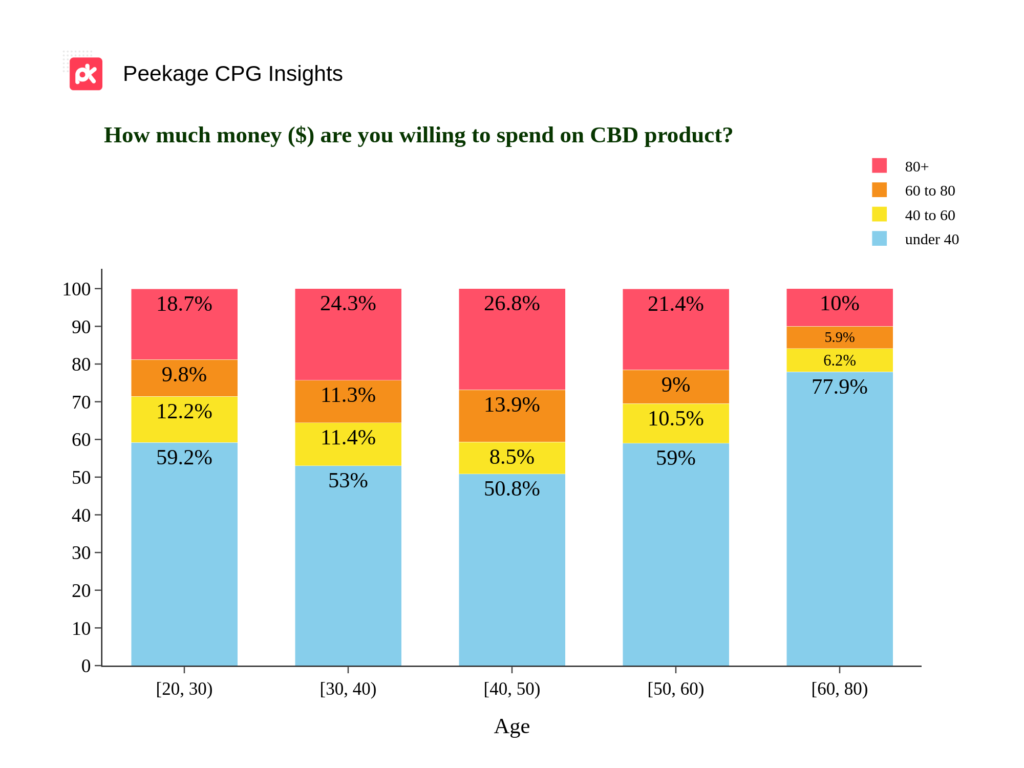

Middle-aged consumers are willing to pay more per CBD product.

Between the ages of 30 and 60, more than 30% of consumers are willing to pay $60 or more per CBD product, while in the other age groups, this percentage is less than 20%.

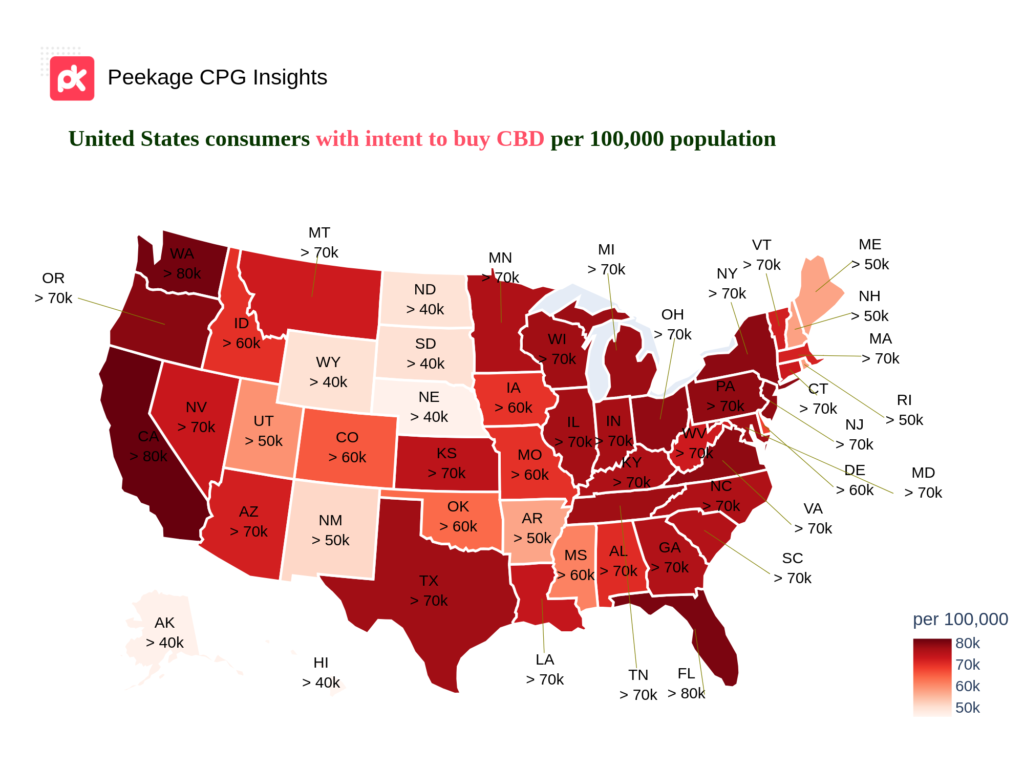

Where are the CBD consumers?

Intent to buy

- California, Washington, Florida, Oregon, and New York are the top five states regarding the intent to buy CBD.

- Wyoming, North Dakota, Alaska, Nebraska, and Hawaii are the bottom five states regarding the intent to buy CBD.

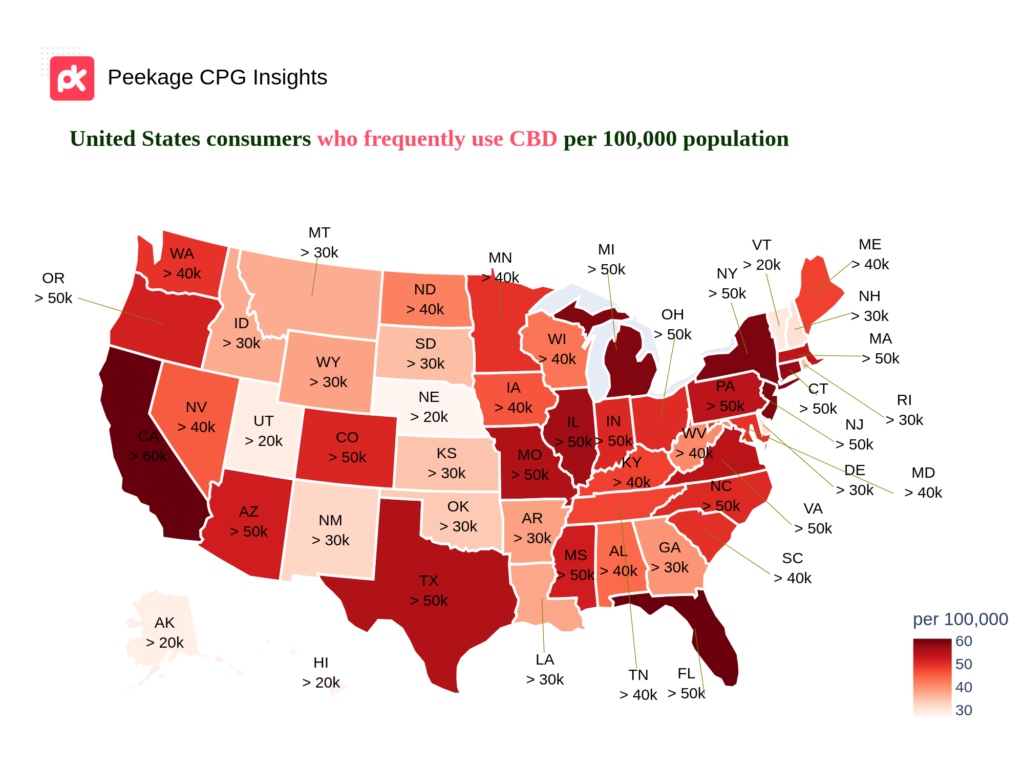

Frequent CBD consumption

- California, Florida, New York, New Jersey, and Michigan are the top five states regarding the frequency of CBD consumption.

- Vermont, Utah, Alaska, Hawaii, and Nebraska are the bottom five states regarding the frequency of CBD consumption.

Highlights

Frequency of CBD Consumption

- Approximately 40% of people in North America have tried CBD products.

- Nearly half of the consumers use CBD frequently, with more than 25% using them very often.

- Men consume CBD more frequently (about 54%) than women (around 45%).

- More than 35% of CBD consumers aged between 60 and 80 years use CBD very frequently, while less than 30% of CBD consumers aged between 20 and 60 years use CBD very frequently.

- The top five states regarding the frequency of CBD consumption are California, Florida, New York, New Jersey, and Michigan.

- The bottom five states regarding the frequency of CBD consumption are Vermont, Utah, Alaska, Hawaii, and Nebraska.

Purpose of CBD Consumption

- More than 25% of consumers use CBD for chronic pain.

- Around 25% of CBD consumers use them for relaxation/leisure.

- Surprisingly, only about 10% of consumers use CBD for cosmetics and beauty, stress, anxiety, depression, or quitting smoking.

- More than 35% of CBD consumers aged 50 years or older use CBD for pain relief, whereas less than 25% of CBD consumers aged 40 years or younger use it for that.

- More than 10% of consumers younger than 30 years use CBD to increase focus, while less than 5% of CBD consumers aged 50 years or older use it for that.

- Women consume CBD for stress/anxiety slightly more than men.

- Men consume CBD for muscle spasms slightly more than women.

CBD Willingness to Pay

- The top five states regarding the intent to buy CBD are California, Washington, Florida, Oregon, and New York.

- The bottom five states regarding the intent to buy CBD are Wyoming, North Dakota, Alaska, Nebraska, and Hawaii.

- On average, people are willing to pay around $50 per CBD product.

CBD Current Payment

- On average, current CBD consumers are paying around $45 per CBD product.

- Approximately 63% of current CBD consumers are paying less than $40 per product.